Another week has passed with tons of intriguing information on the cryptocurrency market place. Let’s evaluation the Kyros Ventures market place evaluation infographics to see what is scorching final week!

one. Price motion and TVL in the final week (October four – October ten)

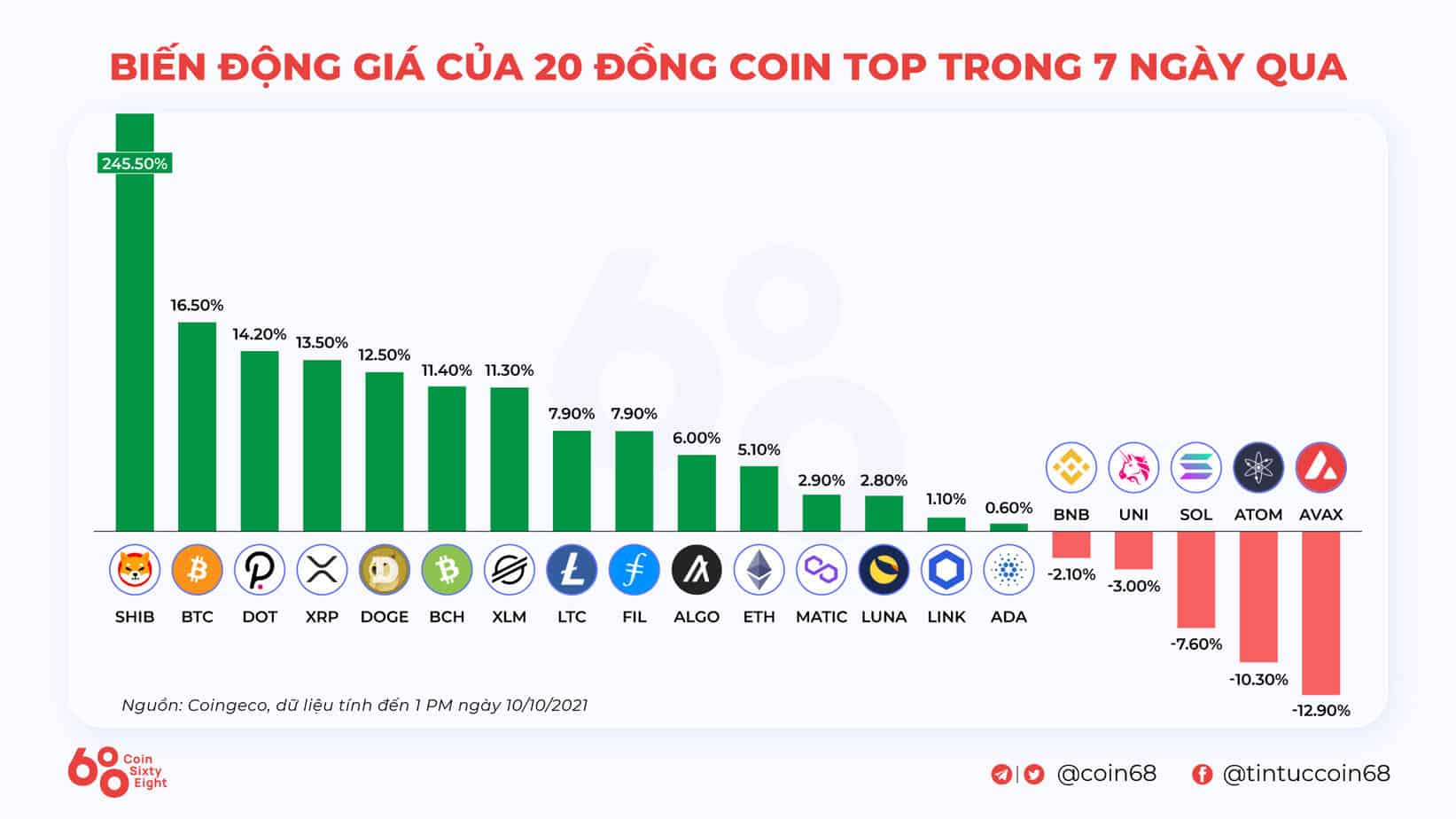

Top twenty rate trend

The twenty most bullish coins

TVL volatility of the primary ecosystems

As the rate of BTC elevated, much more and much more dollars was poured into the market place. The most useful are excellent ecosystems. The complete blocked worth (TVL) of these methods has viewed extraordinary development above the previous seven days.

Notably, Fantom’s TVL elevated significantly by 224%. Of program, the FTM rate also posted an ATH this week.

two. Market overview in the third quarter of 2021

Fluctuations in the quantity of one of a kind addresses of big blockchains

Polygon (MATIC) continues to show its leadership with above 500% development in the quantity of one of a kind wallet addresses. Meanwhile, Fantom (FTM) and Near (Close to) are also accelerating with development of above 300% and 200% respectively.

TVL development of the primary ecosystems

Along with the recovery in charges, the DeFi industry’s TVL hit the $ 210 billion mark, setting a new record.

OKExChain, Avalanche (AVAX) and Solana are the best three with extraordinary TVL development, above one,000%. Even so, Ethereum nonetheless holds the biggest sum of assets in the DeFi section with $ 124 billion of locked-in worth.

Price movements of the primary ecosystems

Avalanche (AVAX)

Avalanche is the blockchain that has acquired the most consideration in the final quarter. In individual, the rate of Trader Joe (JOE) has elevated by above 9,000% in the previous three months!

Fantom (FTM)

Fantom (FTM) established a new ATH in early September, spearheading the total ecosystem explosion. TAROT, GRIM and SCREAM are three excellent tasks with major rate increases in the final quarter. However, BOO, BRUSH or ZOO are also on the rise.

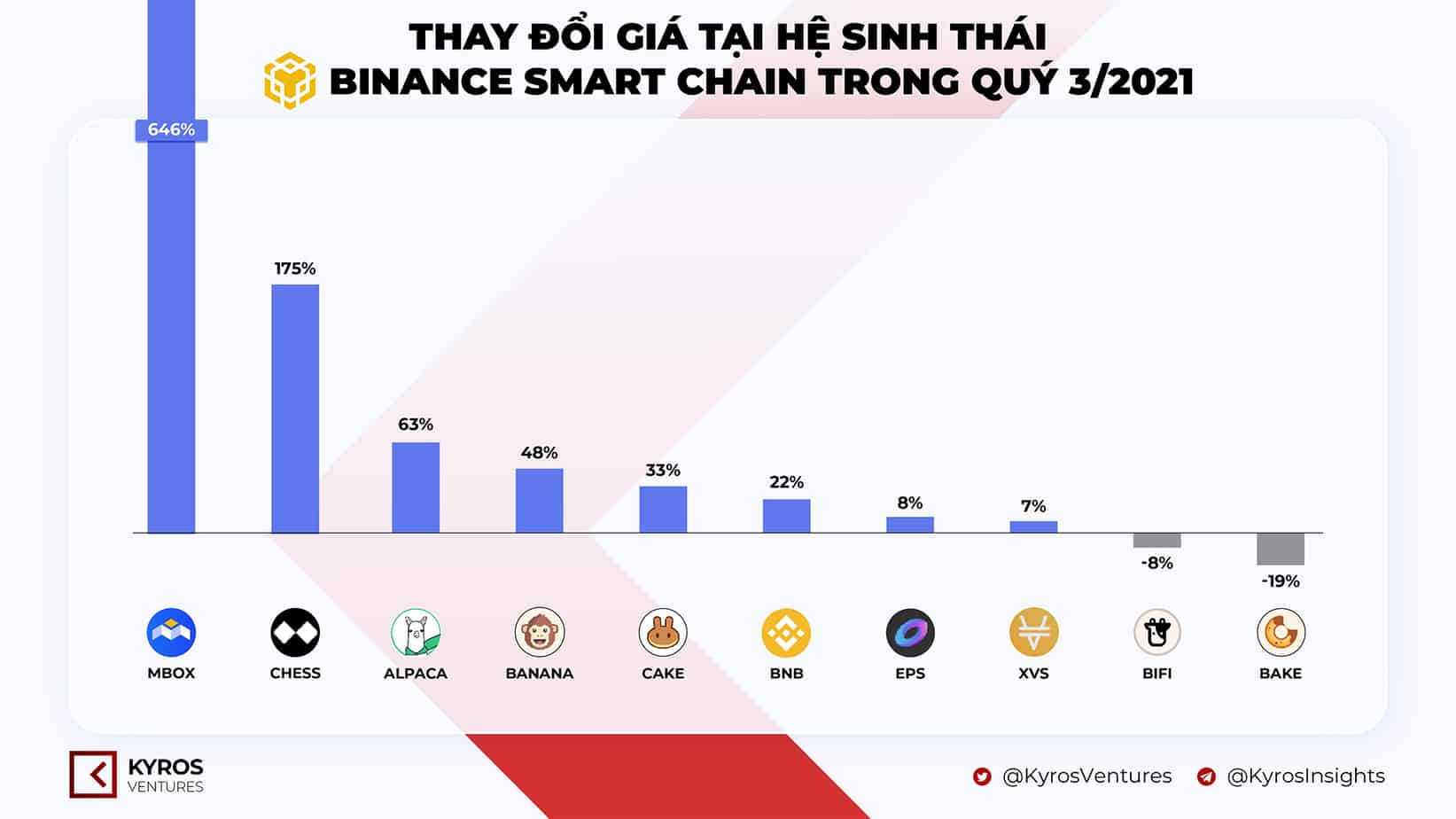

Binance Smart Chain (BSC)

Although some BSC tasks have slowed and even seasoned adverse development in the final quarter, Binance Smart Chain nonetheless has some issues. Hidden gems deliver big income to traders. This is Mobox (MBOX) with extraordinary development of 646%, outperforming quite a few heavyweights this kind of as Tranchess (CHESS) or Alpaca Finance (ALPACA).

Solana (SOL)

Last quarter, SOL “continuously” established a new ATH, which was the primary flag for the Altcoin wave, top to the explosion of the Solana ecosystem.

Saber (SBR) is the brightest identify in the SOL program at the minute, jumping four.381% in 90 days. Solanium (SLIM) or Orca (ORCA) with an $ 18 million fundraiser from Coinbase Ventures, Three Arrows Capital are also possible tasks in the close to potential.

Liquidity incentive plan

The third quarter noticed an explosion of liquidity incentive plans (incentive plan), which aims to appeal to tasks and consumers to the emerging ecosystem.

Thanks to the abundant income movement, these plans have proven their sensible rewards and their usefulness. The $ 180 million liquidity incentive plan was one particular of the factors that pushed the rate of AVAX to rise by 200%. But in actuality, Avalanche’s incentive plan is one particular of the least beneficial plans.

Cryptocurrency Market Report

After 3 months of the third quarter of 2021, the cryptocurrency market place has had a marked modify from the prior time period. Many new trends and potentials seem, creating the market place much more diversified and producing a solid development momentum. Take a appear at the cryptocurrency market place in the third quarter with the third quarter 2021 cryptocurrency market place report – Kyros Ventures.

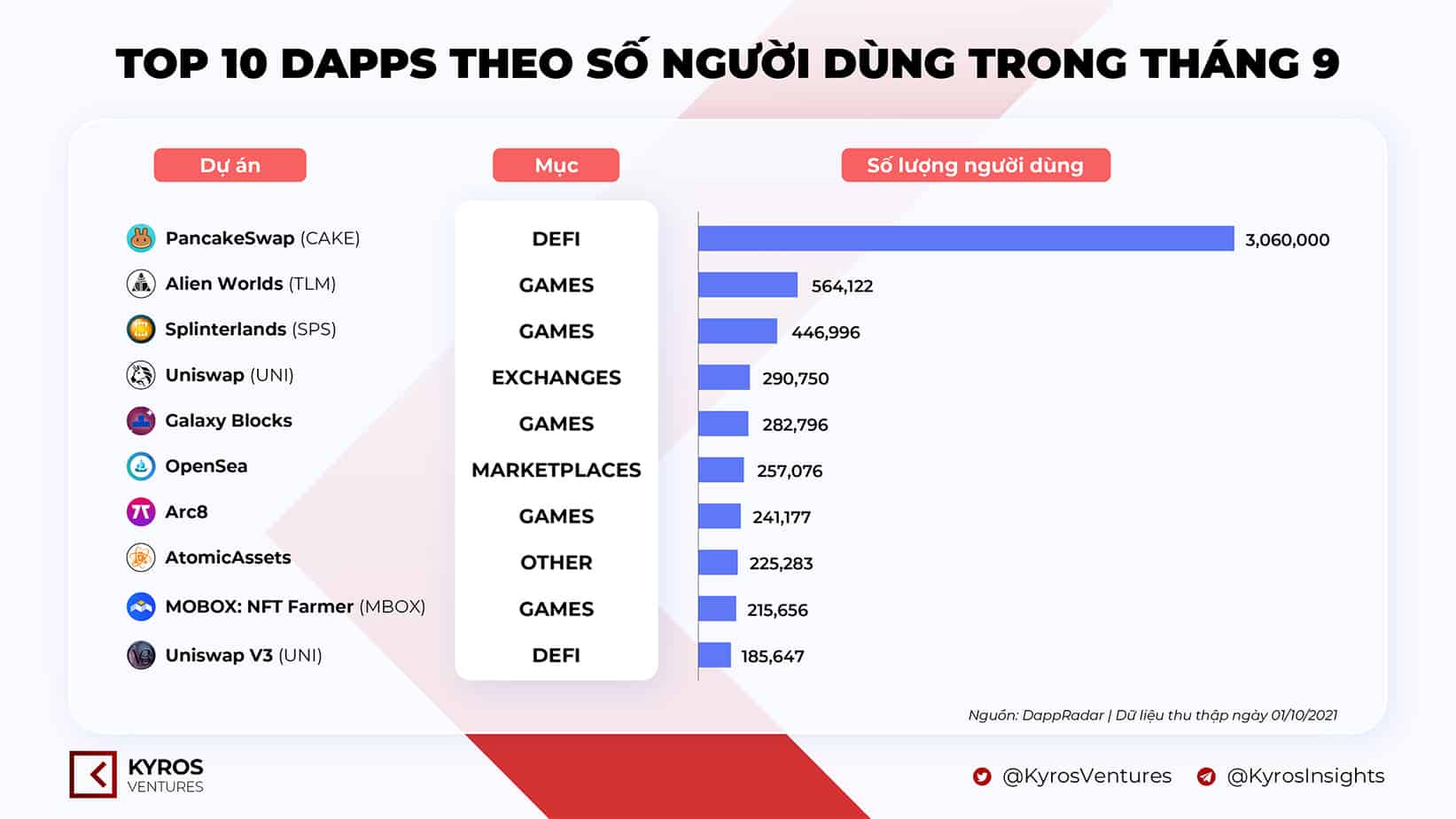

three. The most effective DApps with the most consumers in September 2021

PancakeSwap (CAKE) on the BSC network is the DApp with the most consumers as of September. With above three million consumers, PancakeSwap surpasses the 2nd competitor, Alien Worlds with above 560,000 consumers.

four. Which ecosystem is underestimated?

There are quite a few solutions of evaluating ecosystems, one particular of which is complete comparison ecosystem worth with diluted capitalization of the platform token.

According to the figure beneath, the scale on the vertical axis is calculated in accordance to the following formula:

Ratio = Total Ecosystem Capitalization / Platform Token Diluted Market Cap (FDV)

This calculation has some limitations as this ratio does not incorporate the big difference among the utility tokens of every single platform token. However, this ratio lets for an precise comparison of the extended-phrase worth among tokens, as yearly inflation costs are incorporated. Therefore, this calculation is really helpful for holders, assisting to come across appropriate entry factors for extended-phrase detention.

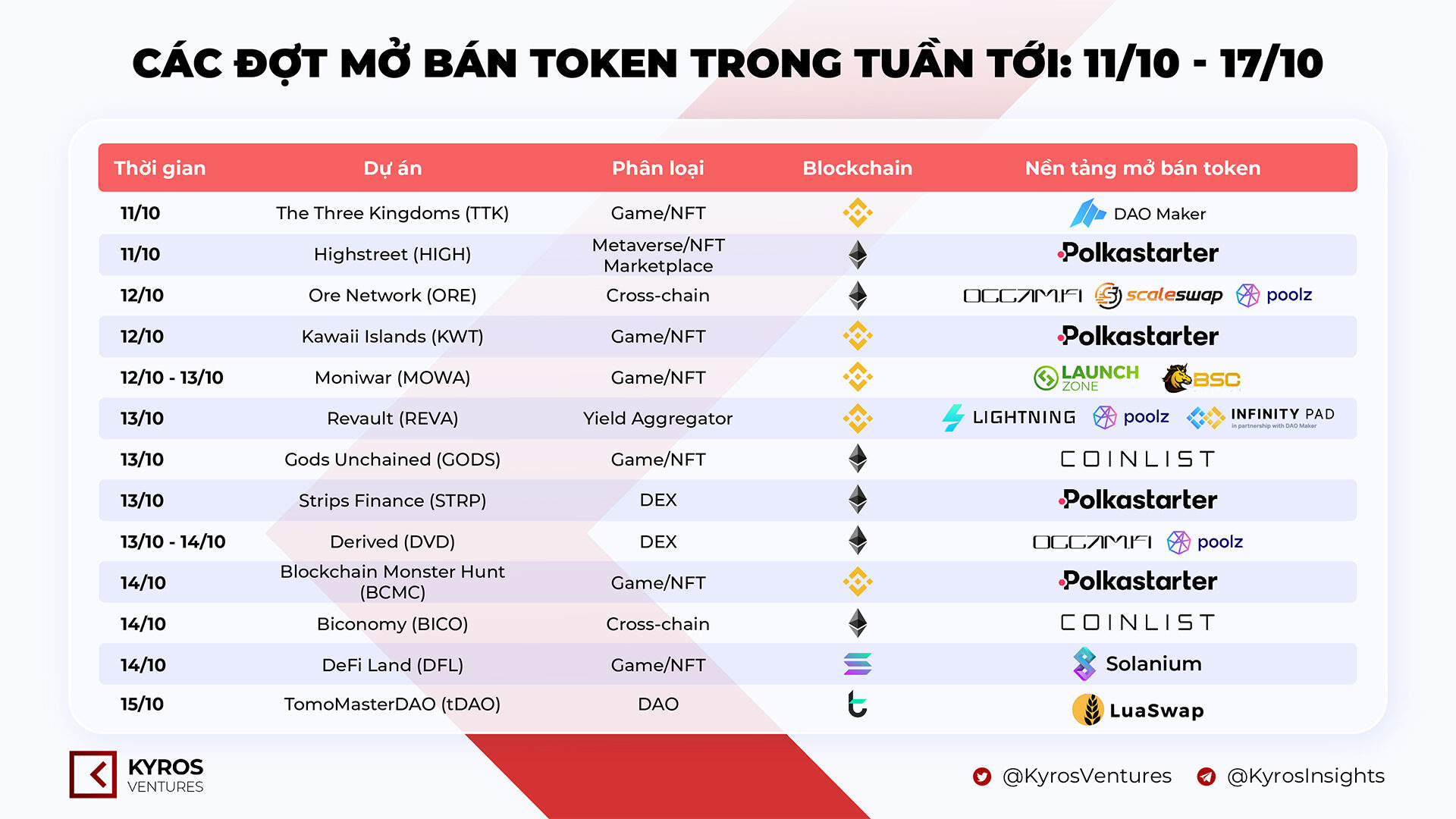

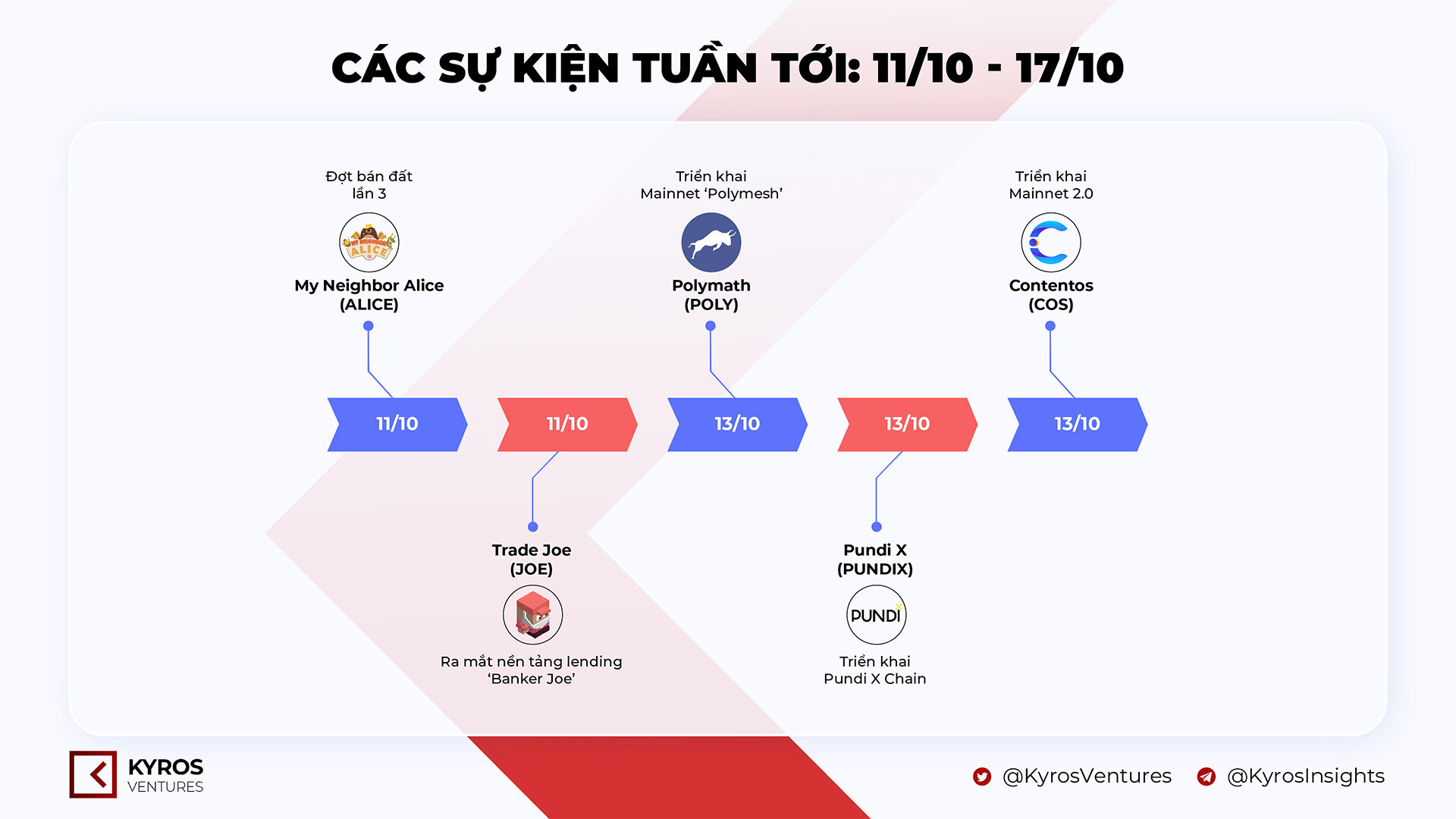

five. Next week’s occasions (eleven October – 17 October)

Maybe you are interested: