Another week has passed with tons of fascinating information on the cryptocurrency market place. Let’s evaluation the Kyros Ventures market place examination infographics to see what is sizzling final week!

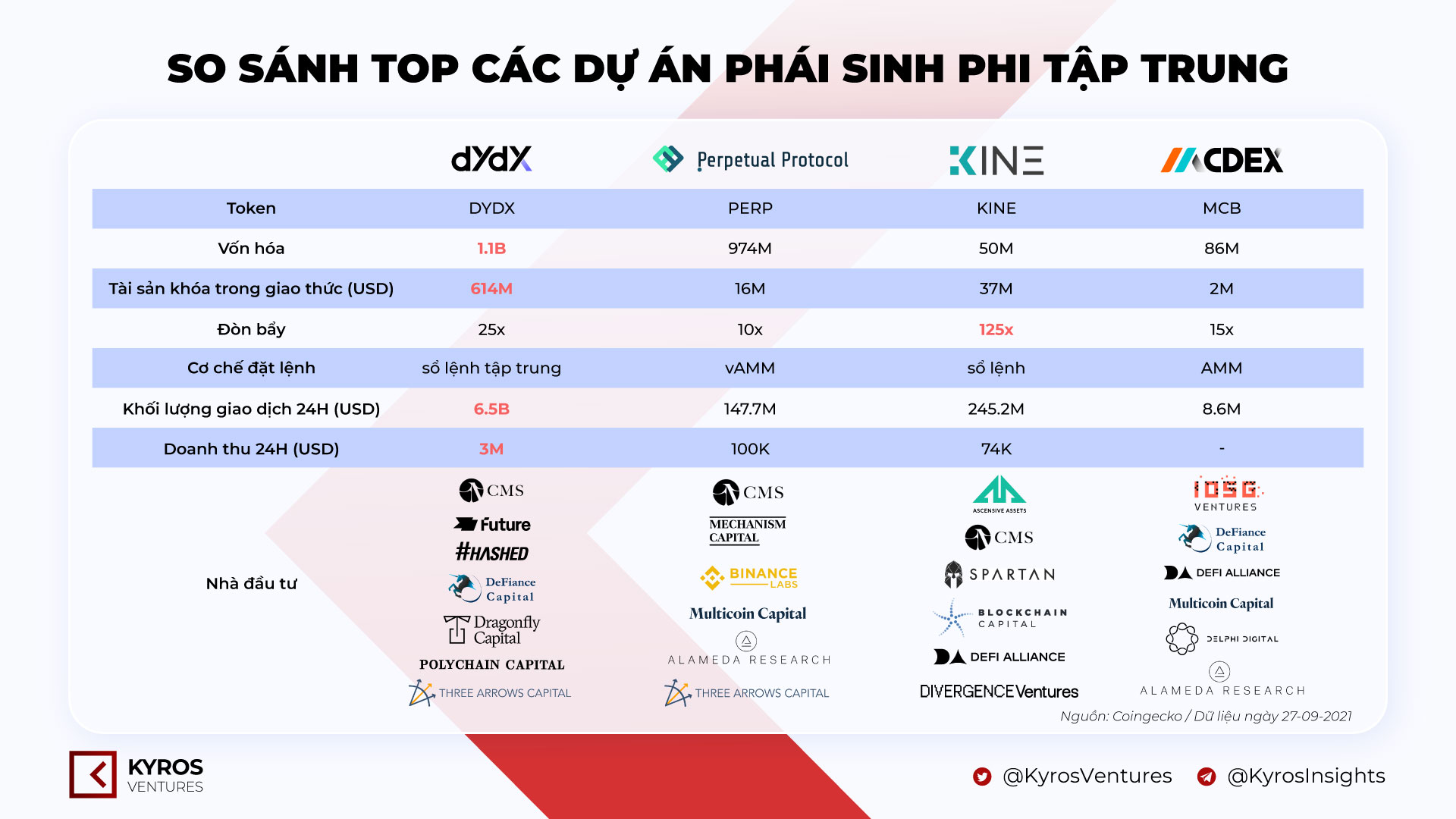

Compare decentralized derivative tasks

The Chinese government’s crackdown this time took spot very harshly, creating a series of trading and mining pools to discover a way to “escape” the nation.

After getting blocked by frequently utilized CEX exchanges, the Chinese are forced to appear to DeFi protocols, DEXs and decentralized derivatives.

It is for this motive that DYDX, the token of the derivatives trading platform dYdX Protocol, has been pumping solid in the previous handful of days.

But is not the market place just DYDX derivatives? Let’s consider a appear at the platforms that are also very prospective in this section with Kyros!

The greatest DeFi tasks actively implementing multi-chain

With the explosion of a quantity of blockchain platforms, it has turn into obsolete for a task to depend only on a single chain. Multi-chain or multi-chain is the aim of present DeFi tasks, to appeal to the greatest quantity of end users from all networks utilizing its protocol.

AnySwap (ANY) is at this time topping the charts with 14 chains He took sides. However, SushiSwap (SUSHI) with 13 chains He is also a formidable opponent.

Price trend in the third quarter of 2021

The third quarter of 2021 has just ended with the rate of Bitcoin recovering, the market place is lively once again. Let’s consider a appear at the rate trends of the greatest coins with Kyros in excess of the previous three months.

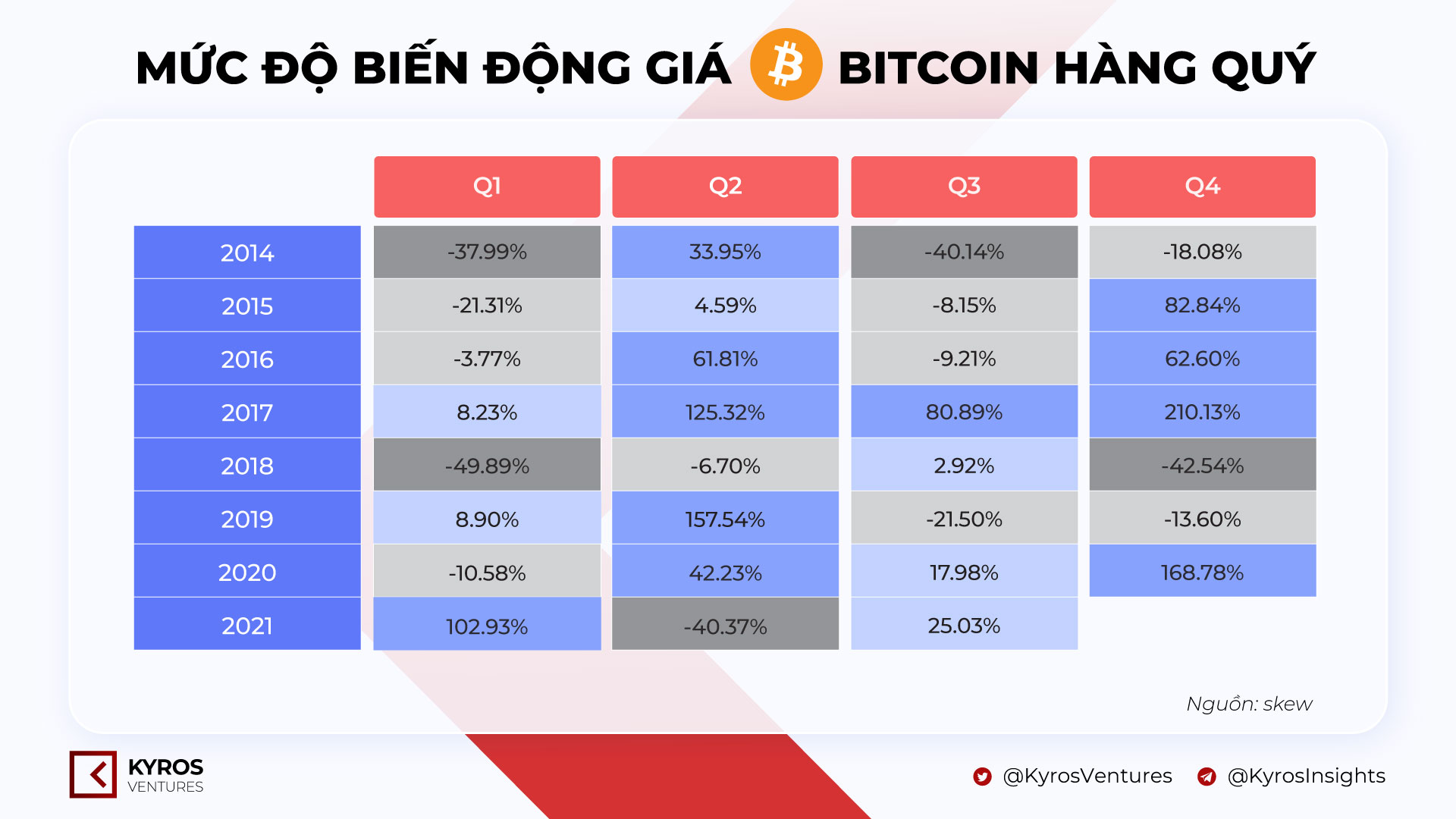

Quarterly volatility in bitcoin charges

After lots of days of volatile volatility, Bitcoin closed the September candle, also the third quarter of 2021 with… a green shade. Not only that, the volume of each day transactions on the Bitcoin network reached an all-time large of $ 29 billion.

What do you feel these staggering numbers predict?

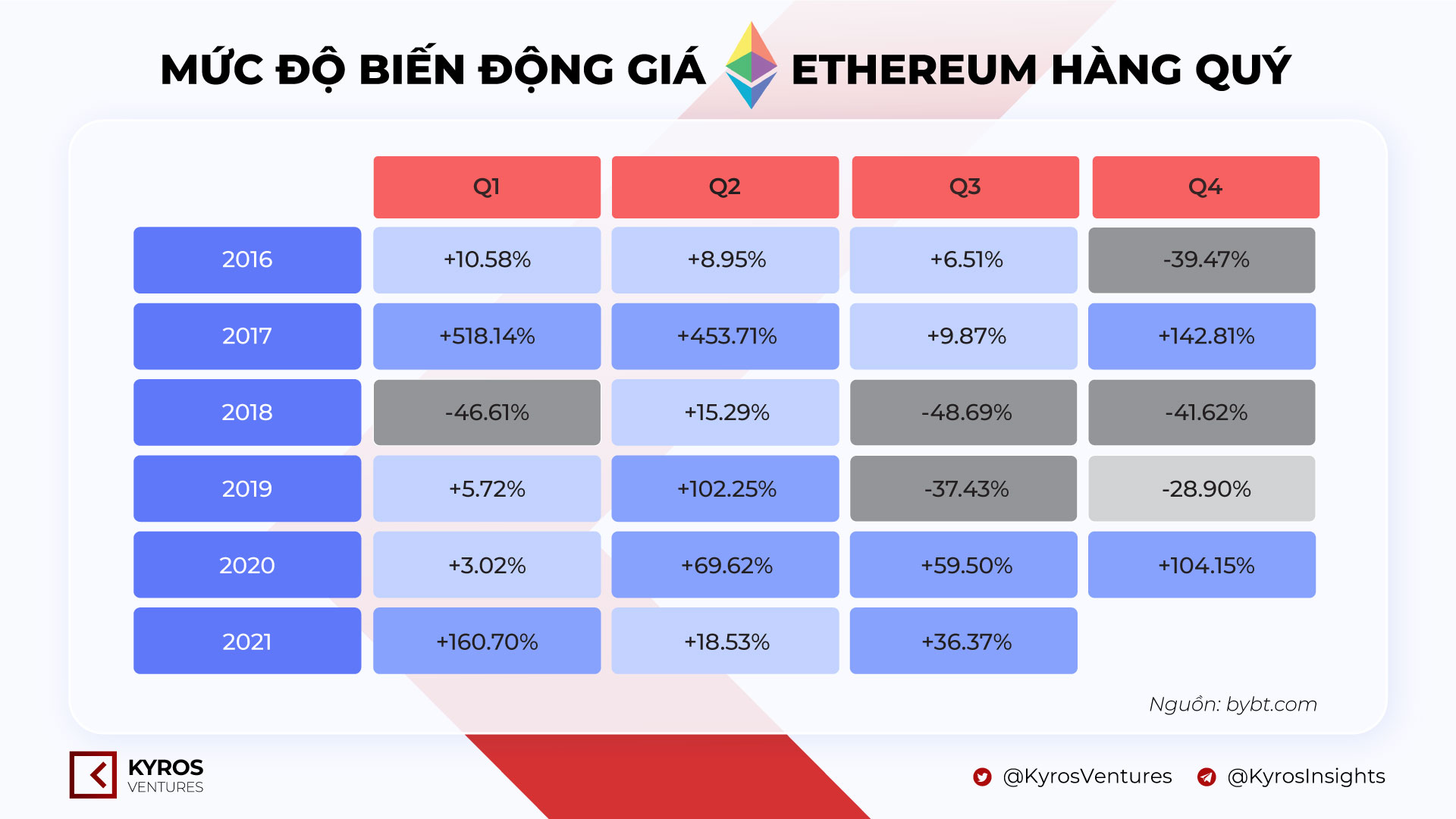

Ethereum quarterly rate volatility

Ethereum ended the quarter with three consecutive green candles in 2021.

Will the historical past of 4 green neighborhoods like 2017 and 2020 repeat itself this 12 months?

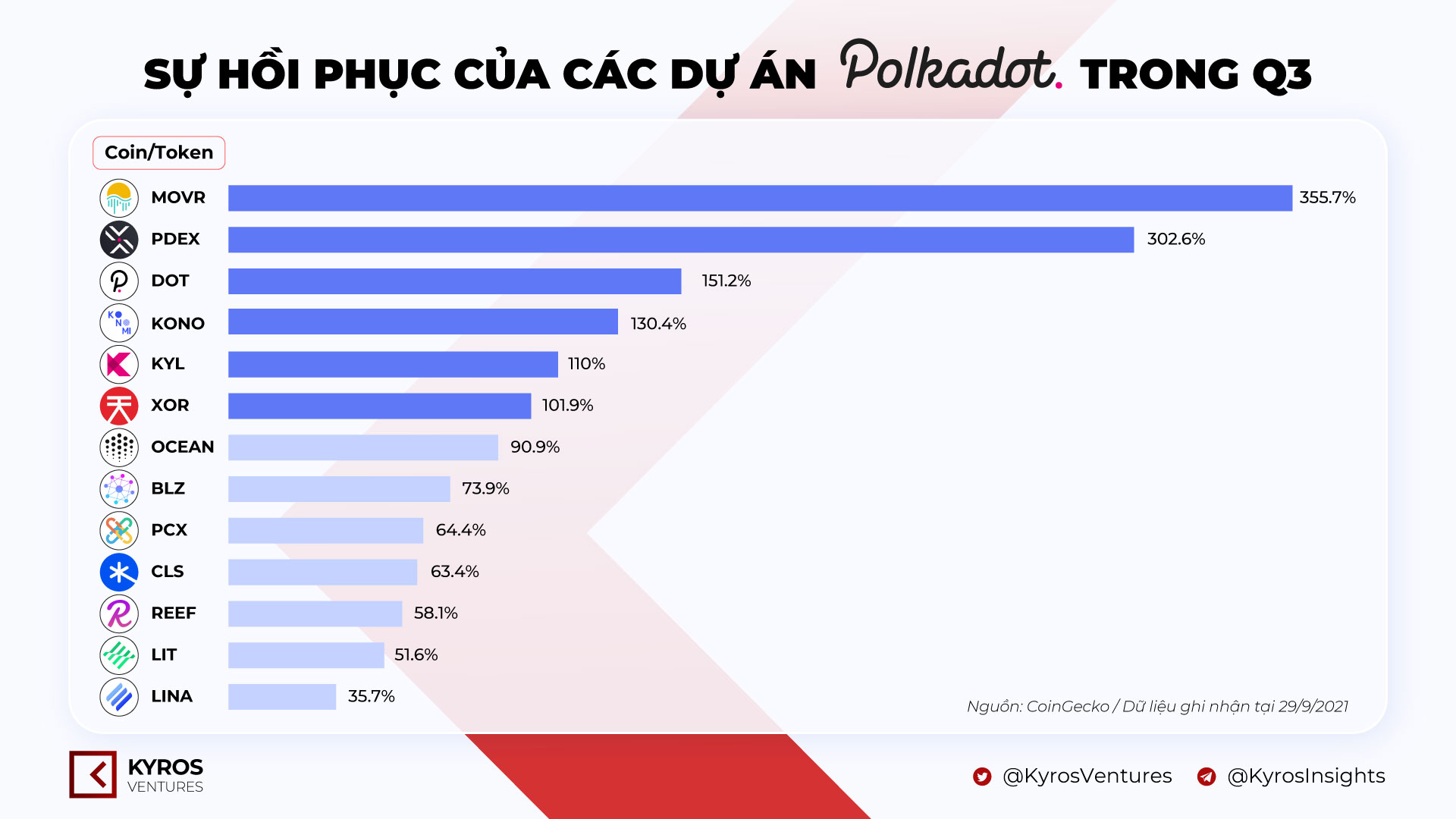

The recovery of the Polkadot process tasks in the third quarter

Polkadot (DOT) will be the focal stage of the cryptocurrency market place in the fourth quarter of 2021. This is the prediction of lots of veteran analysts, as the rate of DOT continues to rise, hitting ATH considering the fact that May.

Thanks to DOT’s solid development, tasks in the Polkadot ecosystem have also exploded. The third quarter ended with remarkable numbers of Polkadot’s rate recovery considering the fact that the May crash.

Maybe you are interested: