After lots of days of waiting, Moonbeam Network (GLMR), an Ethereum compatible task, was officially launched on Polkadot.

Moonbeam is the 1st chain guard to be thoroughly operational on Polkadot. The Moonbeam blockchain is prepared to welcome the implementation of a lot more than 80 tasks, which must “illuminate” the Polkadot ecosystem in the exact same way that the mapping edition of Moonriver has brought lots of dApps and use instances for Kusama.

one / Moonbeam is Dwell @Polka dot! 🔥 We are pleased to announce that Moonbeam is the 1st thoroughly operational chain guard on Polkadot. Moonbeam will carry lots of new integrations, pursuits and consumers to illuminate the Polkadot ecosystem. ⚡ #MoonbeamLightsUphttps://t.co/yBhgyWwaRn

– Moonbeam Network (@MoonbeamNetwork) January 11, 2022

This launch follows a extensively supported crowdfunding campaign organized by the Moonbeam Foundation, which has acquired above 35 million DOTs, or $ 944 million, with contributions from above 200,000 supporters globally. The Moonbeam Community Network has the two the greatest amount of contributors and the greatest amount of DOTs acquired by any organization.

thirty% of the prizes of the 1st local community, for a complete of 45 million GLMR tokens, had been distributed to participants primarily based on their share of the complete money raised. The remaining 70% (105 million GLMR tokens) will be issued incrementally above a 96-week parachain rental time period.

Moonbeam’s prepare just after direct implementation on Polkadot must involve linking a number of infrastructure tasks. Some of them have been uncovered via task announcements, together with The Graph (GRT), Chainlink (Hyperlink), and so on.

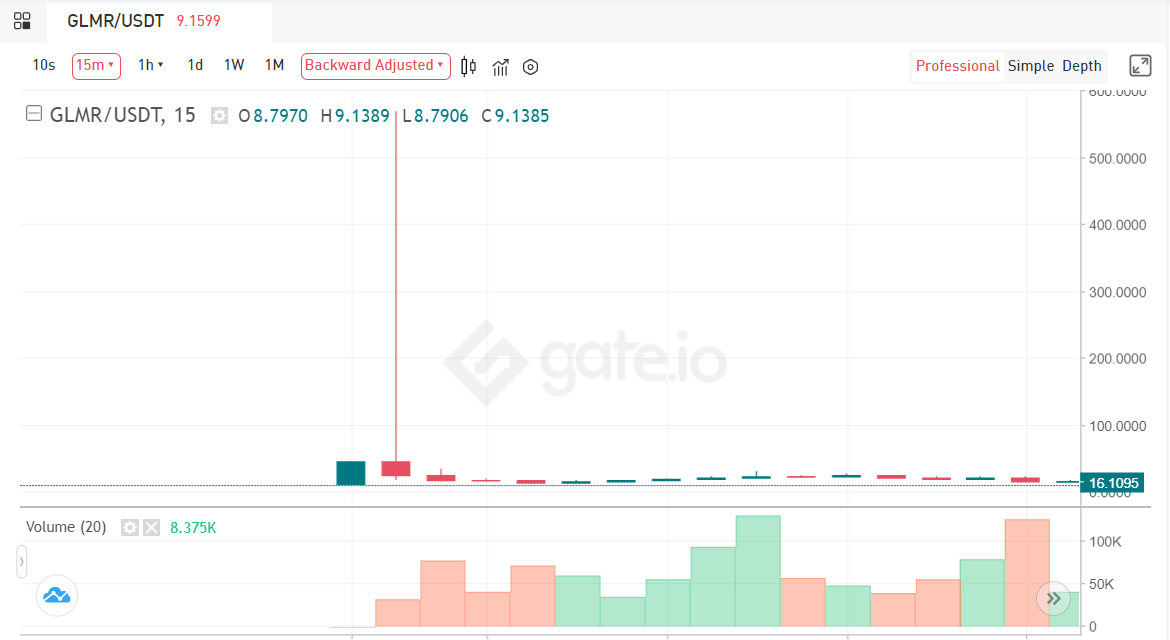

Also on January eleven, just after going public on the Binance stock exchange, GLMR grew from $ .25 to a peak of $ 51, which is 200 occasions its starting up cost. However, as of press time, GLMR is trading at $ eight.76.

An exciting stage is that in advance of staying listed on Binance, GLMR the moment reached a cost of above 500 USD in contrast to Gate.io’s trading information.

Synthetic currency 68

Maybe you are interested: