[ad_1]

The cryptocurrency market saw nearly $4 billion in Bitcoin (BTC) and Ethereum (ETH) options expire today.

Market watchers pay particular attention to this event because of its ability to influence short-term trends through contract volume and their notional value. Looking at the put-to-call ratio and maximum pain points can provide insight into a trader’s expectations and likely market direction.

Bitcoin and Ethereum Options Expire Today

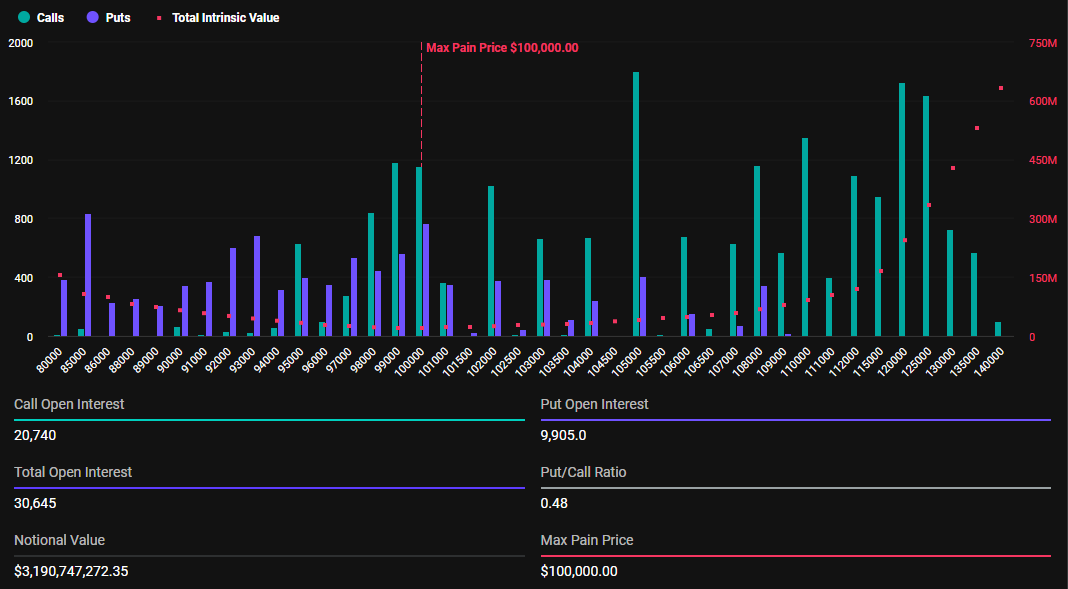

The notional value of BTC options expiring today is $3.19 billion. According to data from Deribit, these expired Bitcoin options contracts have a put-to-call ratio of 0.48. This ratio shows the prevalence of options buying contracts (calls) compared to option selling contracts (puts).

The data also reveals that the maximum pain point for these expiring options contracts is $100k. In crypto options trading, the maximum pain point is the price at which most contracts expire worthless. Here, assets will cause the most financial losses to investors.

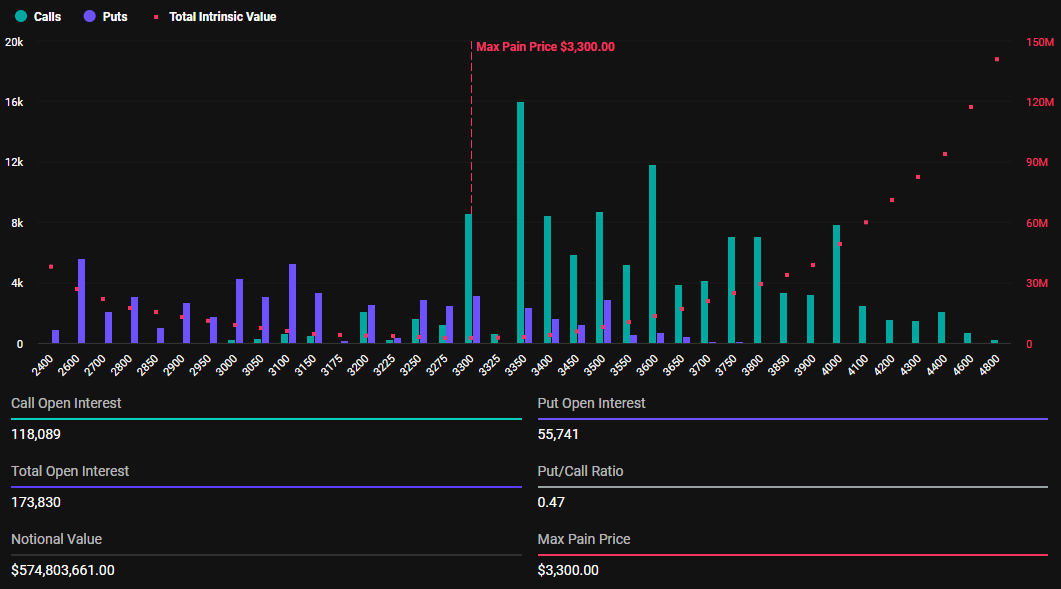

Additionally, there are 173.83K Ethereum options contracts expiring today. These options contracts have a notional value of $574.8 million and a put-to-call ratio of 0.47. The maximum pain point is 3,300 USD.

The current market prices of Bitcoin and Ethereum are both above the maximum pain point. BTC is trading at $103,388, while ETH is at $3,305.

“BTC Maximum Pain Point Moves Higher, While ETH Traders Position Near Key Levels,” Deribit observe.

This shows that if options contracts expire at these prices, it will often represent a loss for the option holder.

Results for options traders can vary significantly depending on the specific strike price and the positions they hold. To accurately assess profit or loss at expiration, traders must consider their entire options position along with current market conditions.

What Expiring Contracts Mean for the Market

These expiring contracts come amid President Donald Trump’s executive order to create a reserve of digital assets in the United States. If approved, the initiative could include crypto assets other than Bitcoin.

More than just a storehouse of digital assets, the president also established a cryptocurrency working group to develop a federal regulatory framework governing digital assets. The US Securities and Exchange Commission (SEC) also repealed policy SAB 121, which allowed banks to custody cryptocurrencies.

These developments, along with the expiration of BTC and ETH options contracts, are bullish fundamental factors that could stimulate volatility. Analysts at CryptoQuant reveal an interesting investor perspective that suggests a comprehensive evaluation is necessary before drawing conclusions.

“Is this the calm before the coming storm? The market continued to decline even after the SEC announced the formation of the Crypto Regulatory Task Force. BTC broke below $106K and now stands at $102K,” analysts said. write.

Furthermore, analysts observe increased interest in buying $95k options contracts for January. This may indicate that traders are looking protection against potential risks as Bitcoin becomes losing momentum.

The change in sentiment from strong to more cautious is said to be due to volatile market conditions.

That said, analysts predict the cryptocurrency market will continue to range until there is more clarity on the impact of recent economic data, especially the weak consumer price index. , for the Federal Open Market Committee (FOMC) meeting scheduled for next week. This meeting could influence the Fed’s upcoming policy decisions.

[ad_2]