In the final days of October and starting of November, Coinlive invites readers to observe some fascinating on-chain occasions this kind of as the movement of funds into the market place, the November open with the Onyx protocol hack, and updates on trading and the liquidation of FTX assets.

Outstanding on-chain occasions final week (October thirty – November four)

Outstanding on-chain occasions final week (October thirty – November four)

one. Cash movement from money to market place

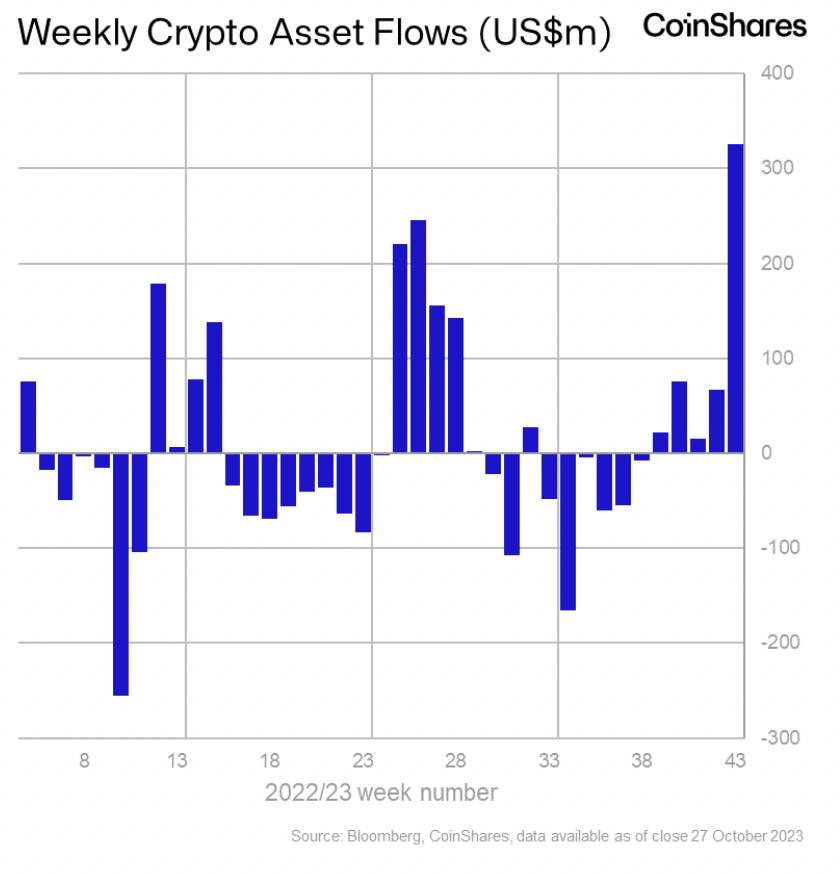

Inflows into digital investment goods final week recorded weekly ATH amounts because July 2022, reached $326 million in Week.

Weekly cryptocurrency inflows. Source: CoinShares

Weekly cryptocurrency inflows. Source: CoinShares

The figure of 326 million bucks are unable to be mentioned in quite a few phrases United States of America When represents only twelve%, Even although we have noticed a whole lot of ETF signals for about two weeks now, this could also be due to the reality that American fiscal giants and organizations are nonetheless waiting for the official approval of the Bitcoin Spot ETF to pour funds into. Most of the funds flows are created by Canada ($134 million), Germany ($82 million) and Switzerland ($50 million).

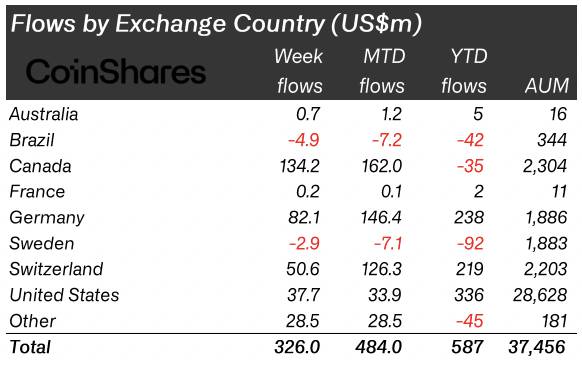

Cash movement by nation. Source: CoinShares

The assets that acquire the most investment are Bitcoin represents 90%equivalent 296 million bucks. Furthermore, approx 15 million bucks it was applied to develop quick marketing positions as BTC produced heat, despite the fact that this was nonetheless a pretty modest volume in contrast to the hundreds of hundreds of thousands of bucks poured into this asset.

Another identify attracting inflows immediately after BTC is Solana When reached 24 million bucks. In October, SOL was the prime token in terms of price tag increases, with an improve of extra than 80%. However, not all Altcoins entice funds flows, together with Ethereum when there is an improve in outflows six million bucks.

two. Two critical hacks of the week

two.one. Unibot is attacked

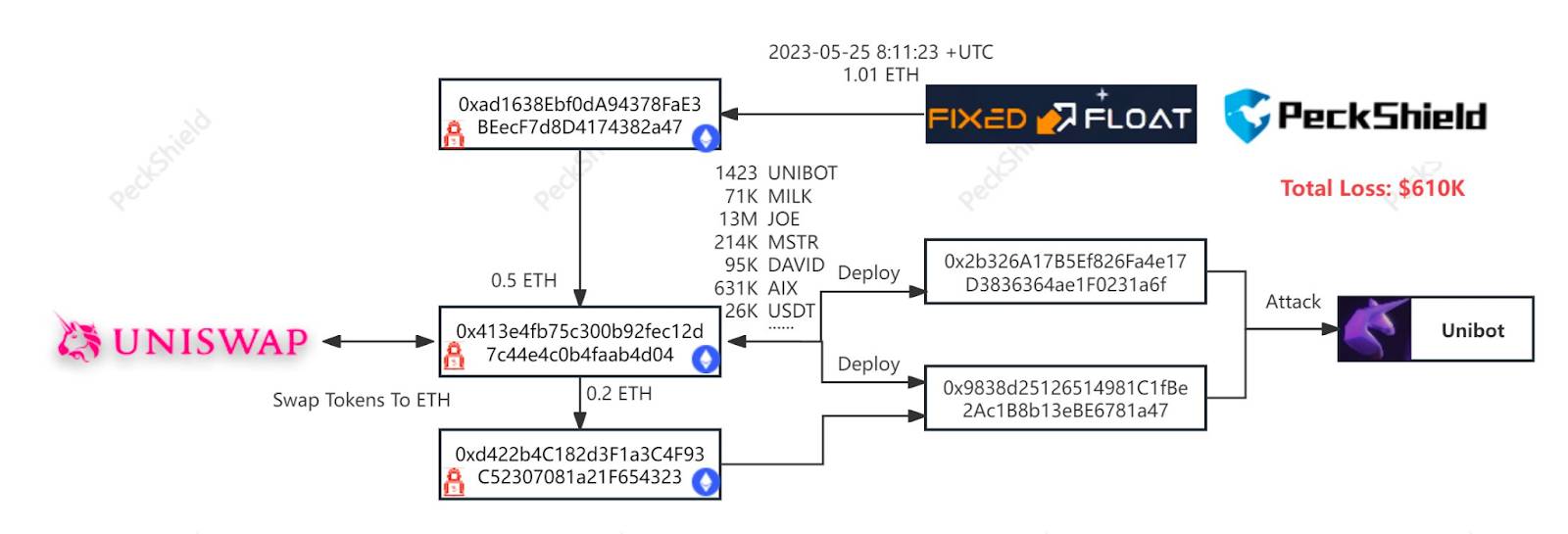

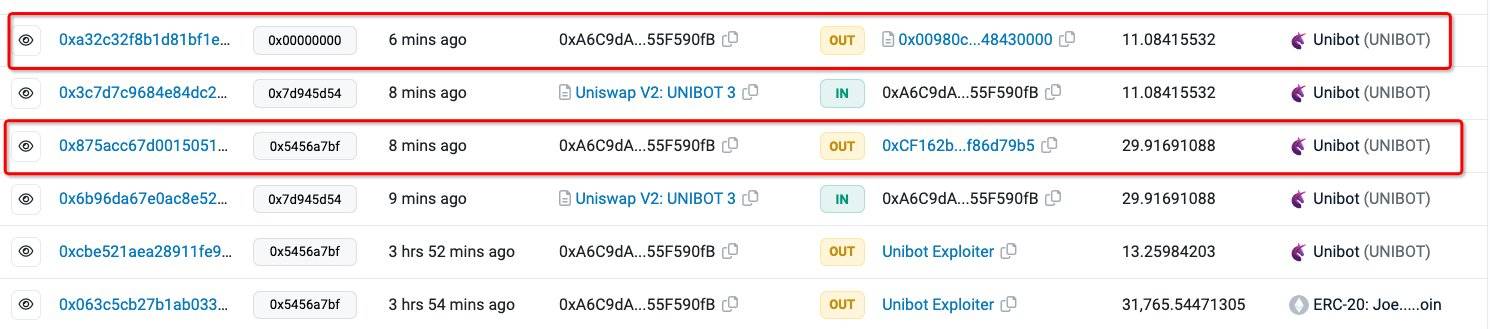

On October 31, Peckshield and Cyvers reported that the Telegram bot undertaking Unibot had been attacked. Unibot is a Telegram instrument that automates cryptocurrency trading. This instrument assists consumers invest in tokens as quickly as they have additional liquidity and set up innovative trading tactics.

According to Cyvers, the result in seems to be the lack of input in the “transferFrom” perform to transfer money from authorized tokens to the contract. Estimated injury approx $640,000.

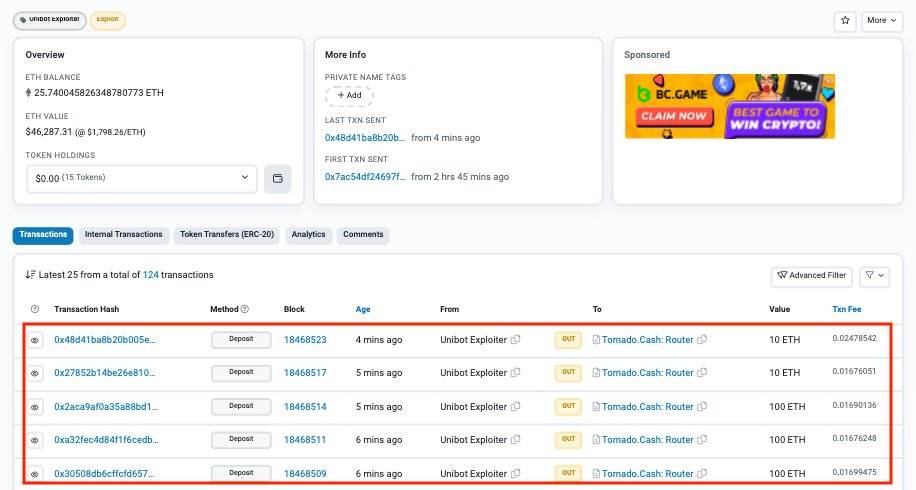

According to Scopescan, the attacker transferred many memecoins from the user’s wallet and immediately exchanged them for 355 ETH. This ETH is then transferred to TornadoCash. Tracing Peckshield, one.01 ETH was at first transferred to the hacker’s wallet one week immediately after the undertaking was launched, this volume came from FixedFloat, a sort of mixer.

Hacker transactions. Source: Peckshield

Hacker transactions. Source: Peckshield

The transaction transfers ETH to TornadoCash. Source: Etherscan

The transaction transfers ETH to TornadoCash. Source: Etherscan

Another awesome matter is to have a wallet deal with 0xA6C All Unibots have been withdrawn, but it seems that this individual was not paying out focus and continued to invest in extra tokens from the exact same hacked wallet and misplaced all Unibots yet again.

The 0xA6C wallet has been retired by Unibot. Source: Etherscan

The 0xA6C wallet has been retired by Unibot. Source: Etherscan

On the 31st the Unibot hack occurred which closed the month of Uptober. There have been roughly 32 attacks that induced complete injury $32.47 million in latest occasionsWTF five.one million bucks restored. Below are the prime five most notable attacks of October:

two.two. Onyx Protocol misplaced $two.one million

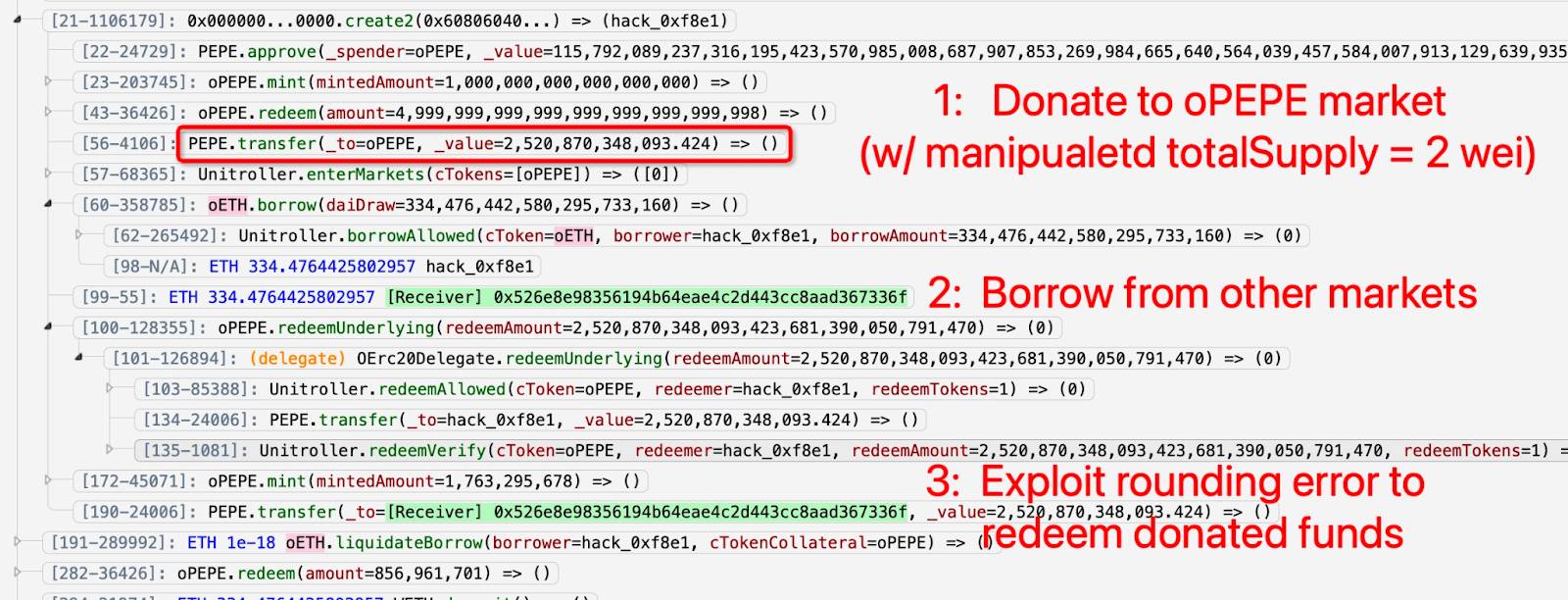

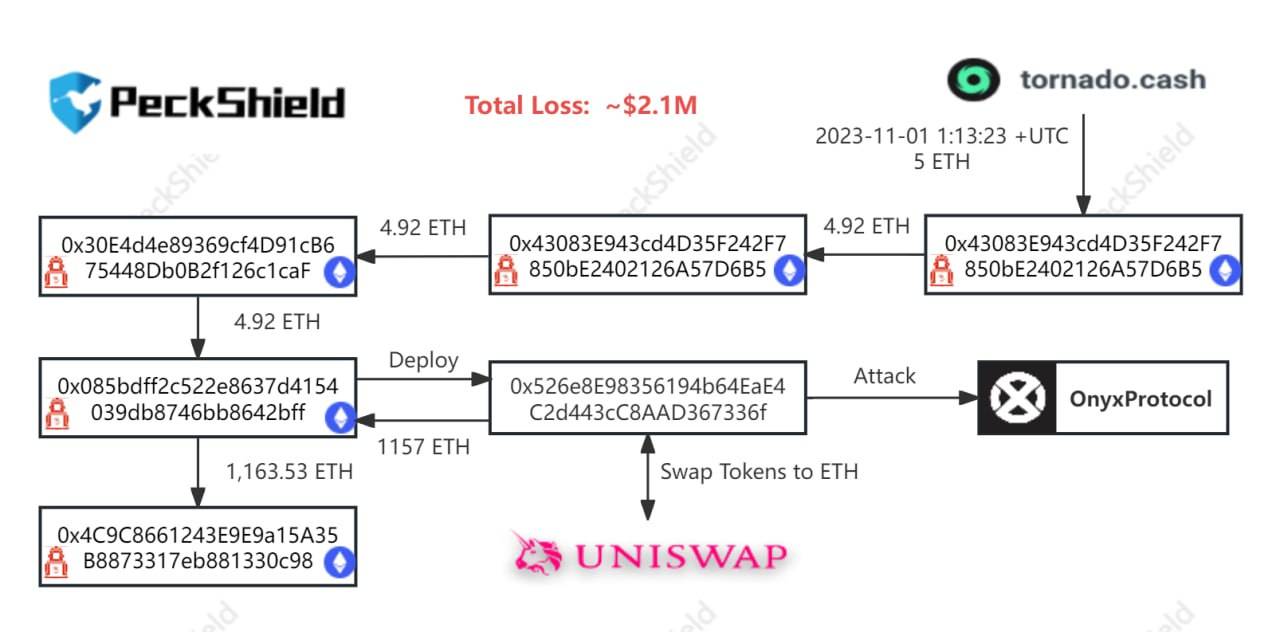

Late October, early November, we yet again acquire data about the Onyx DeFi protocol becoming drained by hackers two.one million bucks exploiting a rounding vulnerability, which has an effect on the accuracy of the style and design (reduction of precision). This vulnerability comes from an older forked edition of Compound V2.

Rounding vulnerability. Source: PeckShield

Rounding vulnerability. Source: PeckShield

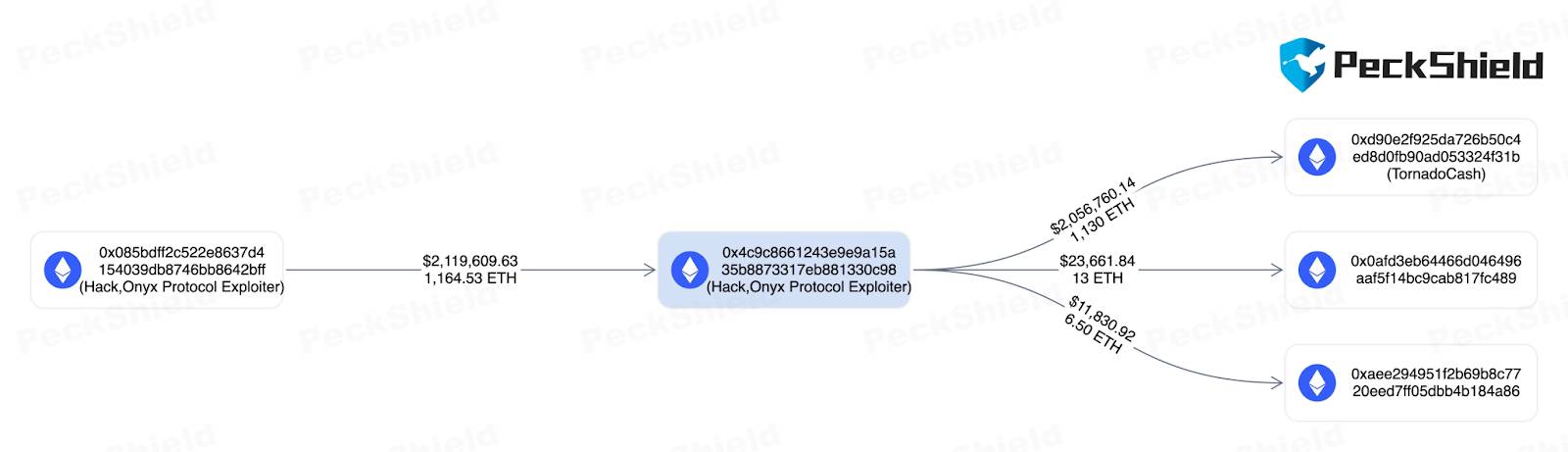

According to PeckShield, the incident occurred similarly to the Hundred Finance assault that induced injury seven.four million bucks in April 2023. Just in excess of an hour later on, in accordance to PeckShield, all of the stolen funds was laundered by the hackers by way of Tornado Cash.

Onyx protocol hacking approach. Source: PeckShield

Onyx protocol hacking approach. Source: PeckShield

Transfer to TornadoCash: Source: PeckShield

Transfer to TornadoCash: Source: PeckShield

The hacker then also sent funds to the addresses that sent messages asking for some ETH-like wallets 0xaEe acquired six.five ETH (roughly twelve,000 USD).

three. Chain memeland

Memeland is a web3 undertaking with the aim of selling meme culture and combining it with the electrical power of NFTs. This is a newly launched memecoin undertaking, which has previously mobilized ten million bucks just a handful of minutes immediately after launch.

The MEME token was just listed on Binance on November 3rd. Previously, the undertaking opened the token request portal for consumers. However, not like the undertaking workers’ expectations, the token request only prioritizes traders who hold three sorts of NFTs: YOU THE Serious MVP (273 owners), The Captainz (four,061 owners), and The Potatoz (two,914 owners).

However, the undertaking that guarantees MEME farming is not completed nevertheless, every person nonetheless has the chance to complete duties to get factors.

According to Tokenomics, the Memeland undertaking spends 25% of the complete provide, roughly 17.25 billion MEME, on airdop for the local community. Although the tokens that enable the declare are constrained to the group that holds NFTs, the quantity of MEMEs claimed by the Memeland local community has surpassed the milestone. one hundred million bucks.

Notably, in this set of claims, there is one particular wallet with ENS, lastviking.eth, which acquired the greatest quantity of tokens. 71.eight million MEMES – at present well worth approx $one.75 million.

A bunch of wallets claiming MEME. Source: Arkham Intelligence

A bunch of wallets claiming MEME. Source: Arkham Intelligence

Based on Lookonchain information, between the ten addresses that acquired the most airdrops, seven wallets sent MEMEs to the exchange immediately after obtaining the tokens.

Wallet that receives the most MEMES. Source: Lookonchain

Wallet that receives the most MEMES. Source: Lookonchain

Furthermore, the undertaking workforce also moved ten million MEMES on DEXs to supply liquidity and deposits 670 million MEMES ($15 million) in Binance, OKX, Bybit, KuCoin, Gateio and Huobi, probably for “market making”.

four. Update FTX asset settlement

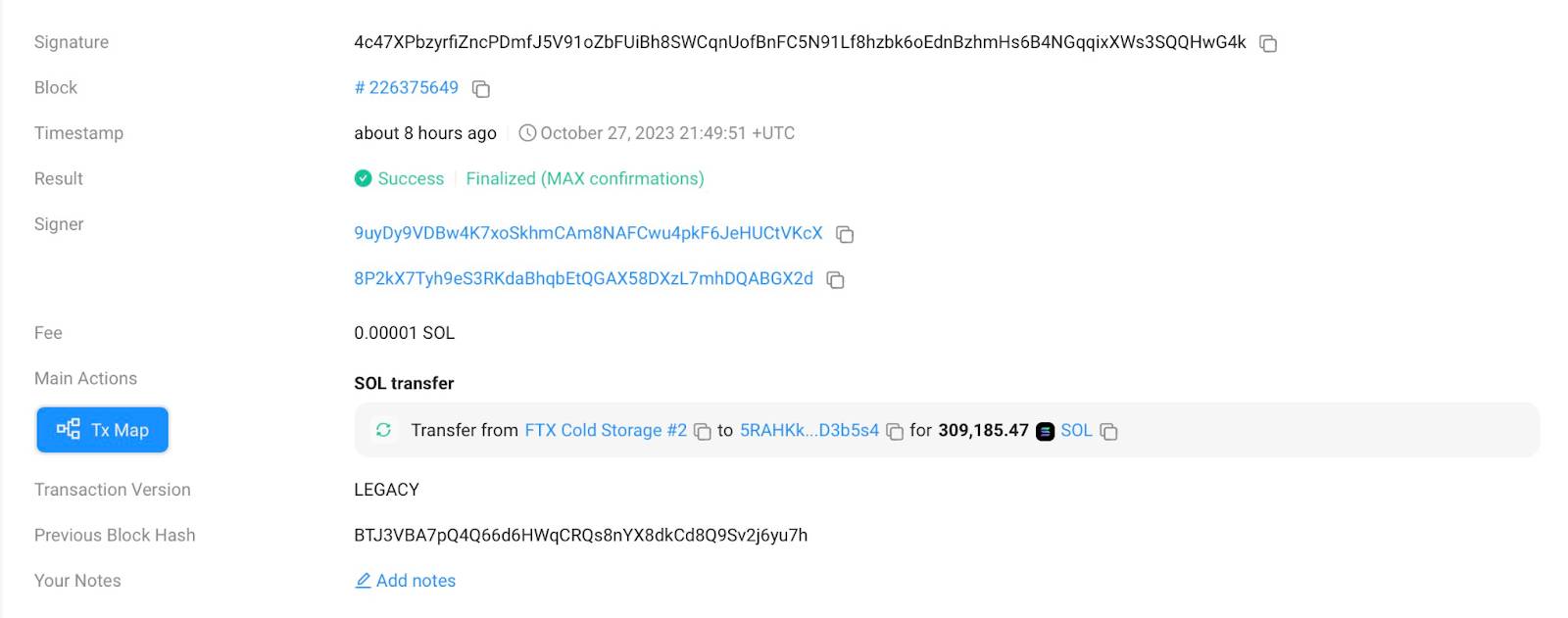

The approach of liquidating FTX’s assets continues immediately after marketing extra than $59 million final week. On October 28th the FTX portfolio on Solana moved by approx 309,200 SOL (roughly $9.9 million) by way of 5RAHkk walletwherever an interval 244,000 SOL sent to the Binance exchange.

SOL transfer transaction. Source: Solscan

SOL transfer transaction. Source: Solscan

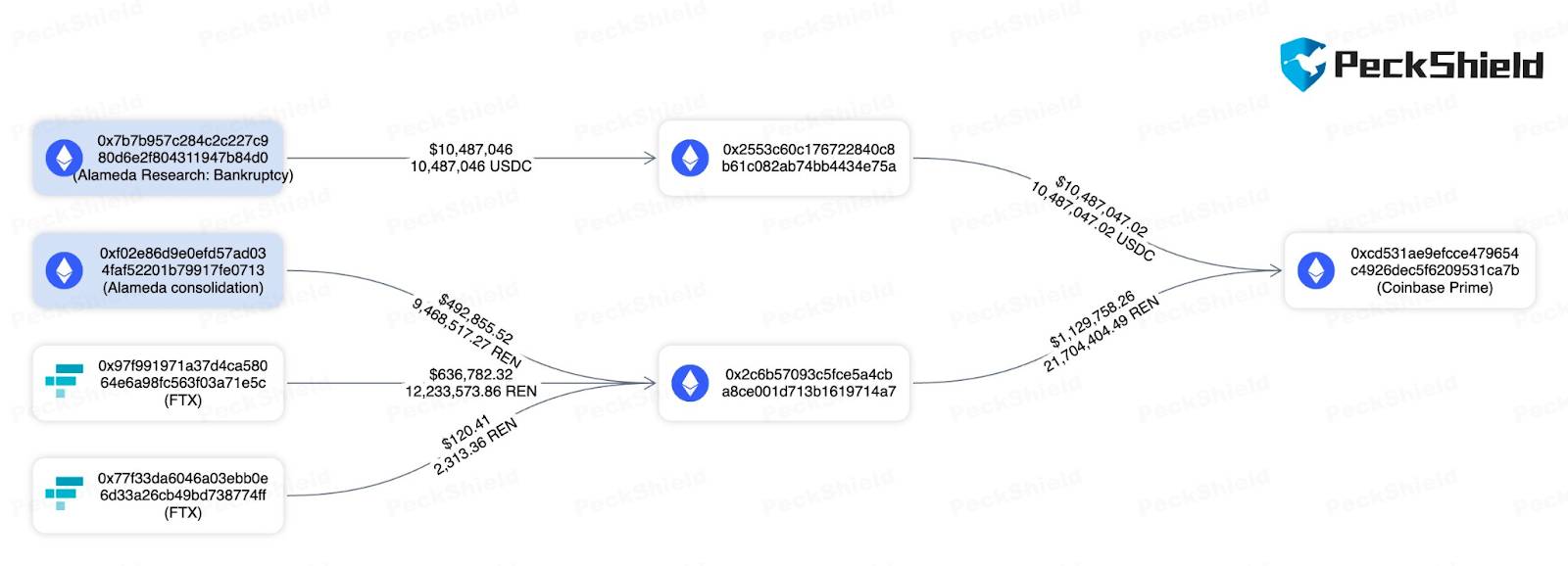

Then October 30th 131,930 SOL (four.six million bucks) carry on to be collected. In addition to SOL, FTX/Alamenda also broadcast on the exact same day twelve.eight million US bucks AND REN 21.seven million worth one.one million bucks to Coinbase Prime by way of the Ethereum network.

REN and USDC trade transfers. Source: PeckShield

REN and USDC trade transfers. Source: PeckShield

USDC Transfers. Source: PeckShield

USDC Transfers. Source: PeckShield

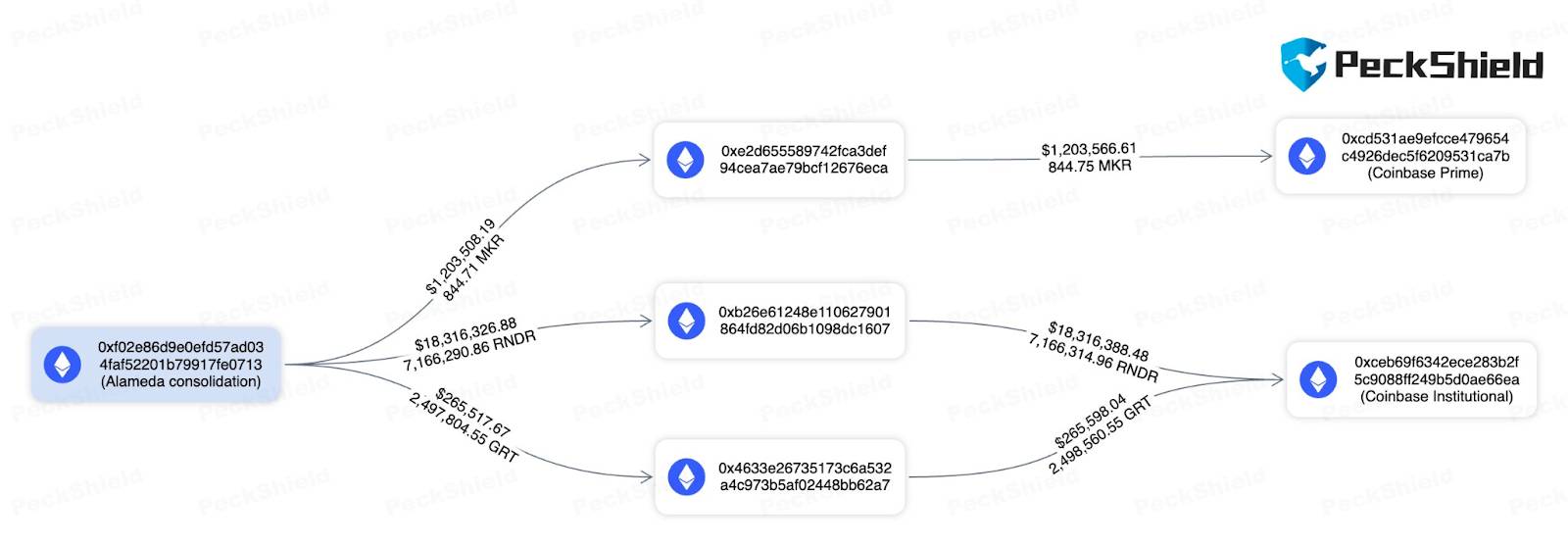

According to Peckshild, the deal with named Alameda transferred roughly $twenty million in other assets to Coinbase on the exact same day, together with 844.seven MKRFrom seven.two million RNDR and approx two.five million GRT.

RNDR and MKR transfers. Source: PeckShield

RNDR and MKR transfers. Source: PeckShield

A series of asset liquidation operations continued on November two with the liquidation of asset values exceeded 22 million bucks.

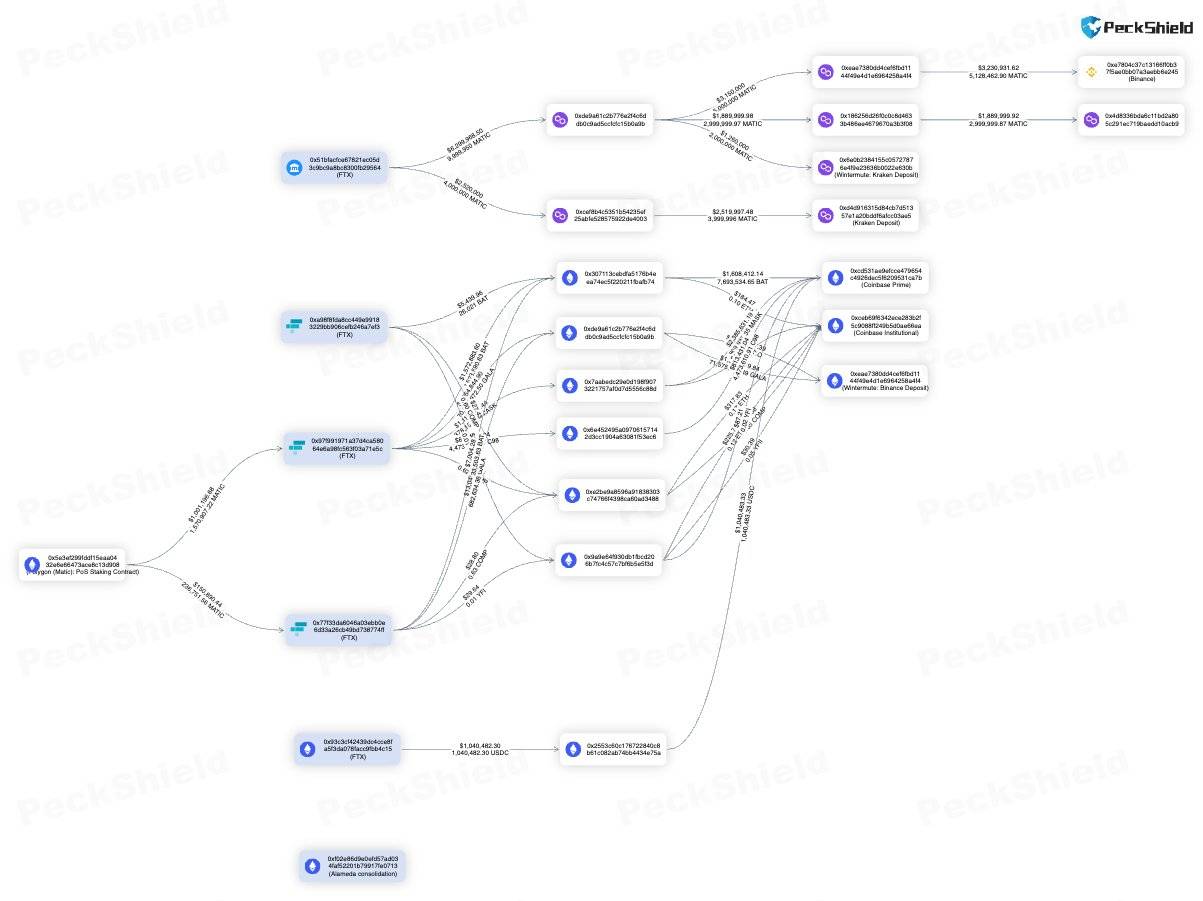

After FTX/Alamenda wallets acquired approx one.81 million MATICs (well worth roughly $one.15 million) from Polygon: POS staking contract.

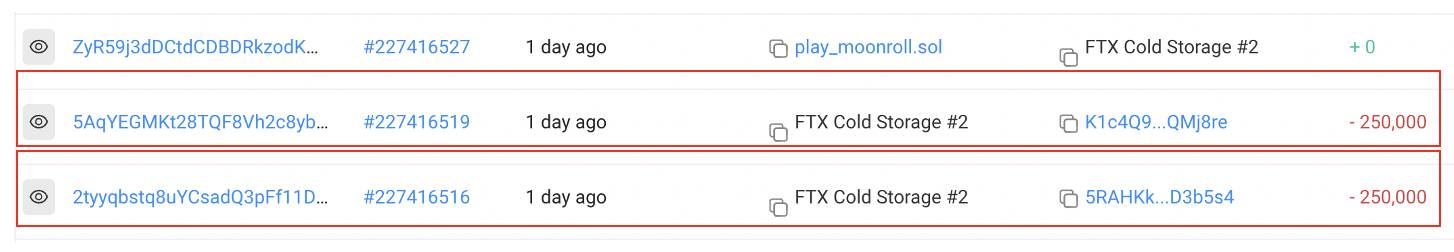

At the exact same time, the FTX wallet also withdrew approx one.six million SOL get out of the staking pool and get moving 500,000 SOL (well worth $twenty.seven million) from the wallet, which contained approx 250,000 SOL Deposited on Binance.

SOL transfer transaction. Source: Solscan

SOL transfer transaction. Source: Solscan

It would seem that FTX is aware of how to consider benefit of the increasing wave of SOL to liquidate this token at a large price tag simply because it sells SOL constantly every single day. Recently, on November three, FTX moved extra 850,000 SOL ($33.48 million) to the 4Axqyo and 5RAHkk wallets. The 5RAHkk wallet is branded as a Binance Deposit wallet by Wintermute.

Additional SOL transfer transaction. Source: Solscan

Additional SOL transfer transaction. Source: Solscan

Also, FTX/Alamenda is moving eleven million bucks a variety of assets in portfolio on the Ethereum network at the most important centralized exchanges this kind of as Coinbase Prime, Binance and Kraken, together with: seven.seven million BAT (well worth one.65 million bucks), 71.six million bucks GALA (one .36 million bucks), 810,000 MASK (two.49 million bucks), four.five million C98 (836,500 USD),…

$eleven million transfer transaction. Source: PeckShield

$eleven million transfer transaction. Source: PeckShield

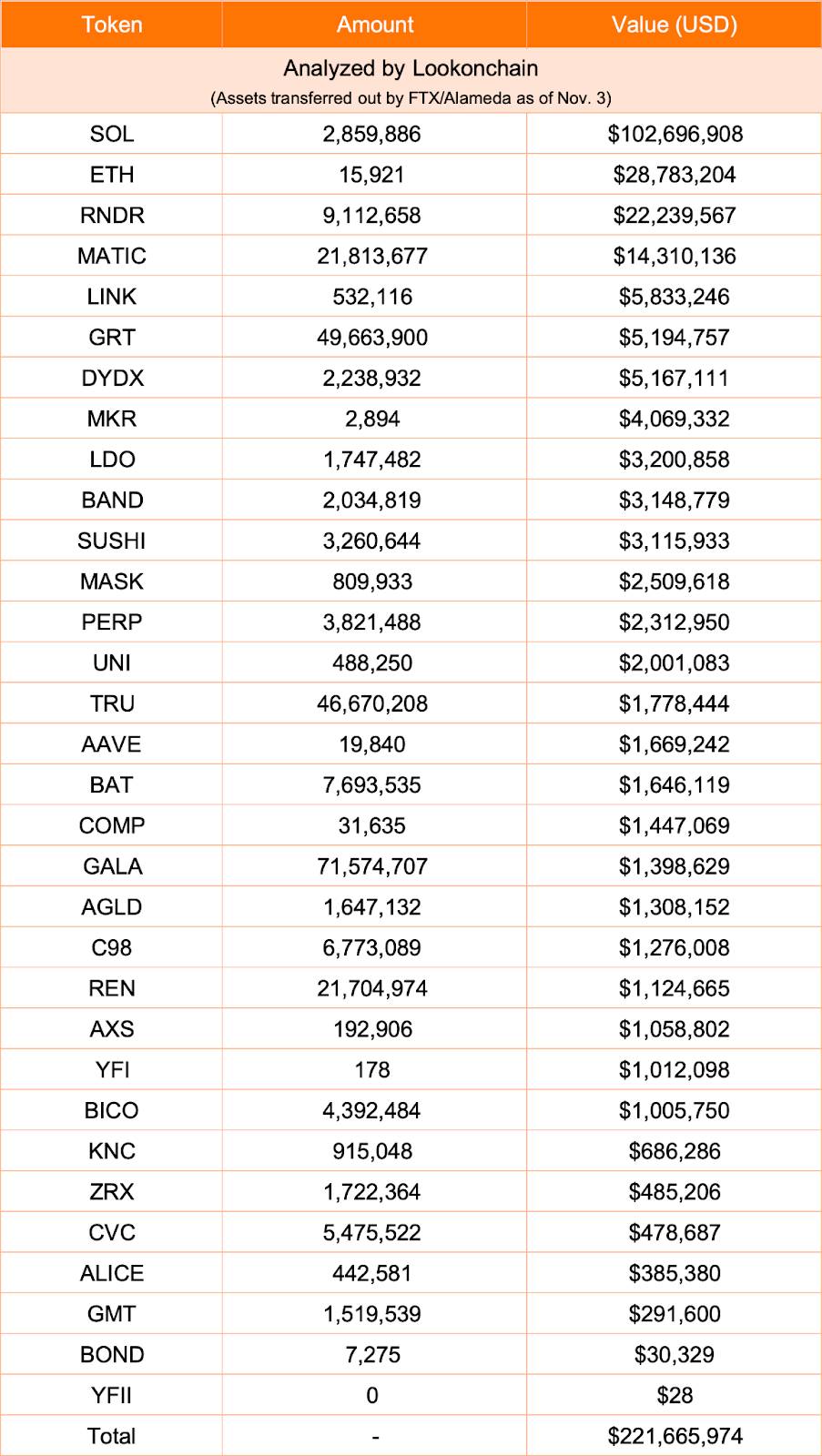

As of November three, FTX has transferred $221.seven million on CEX exchanges.

Statistics of crypto assets transferred to the exchange by way of FTX wallet addresses because the finish of October. Source: Lookonchain

Statistics of crypto assets transferred to the exchange by way of FTX wallet addresses because the finish of October. Source: Lookonchain

Coinlive compiled

Join the discussion on the hottest challenges in the DeFi market place in the chat group Coinlive Chats Let’s join the administrators of Coinlive!!!