[ad_1]

Recently, I have received a few questions from you in the group chat Fomo Sapien, what an algorithmic stablecoin is, and at the same time, what is your opinion about the relatively new stablecoins on the market. Well, I would like to briefly summarize a few key points related to stablecoins and my personal opinion about this market right now.

First, let’s go through a few stablecoins from primitive to complex.

Ancient stablecoin

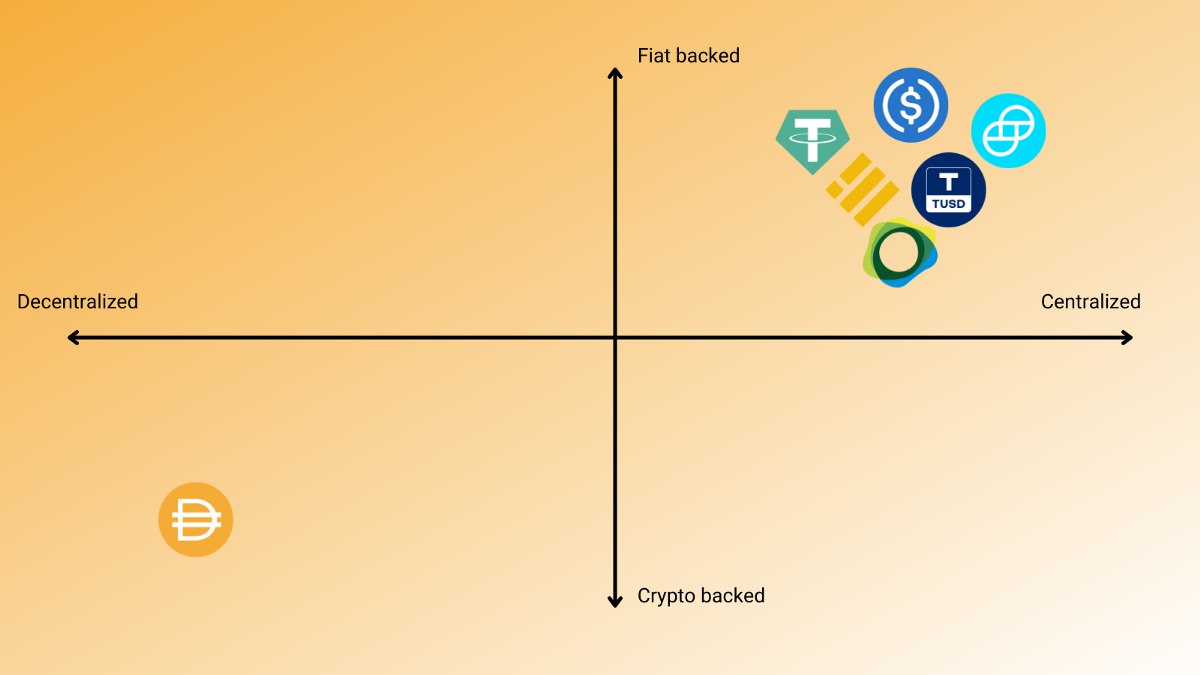

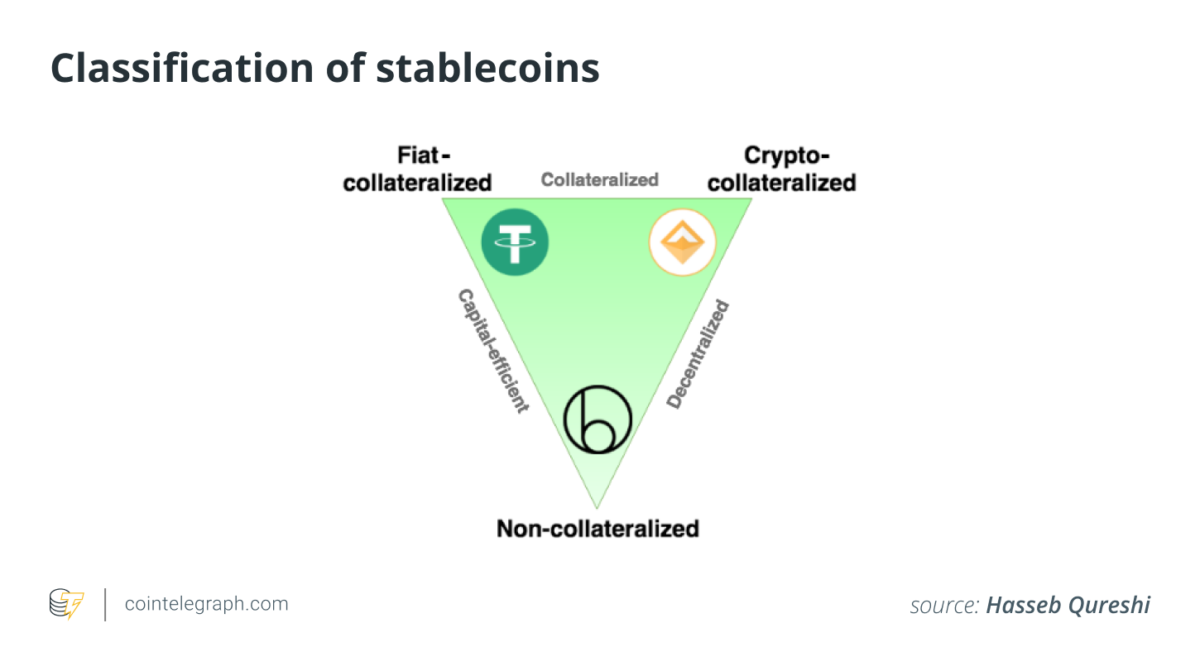

Representative examples of this group are USDT, USDC, PAX… That is, there will be one party standing out to receive cash and print a corresponding amount of stablecoins. The basic principle is that the amount of stablecoin mint will have to be backed by real assets. And of course, because of the centralized nature of this stablecoin, there have been many speculations.

The first scandal involved Tether printing virtual stablecoins without enough USD backing. The second scandal is that Bitfinex (a company with the same owner of Tether) took money from this stablecoin issuer to cover a loss of $850 million. These cases have been mentioned in great detail by Jane in the article below, you can read them if you are interested:

> See more: Tether (USDT): Who gives me honesty?

Decentralized stablecoins

Specific examples of this group would be DAI, sUSD, PAI, USDJ… To be able to mint this stablecoin, the user (emphasis is on the user himself) would have to lock the collateral into the smart contract, and then print it out. a proportional amount of stablecoins of value. However, there will be a maximum print limit, for example, if you mortgage 1 ETH (for example, at a market price of $2,000), then you are only allowed to print $1,000.

To learn more about this issue, please follow the article describing how MakerDao and DAI work here:

>> See more: MakerDAO – What is DAI? Detailed information about cryptocurrencies in the MakerDAO ecosystem – DAI

Of course, the problem of centralization and dependence on a single party has been resolved. The network can also track the transparency of collateral assets. However, I personally think that this solution still has a problem, that is, the collateral will be limited, and sometimes the amount of stablecoin mint will not be enough to meet the needs of the market.

The solution is to accept more collateral solutions like Unit Protocol (DUCK)? There’s potential, but who’s to make sure the collateral won’t fluctuate wildly when the market is up. Therefore, this decentralized stablecoin still has a problem of scale.

Before going through the last form of stablecoin, I would like to talk about a branch of this decentralized stablecoin. Currently, there are several proposals to create a stablecoin that can pay interest to users every month. For example, you store 100 USD in your wallet, but thanks to a specific farming, staking mechanism or strategy, the project can generate more stablecoins, thereby paying interest to users. That is, each month the balance in the user’s wallet will probably be 103-104 USD from the initial 100 USD. This stablecoin branch, I would not like to make a comment, because currently too few projects attract attention to this direction.

Algorithmic stablecoins

Instead of having to have collateral as well as demand problems, like type 2, the direction of the algorithmic stablecoin group will be to self-adjust supply based on market demand.

There will be 3 subgroups of algorithmic stablecoins, namely rebase, basis and esd. Stay calm and don’t be shy with these terms. Simply because I don’t know which Vietnamese word to use to make 100% semantics, so I would like to use the English prototype for now.

How to divide this format, I refer to the video of Boxmining, a famous Youtuber in the field of coding. You can search his channel to follow. Then we come to the first form.

Rebase

Some representatives are AMPL, BASE, xBTC, etc.

This form is simple, the algorithm it has predefined, is that when the stablecoin price > 1 USD, it will print more money, increase the supply so that the stablecoin price decreases. Conversely, if the price is < 1 USD, the algorithm automatically burns tokens in each user's wallet, to reduce the supply, from which the price will increase to the 1 USD area.

However, I find this method is not very effective and you can go to coinecko to check the price of these coins. AMPL’s volatile price range is quite far from 1 USD and the frequency of fluctuations is very frequent.

Basis

Some representatives are Basic Cash, MITH CASH,..

This model will include 1 stablecoin and the other 2 coins will have the purpose of coordinating so that the stablecoin moves to the 1 USD zone. Well, let’s take the example of Basis Cash (BAC).

Projecting the above model, the stablecoin will be Basis Cash (BAC) and will be coordinated to 1 USD. Besides, the remaining 2 coins will have the purpose of coordinating BAC, and of course in opposite directions:

. Basic Shares (BAS): whoever holds this coin will receive BAC when the price is higher than 1 USD. These people will sell BAC to push the price to the 1 USD zone.

. Basis Bond (BAB): when BAC is less than 1 USD, people can buy Bond (of course the bond price will be 1u lower), and Bond holders will be converted 1:1 with BAC if and only if BAC crosses the 1 USD zone. Thus, if they sold BAC at a price above 1 USD, they would have benefited from the price difference.

ESD (Empty Set Dollar)

Represented by ESD, USDN. This type of algorithm will not generate 3 tokens, instead only 1. Let’s take ESD as an example to understand the operating model.

When ESD surpasses 1 USD, the algorithm will automatically print more tokens for those who choose bond token ESD. Conversely, if ESD falls below 1 USD, user can use ESD to buy coupon (with discount price lower than 1u, of course). And ESD buy coupon that the system obtained will be burned to reduce supply. And when ESD rises above 1u, coupon will be returned to ESD.

Details of how this token works can be found in the article below.

What is Empty Set Dollar (ESD)?Get detailed information about Empty Set Dollar (ESD)

Ending

With that, we’ve gone through several forms of stablecoins on the market today. As for the last form, ie algorithmic stablecoins, I think this array needs more time to develop, to really implement the principle of decentralization. As for the size of the market capitalization and the current development of the cryptocurrency market, I believe that fiat stablecoins and stablecoin from collateral on defi is enough to serve the needs of the user.

Note, the above article is for informational purposes only, as well as a personal opinion and should not be considered investment advice.

Synthetic

Maybe you are interested:

[ad_2]