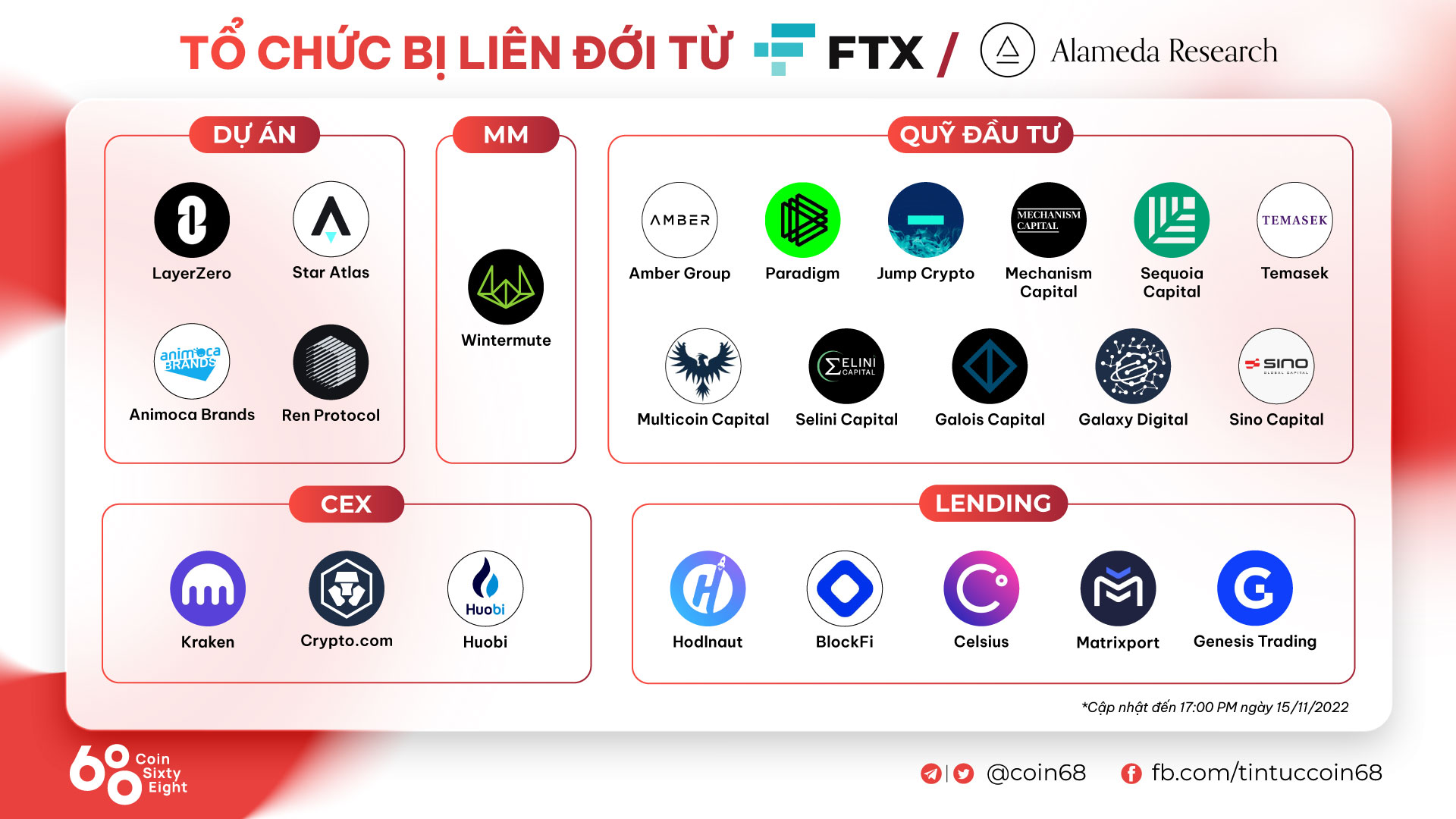

The collapse of FTX is and will impact a variety of providers and investment money. In current days, the neighborhood has witnessed 1 by 1 organizations huge and tiny claiming to be concerned in this incident. The following Coinlive post will summarize these providers for you to get an overview!

The organization is badly impacted

BlockFi blocks withdrawals

Does the organization reveal damages?

Investment money

Amber group

Amber Group claims it has no get in touch with with Alameda or FTT, but has actively participated in the transactions and has approx ten% of the complete trade capital it is “stranded” on the floor.

one) We have knowledgeable many industry cycles more than the previous five many years and our purpose has been and continues to be the very same: to offer an field primary support for trading, storing, hedging and managing your digital assets with an unique interest to these basic pillars.

— Amber Group (@ambergroup_io) November 9, 2022

Redwood Capital

Sequoia Capital mentioned that due to the current occasions with FTX and as the complete nature of the situation is not but identified, Sequoia will worth its investment in FTX at zero.

Specifically, their Global Growth Fund III invested $ 150 million in FTX and FTX US, although the SCGE fund invested $ 63.five million. These investments are manufactured in 2021, for a complete of $213.five million.

Here is the note we sent to our LPs in GGFIII concerning FTX. pic.twitter.com/Cgp1Yxk1pz

— Sequoia Capital (@sequoia) November 10, 2022

Digital Galaxy

Galaxy Digital uncovered it has an publicity of $ 76.eight million in FTX-associated assets.

Multi-currency capital

ten% of Multicoin Capital’s assets are locked in the FTX exchange.

Galois Capital

Galois Capital is caught at $ forty million on FTX.

Crypto fund @Galois_Capitale says he has $forty million locked up @FTX_Officialwith the corporation now thinking about its potential prospective customers.@skesslr relationshipshttps://t.co/bVhaNLkGnU

—CoinDesk (@CoinDesk) November 12, 2022

Paradigm

The paradigm invests a 290 million bucks in FTX more than the many years and will log zero.

Loan

Genesis Trading

Genesis Trading admits there is even much more 175 million bucks assets held on FTX.

As component of our purpose to offer transparency on this week’s industry occasions, the Genesis derivatives enterprise at the moment has about $ 175 million of frozen money in our FTX trading account. This has no influence on our industry-building routines.

— Genesis (@GenesisTrading) November 10, 2022

Hodlnaut

To follow CoinDeskHodlnaut has 13 million bucks held on the FTX bag.

Centigrade

Celsius holds three.five million Sereum (SRM) tokens on the FTX exchange. Additionally, Celsius lends to the Alameda Research Foundation 13 million bucks.

We have closely monitored the occasions surrounding FTX and maintained shut communication on these issues with crucial stakeholders in our situations.

—Celsius (@CelsiusNetwork) November 11, 2022

Exchange (CEX)

crypto. com

Crypto.com after uncovered only interested significantly less than ten million bucks. However, current “shady” actions are creating suspicions during the neighborhood, building Crypto.com much more topic to scrutiny than ever.

Kraken

Kraken mentioned it just holds 9,000 FTT tokens on the FTX exchange.

Furthermore, at the request of the authorities, Kraken has frozen the assets of FTX – Alameda.

🔐 We have no publicity to Alameda Research and hold about 9,000 FTT tokens on the FTX exchange. We motivate our customers to regain management of their fiscal freedom by verifying their balances, which are incorporated in our Proof of Reserve audit.

➡️ Find out much more: https://t.co/mnCE9epzlN pic.twitter.com/OT7CZAhdX6

— Kraken Exchange (@krakenfx) November 10, 2022

Huobi

Huobi is caught at $18 million on the FTX exchange.

Project

StratoZero

LayerZero, the venture invested by FTX-Alameda in March 2022, announced that it has acquired all ownership of shares, tokens and asset safety certificates, severing all ties with SBF. LayerZero also acquired Alameda’s total investment in Stargate (STG).

The venture claims to have up to $134 million in reserve assets, plus eleven.five million bucks caught on the FTX exchange, pledged to even now have adequate income left to trade for numerous many years to come.

Memo we just sent to @LayerZero_Labs traders pic.twitter.com/YfyONdGlAe

— Bryan Pellegrino (@PrimordialAA) November 10, 2022

Star Atlas

The Star Atlas (ATLAS / POLIS) game venture on Solana admits to retaining up half of the financial reserve on FTX and chance shedding almost everything, but did not reveal unique numbers.

To go over this with complete transparency, join us at a Town Hall currently at 5pm EST onwards https://t.co/mCa6L6xBZj. pic.twitter.com/XnNuSdEaNG

— SW4²6N3R (@at_mwagner) November 11, 2022

The organization reveals no damages

Investment money

Skip Crypto

Jump Crypto has publicity to FTX, but the chance has been managed and the fund can even now operate usually.

one / We, like all of you, have been shocked by the occasions that took spot more than the previous week. Jump’s publicity to FTX has been managed in accordance with our chance framework and we stay nicely capitalized.

– leap_crypto 🔥💃🏻 (@leap_) November 12, 2022

Capital Mechanism

Capital Mechanism amongst money with assets locked in FTX, exploring legal solutionshttps://t.co/ITezuVfqkS

– The Block (@TheBlock__) November 11, 2022

Temasek

Temasek is an investment fund in Singapore that participated in two funding rounds in January 2022 of FTX and FTX.US. It’s unclear how unique the investment is, but it can be confirmed that this fund has been impacted by the current crash.

Brands Animoca

Prominent gaming/Web3 investment fund Animoca Brands mentioned it was hit by the FTX-Alameda situation, but the influence was not a great deal.

one/ our ideas on the #FTX saga tldr we have minimum publicity and a incredibly solid stability sheet and we want to preserve that #BUILD #web3 and celebrate the victories they have permitted #teachers #creators #players and so on. a superior lifestyle by way of #digital property #NFT https://t.co/MxKvbXMOId

— Yat Siu (@ysiu) November 11, 2022

Other

Matrixport

‼️ Important observe ️ pic.twitter.com/kQXg1OVh4l

—Matrixport (@genuineMatrixport) November 11, 2022

Ren protocol

one) An update from Ren Labs on current occasions:

— Ren (@renprotocol) November 11, 2022

Wintermute

Wintermute has income on the FTX exchange, but not a great deal.

one/ We uncover the current occasions all around Alameda and FTX disappointing and unfortunate for the field. Wintermute is committed to accomplishing almost everything in our energy to assistance the field recover and come out more powerful.

— Wintermute (@wintermute_t) November 9, 2022

Synthetic currency 68

Maybe you are interested: