Taking benefit of Bitcoin’s move to $ 42,000 just before a correction, altcoins have quite a few robust fundamentals and swiftly developing genuine-planet applications.

Terra (LUNA), a blockchain protocol that powers the fiat-pegged TerraUSD (UST) stablecoin, is 1 this kind of undertaking, which has managed to counter Bitcoin’s downtrend and rise from the start off.

LUNA acquired 162% from a reduced of $ five.53 on July twenty to an intraday higher of $ 14.51 on August three, as the platform’s 24-hour trading volume elevated from $ 137 million to $ 774. Millions of bucks. LUNA is presently trading at USD 14.44.

Three causes for the surge of curiosity consist of LUNA’s swiftly expanding ecosystem, the addition of a wrapped kind of Ether (ETH) to the Anchor protocol, which brings the Ether rewards up for grabs for the ecosystem. Terra and the symbolic protocol aid to manage the circulating provide of LUNA as nicely as the FSO.

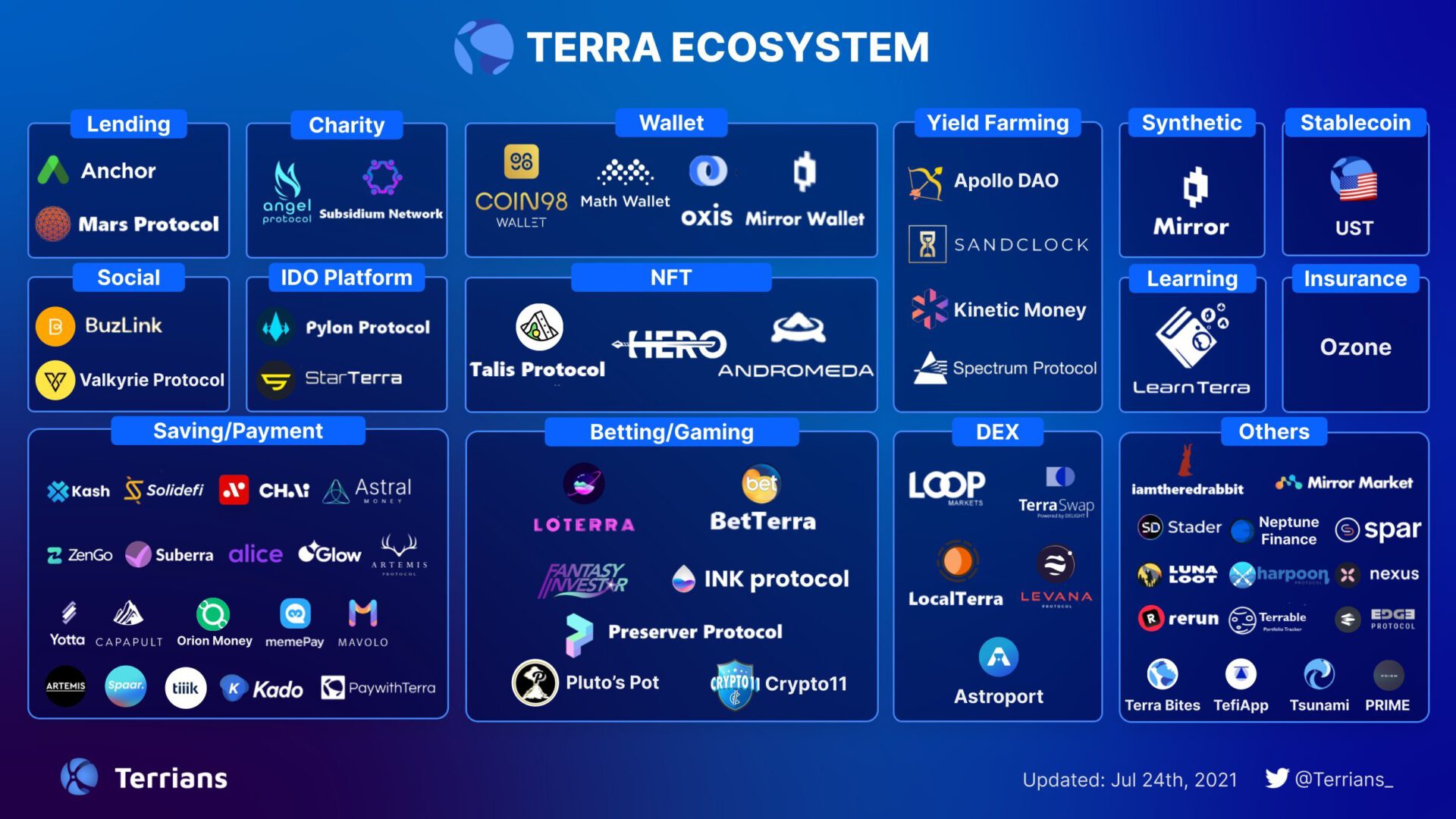

Positive alter ecosystem

One of the most clear indicators of adoption for the Terra ecosystem is the swiftly expanding listing of partners and tasks launched on the Terra blockchain.

The developing ecosystem supplies entry to some of the most critical locations of cryptocurrency, which includes decentralized finance (DeFi) and NFT, as nicely as bridges to other blockchain networks like Ethereum and Solana.

At the very same time, Terra presently delivers stablecoin help for 17 fiat currencies which includes US bucks, euros, and Canadian bucks, and strategies to broaden this listing as the ecosystem grows.

The turning level of Ethereum

The ongoing vote on the Anchor protocol to include wrapped Ether to the UST mining platform is an occasion not to be missed.

A proposal to listing bETH (wrapped stETH on Terra) as a assure for @protocollo_ancora was presented🏝️

This will enable customers to borrow UST towards the ETH assure up for grabs and earn money-extraction rewards working with Anchor’s secured loan.https://t.co/ThQrW9PGyc pic.twitter.com/C1DGLhqQZL

– Lido (@LidoFinanza) 2 August 2021

The integration requires location by means of a partnership with Lido, a staking protocol for Ethereum and Terra that will allow distributors to obtain stETH (staking Ethereum) and bLUNA (linked LUNA) tokens.

If the vote passes, Ethereum will grow to be the to start with side selection to carry staking rewards outdoors the Earth ecosystem and this really should carry the complete worth locked on the protocol to a new all-time higher.

LUNA “Pedal” promotes UST

The elevated demand for LUNA is on an explosive track linked to the use of LUNA for UST minting. To make new quantities of FSO, an equivalent amount of LUNA need to be incinerated in the course of action, influencing LUNA’s provide and price tag.

As established platforms this kind of as Mirror Protocol increase and call for additional USTs to launch the platform and new protocols are launched on the Earth network, the elevated demand is most likely to set off a price tag development buffer for the two LUNA and UST.

Higher UST demand generally pushes the USD price tag over USD one. It prospects to an arbitrage possibility for UST holders who can get one UST on the exchange and burn up UST through Terra Station.

Through the chart over, as new USTs have been mined above the previous week, we can see how LUNA’s circulating provide has decreased and this has a beneficial effect on LUNA’s price tag.

However, mixed with the over components, the developing provide of stablecoins and the launch of new protocols on the network are most likely to positively effect LUNA’s place in the long term.

Synthetic Currency 68

Maybe you are interested: