Tether’s leadership explained it will perform a total audit in the coming months. This declare comes immediately after getting criticized by Paxos, the enterprise behind the PAX and BUSD stablecoins, that USDT is not actually a stablecoin.

A USDT stablecoin audit is some thing quite a few men and women have been waiting for in current many years. In distinct, expanding regulatory strain has pushed this course of action to get location earlier.

Recently, in a uncommon interview with the media, Tether technical director Paolo Ardoino and basic councilor Stu Hoegner have been asked some issues about the ensure and transparency of the USDT. General Councilor Hoegner answered the query as follows:

“We are working on a financial audit, something no one else in the stablecoin field has done.”

Hoegner also expects Tether to be the initial to do so and audits will get location in “months, not years”. He claims USDT is backed one-one with Tether reserves.

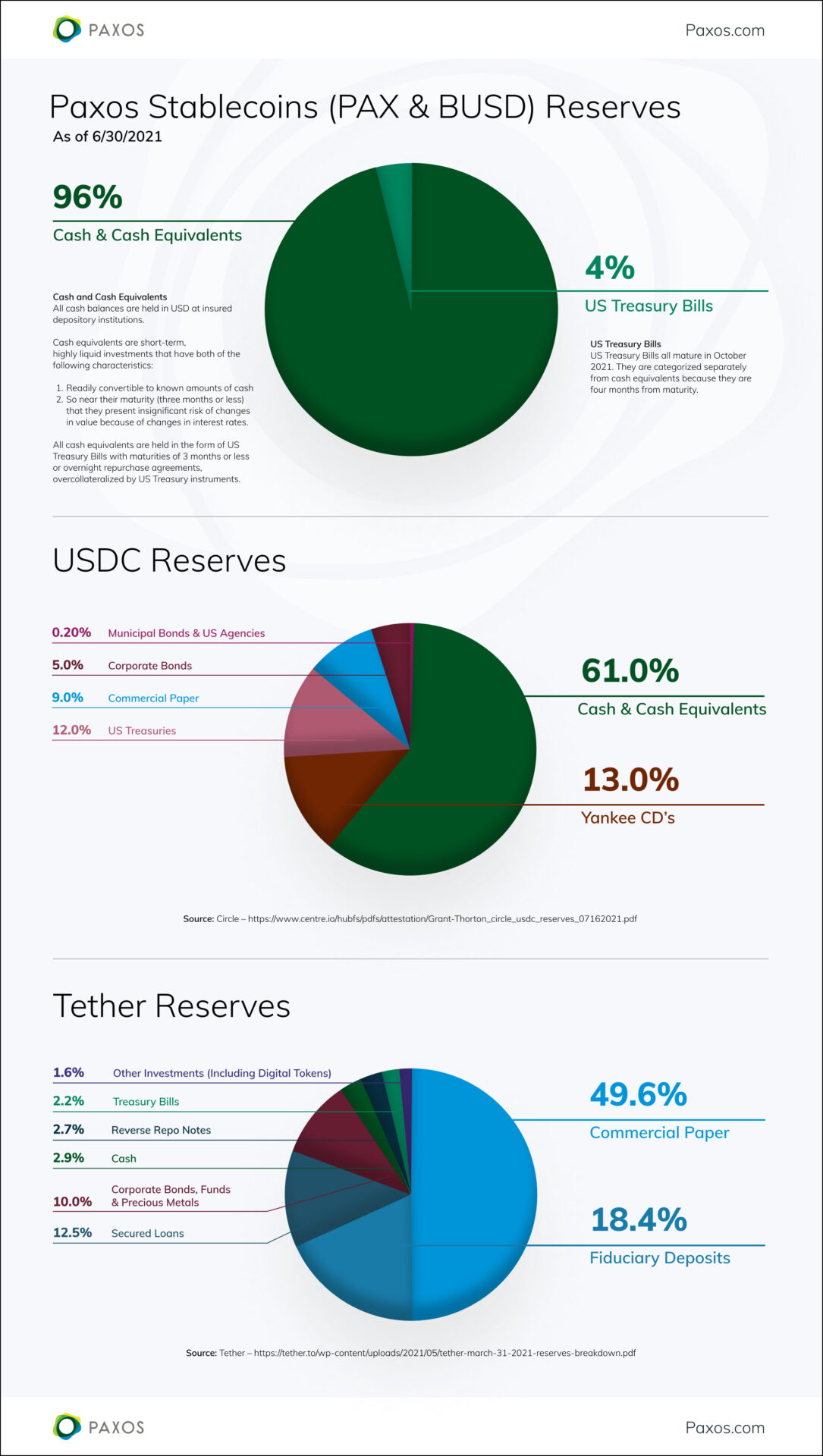

However, he also acknowledged that individuals reserves are not all in USD. According to Hoegner, USDT’s reserves are heavily weighted in USD, but also contain income equivalents this kind of as bonds, secured loans, crypto assets, and a quantity of other investments.

Currently, in accordance to Tether’s transparency reviews, stablecoins have a marketplace capitalization of above $ 62 billion. Since the starting of the 12 months, the marketplace capitalization of this stablecoin has grown by 195%. However, this development charge is nevertheless significantly decrease than that of other rivals, USDC and BUSD.

Recently, on July 21, Circle also launched a report on the volume of collateral assets for USDC stablecoins. As a end result, only 61% of USDC’s reserves are income, the rest are equivalent like business paper, treasury payments, and corporate bonds.

After Circle, Paxos also exposed the escrow mechanism behind the PAX and BUSD stablecoins. According to the Paxos announcement, the Paxos Standard (PAX) and Binance USD (BUSD) duo are the two supported up to 96% in income. Not only that, but Paxos also expressed “coffee” the two Circle and Tether when they claimed that USDC and USDT are not real stablecoins.

“Neither USDC nor USDT are regulated digital assets, for the very simple cause that the two tokens have no regulatory authority. In truth, the two tokens are tied to stablecoins only in terms of title, absolutely nothing else. “

Synthetic currency 68

Maybe you are interested:

.