The complete provide of the biggest stablecoin in the cryptocurrency marketplace, Tether (USDT), continues to decline as traders are explained to massively withdraw their cash.

As reported by Coinlive, the cryptocurrency marketplace has just undergone a series of “sell offs” that started on June ten, with the charges of a lot of of the significant currencies this kind of as BTC and ETH hitting their lows considering that June, respectively. 2020 – January 2021. Total marketplace capitalization plummeted to $ 829 billion, the lowest degree considering that January 2021.

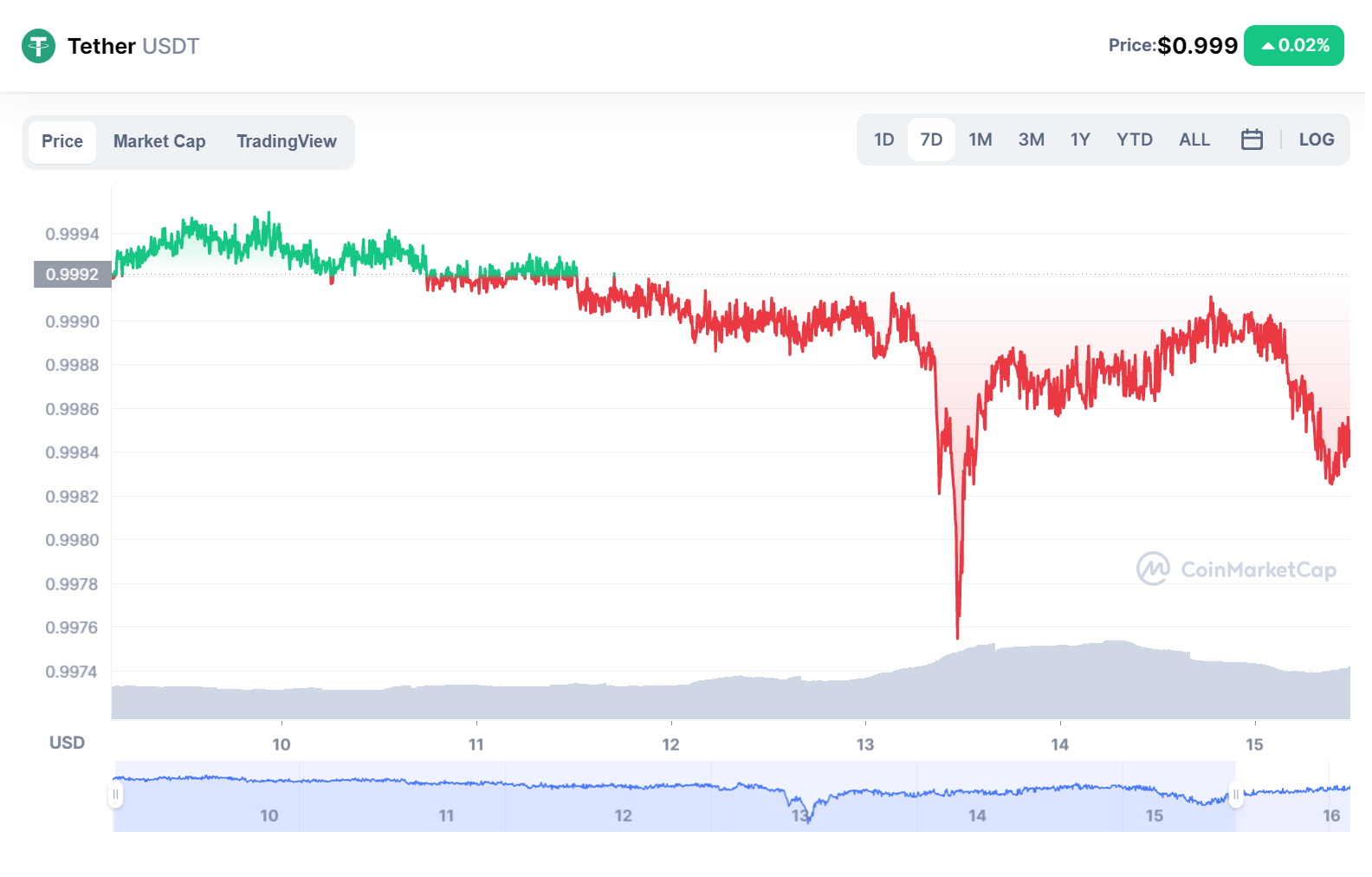

Even stablecoins are not protected from marketplace power. The biggest stablecoin on the marketplace, Tether, on June 15 was often depeg (dropping the $ one mark), as very low as $ .9983.

The purpose for this drop stems from false marketplace rumors that USDT’s issuer is Tether has a partnership with Celsius, the loan task that is at the heart of the newest marketplace dump. Additionally, an outdated mess has been revived about Tether’s lack of collateral for USDT, as significantly of the company’s assets have been shifted to riskier varieties this kind of as corporate card.

The overpowering unfavorable information brought on Tether’s capitalization to drop from $ 72.four billion on June twelve to $ 70.eight billion on the morning of June sixteen, most probably for the reason that traders converted USDT back to USD. Tether later on denied these rumors.

By mid-May, when the LUNA-UST crash occurred, the USDT was also down to $ .97. Tether’s capitalization also dropped from $ 82 billion to $ 72 billion as consumers rushed to pull out. This information and facts was corroborated by Tether and confirmed that they are nonetheless “overwhelming” to return $ ten billion to traders in just 72 hrs, which is the strongest proof for the company’s well being, debunking the information. Unfounded rumors that Tether does not it does have adequate ensures.

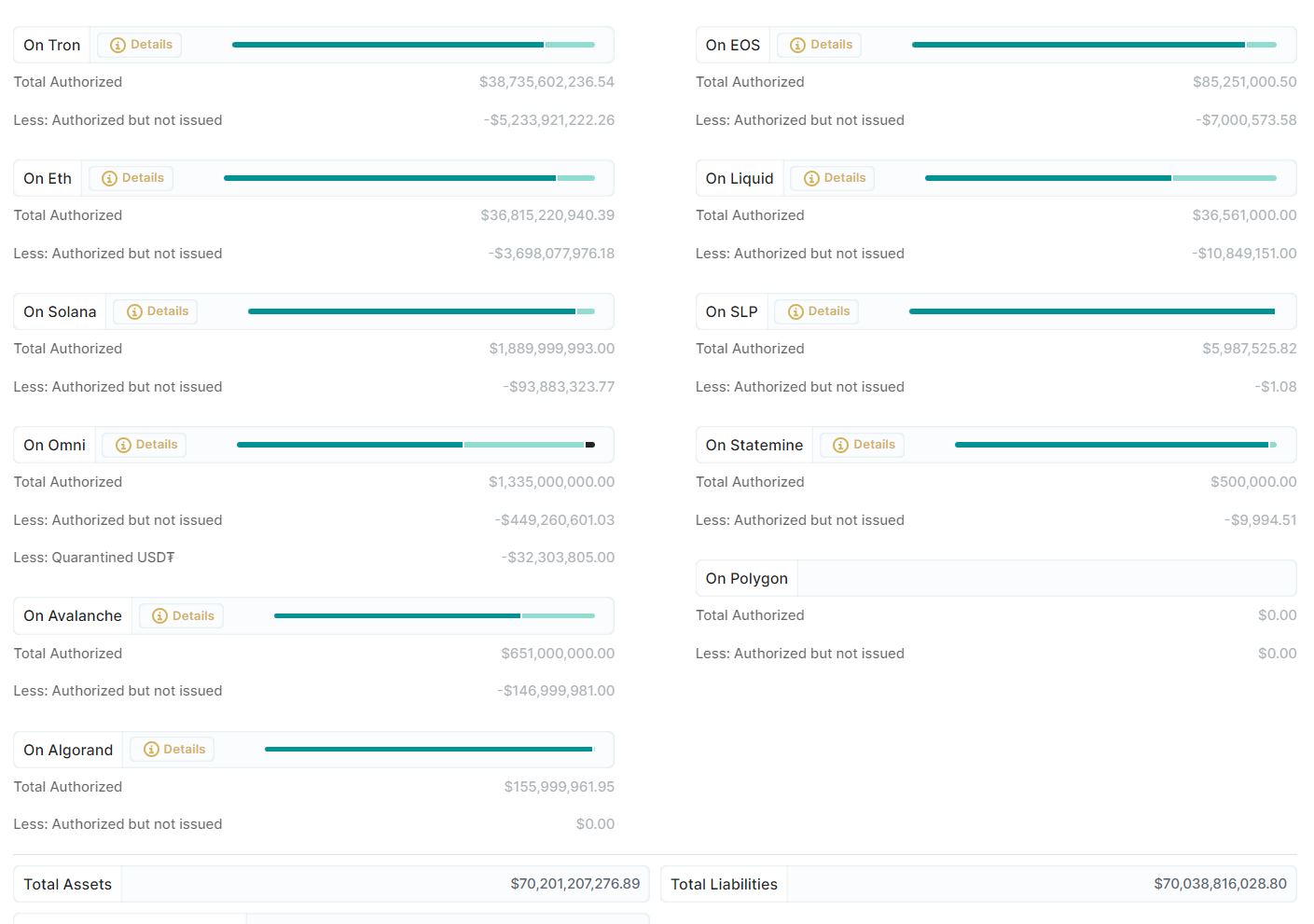

However, in contrast to the other two significant stablecoins on the marketplace, USD Coin (USDC) and Binance USD (BUSD), Tether’s margin chance is even increased. Notably, USDT’s collateral assets as of late March 2022 incorporate income ($ four.one billion), US Treasury expenses ($ 39.one billion), industrial paper ($ twenty billion) and other accounts (18, six billion bucks). Meanwhile, USDC is backed by $ eleven.six billion in income and $ 39 billion in US Treasury expenses and BUSD is one hundred% backed by $ 17.four billion in income at the finish of March 2022.

USDC and BUSD have also not diverged as strongly as USDT in each May and June declines. Conversely, a lot of traders are “fleeing” USDT to these two stablecoins.

Lately number of #stablecoin they are not as steady as they need to be… 🤔🤔🤔

Survivors, which of these is your very best retreat at the second ⁉️⁉️$ USDT $ USDC $ billions of dollars $ USDP $ DAI $ FRAX $ USDN $ US pic.twitter.com/KfU1yRuZRh

– Kyros Ventures (@KyrosVentures) June 15, 2022

Tether has constantly pushed its growth to other blockchains in latest weeks, issuing USDT on Polygon and Tezos in latest weeks, bringing the degree one assistance amount to twelve. TRON and Ethereum are nonetheless two blockchains. equal to 66 billion USDT out of a complete of more than 70 billion USDT in circulation.

Another stablecoin becoming depeged is USDD, the “copy” edition of UST on TRON, despite the fact that the ecosystem has invested a whole lot of cash subsidizing TRX in latest days.

Synthetic currency 68

Maybe you are interested: