This posting is about the keywords and phrases that have been buzzing recently. However, do you seriously comprehend the nature, formation, advancement system and possible of LSDfi in common and Pendle Finance, one particular of the most essential tasks in this section? Let’s locate out by way of two elements of this series!

Complete LSDfi and the Story of the Pendle Wars (Part one)

Complete LSDfi and the Story of the Pendle Wars (Part one)

one. Summary of LSD Finance (LSDfi)

you can comprehend LSDfi is an acronym to refer to tasks that revolve all around the LSD (Liquid Staking Derivatives) array. This is a niche for creating solutions that assist customers holding Liquid Staking solutions maximize earnings and boost capital efficiency.

If you are even now puzzled with the phrase Liquid Staking, you can get five minutes to read through about it this paragraph. Simply place, Liquid Staking are options that help staking on chains this kind of as Ethereum, Polkadot, Solana, Avalanche…, assisting to resolve the limitations of the staking section that have existed for a lengthy time (limiting staking participants) by way of a minimal capital limits complicated technical techniques or lengthy “capital burial” occasions with tiny revenue…). One of the most renowned names in the discipline of Liquid Staking is Lido Finance.

The Liquid Staking story seriously heated up most likely started out when Ethereum launched the Beacon Chain and permitted customers to participate in staking ETH to earn earnings. However, participating in ETH staking is not effortless as it is essential to have:

-

Minimum 32 ETH to participate, if there are far more it will have to be a various of 32 ETH.

-

ETH through staking will be temporarily locked and only when Ethereum two. is effectively activated will it be steadily unlocked.

-

Node engineering and operation prerequisites to keep away from fines.

Too lots of barriers make lots of traders annoyed. At that time, Liquid Staking options like Lido Finance appeared and exploded promptly solving all the over limitations. Users can use any volume of ETH and stake it by way of Lido Finance, get stETH (representing the variety of ETH staked), devoid of worrying about technical challenges, and can also use offered stETH to deliver liquidity or collateral on Defi platforms, consequently making earnings more.

After the achievement of Ethereum two., contrary to lots of people’s predictions that there will be a significant volume of unstaking ETH and the value will drop sharply, there are far more and far more individuals prepared to invest in far more and lock ETH in the chain for the lengthy phrase.

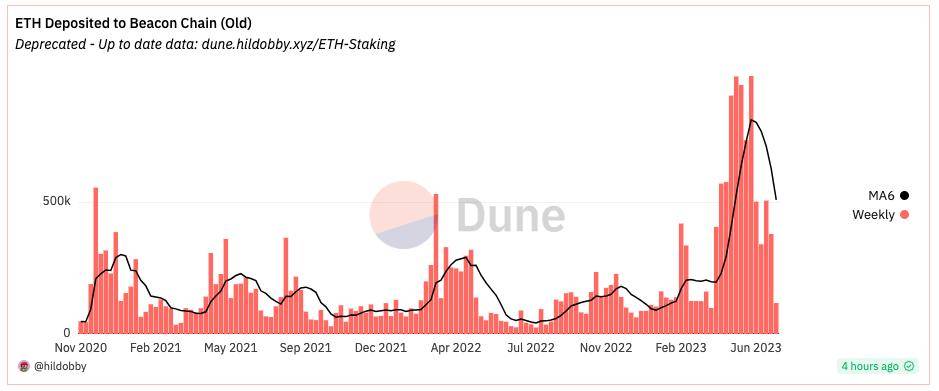

Chart displaying the volume of ETH deposited weekly into Beacon Chain – Source: @hildobby on Dune Analytics, July eleven, 2023

Chart displaying the volume of ETH deposited weekly into Beacon Chain – Source: @hildobby on Dune Analytics, July eleven, 2023

You can see that in excess of the previous handful of months the volume of ETH staked has continued to boost considerably, even considerably far more than prior to. Furthermore, the staking queue (waiting time to stake ETH) has also enhanced to 44 days. This exhibits that there is even now substantial demand for ETH staking in common and Liquid staking in certain.

As the demand for ETH staking increases, far more and far more varieties of Liquid Staking tokens seem and their capitalization increases quickly: stETH, rETH, dsETH… This is also the supply of the supporting solutions that revolve all around. very well, forming LSDfi.

two. Typical solutions of LSDfi

Currently, LSDfi can be divided into the following most important product or service segments:

– Bet options: which includes CEX companies like Binance, Coinbase… or decentralized options like Lido Finance, Rocket Pool…

– Loan: are protocols that let you to collateralize Liquid Staking Tokens (LST) to borrow assets, for instance: AAVE, Silo…

– CDP stablecoins: they are solutions that let LSTs to mint stablecoins this kind of as MakerDAO, Lybra Finance, Raft

– LSD Index: are solutions that let customers to get a “basket” of LSD tokens based mostly on the project’s allocation fee. This aids decrease hazards through the investment system. Instead of holding just one particular kind of Liquid Staking token, the undertaking aids customers allocate capital across a wide variety of Liquid Staking tokens to reduce threat.

– DES: This is also a fairly a short while ago produced location in LSDfi, arising from the have to have to invest in, promote and trade varieties of LST with just about every other and involving LST and ETH. Famous Japanese names consist of: Curve, Uniswap, Balancer…

– Yield approach: These are solutions aimed at making much better earnings for LST holders by defining tactics for offering liquidity, loans and mortgages… The most normal of this product or service line is the Pendle Finance undertaking, which we will examine under.

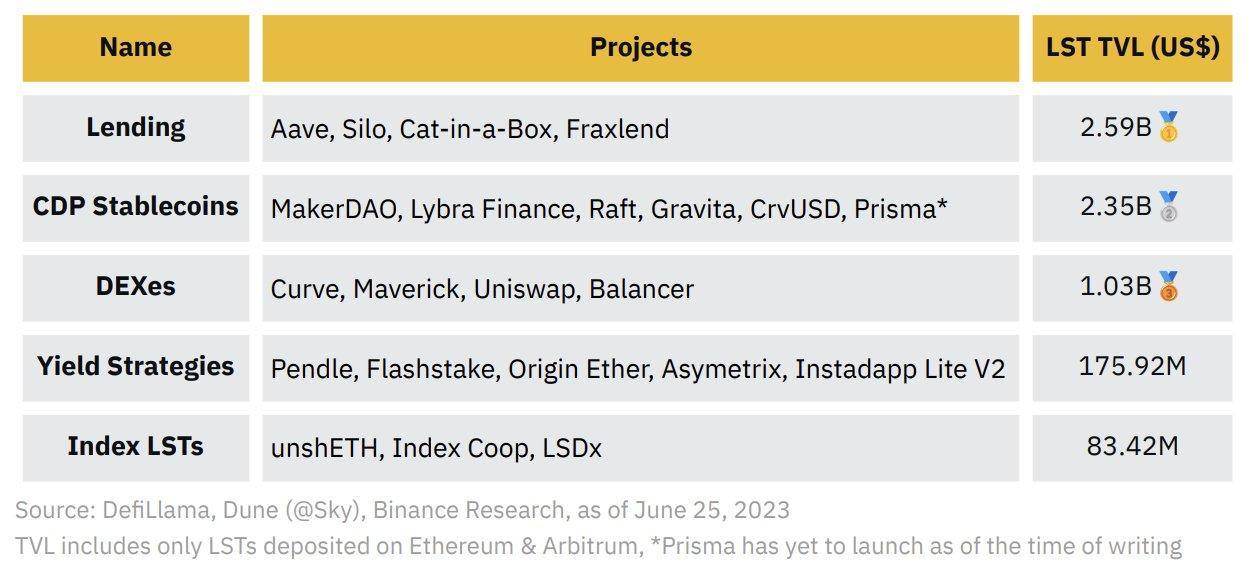

Niche division in LSDfi – Source: Binance Research

Niche division in LSDfi – Source: Binance Research

three. Situation of the advancement of LSDfi

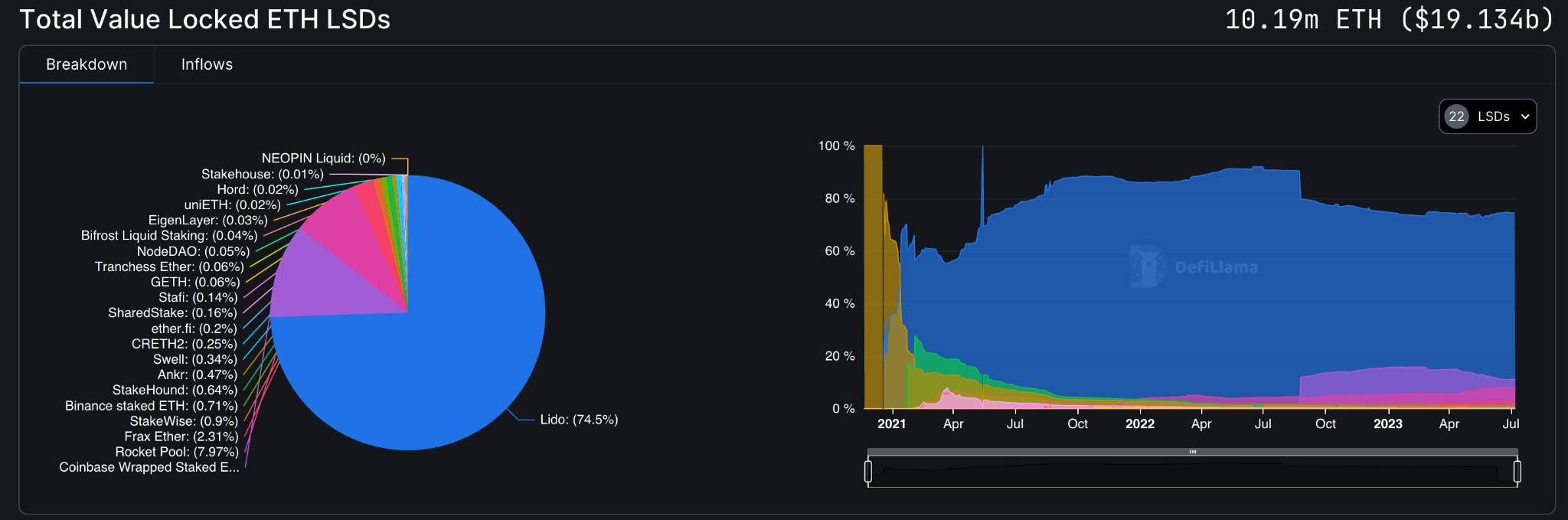

Currently, in accordance to DefiLlama statistics, the complete worth of ETH in LSDs is reaching 19.13 billion bucks. Therefore, LSDfi solutions can get total benefit of this volume of TVL, which includes by way of borrowing or leverage mechanisms boost this variety quite a few occasions.

Data on TVL in the LSD section – Source: DefiLlama (seven/eleven/2023)

Data on TVL in the LSD section – Source: DefiLlama (seven/eleven/2023)

Furthermore, we also have to have to get into account how considerably ETH can proceed to be staked in tasks and proceed to generate liquid staking tokens. According to information from CoinMaketCap (July eight, 2023), the complete provide of circulating ETH is 120.two million coins. There are presently only all around 26.two million ETH staked (Dune information, @hildobby), equivalent to all around 21.eight% of the complete circulating provide. Therefore, the potential possible of the LSDfi array will be substantial.

Going back to the recent tasks, we can do some evaluation to see how speedy they are rising

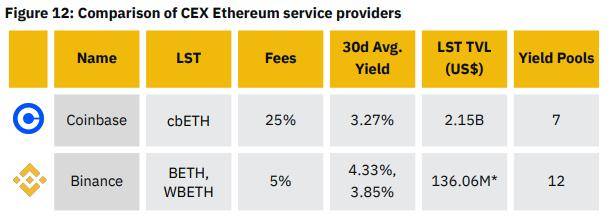

three.one. Staking services by way of CEX

Although CEX exchanges suffered a good deal of lousy information and “lost trust” of customers immediately after the FTX incident, we can not deny that Binance, Coinbase or OKX are even now the top manufacturers – a substantial fiscal institution and an essential place in the market place. Recognizing the chance of the Liquid Staking section, CEXs have also launched companies and attracted a selected volume of TVL worth.

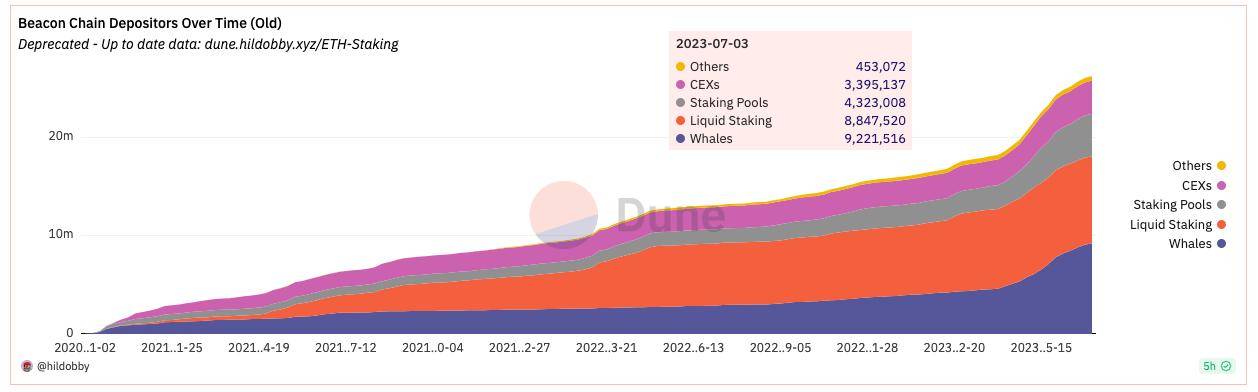

Beacon Chain ETH Deposit Data by way of Sources (July three, 2023 – Dune, @hildobby)

Beacon Chain ETH Deposit Data by way of Sources (July three, 2023 – Dune, @hildobby)

According to the most recent information at the time of creating this posting, the volume of ETH coming from CEXs is even now investing a fee equivalent to just about 13% of the complete volume of ETH deposited in Beacon Chain. However, this is an amazing variety and not considerably much less than the sources of Staking Pools or Liquid Staking.

Recently, Binance’s actions through the launch of BETH and WBETH when decreasing services charges and boosting earnings present that this giant also desires to obtain far more market place share in the ETH staking section.

Compare staking companies on DEX exchanges. Source: Binance Research

three.two. Liquid staking options

I will not speak also considerably about Staking Pools since most of them are experienced firms and they carry out staking companies to make revenue, devoid of tokens.

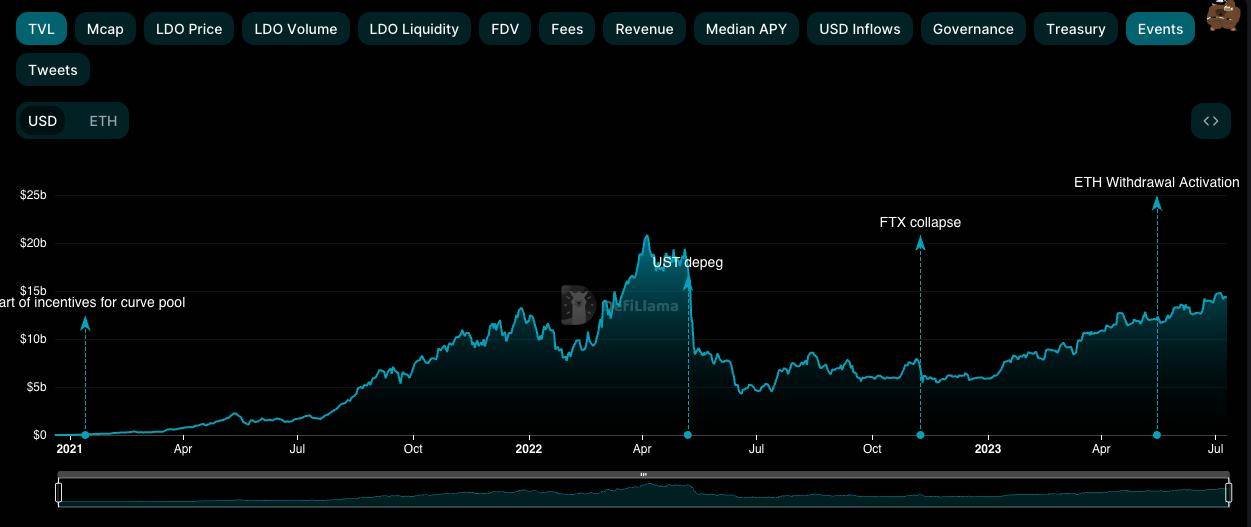

To see the advancement velocity of Liquid Staking far more obviously, see the picture under:

You can see that the volume of ETH in Lido enhanced constantly, only reducing when the UST depeg occasion occurred, then when the market place stabilized, it continued to boost, while now ETH can be withdrawn from Beacon .Chain. It can be mentioned that the attraction of Liquid Staking is irresistible.

three.three. DES

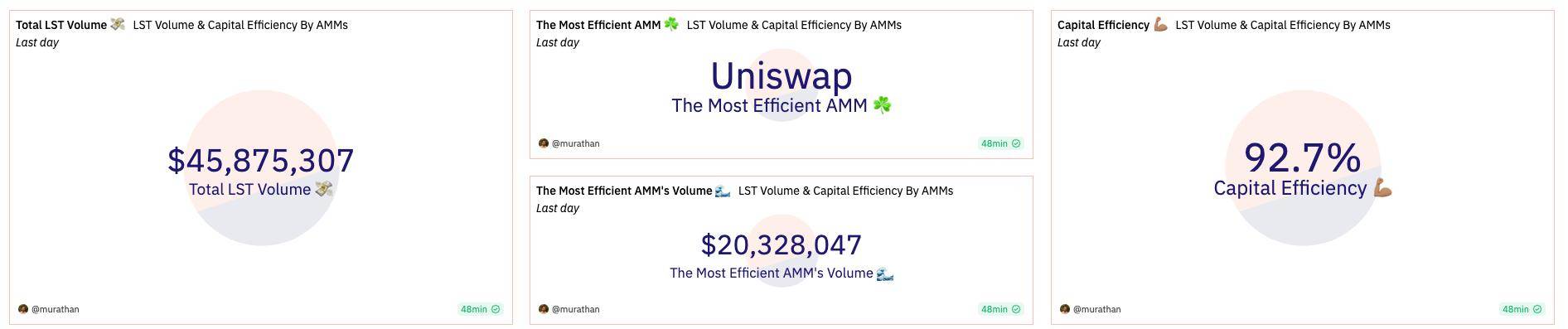

Currently, in accordance to unofficial statistics, there is far more than $one.one billion TVL of LST on DEXs. This is a rather amazing variety, which transforms LSTs from illiquid assets into liquid ones.

Staking lock token (LST) statistics on DEX exchanges. Source: Dune, @murathan (July eleven, 2023)

Staking lock token (LST) statistics on DEX exchanges. Source: Dune, @murathan (July eleven, 2023)

You can see that on July eleven, LST trading volume on DEXs was $45 million. Currently Uniswap is even now the exchange that gives the finest capital efficiency.

|

Efficient use of capital |

Transaction Volume/Market Share |

TVL |

|

|

#one Uniswap |

92.seven% |

twenty.three million / 44.three% |

21.9 million |

|

#two Wonderful |

37.eight% |

seven.five million / sixteen.three% |

19.seven million |

|

#three Balancer |

three.one% |

seven.six million / sixteen.five% |

245.two million |

|

#four Curve |

one.three% |

ten.five million / 22.9% |

887.seven US bucks |

LSDfi DEX Ranking by Capital Efficiency – Source: Dune, @murathan (July eleven, 2023)

It can be mentioned that the liquidity provision mechanism on Uniswap and Marvelick is even now incredibly excellent, primarily Uniswap with an amazing figure of 92.seven%, while the TVL on these two protocols is not substantial.

three.four. Loan

Indeed, the nature of the lending solutions in the LSDfi section is not new but entirely simulates profitable mechanisms this kind of as Lending Pools or CDPs. I’ll search at some of the notable names:

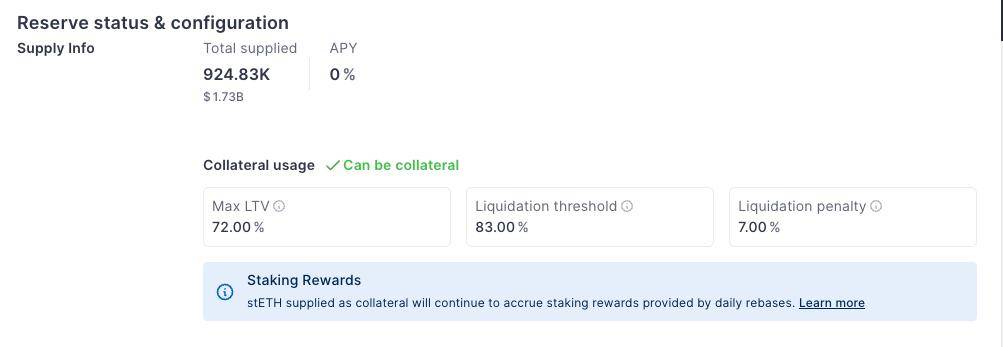

AAVE: As a home identify, AAVE is also at the forefront of the LSDfi lending marketplace. As of March 2022, AAVE has permitted the use of stETH as collateral to borrow ETH. This lets stETH holders to maximize earnings:

Deposit ETH to Lido -> Receive stETH -> Mortgage stETH to AAVE to Borrow ETH -> Use ETH to Continue Depositing to Lido and Repeat Above Steps to Optimize Profits from Lido

According to AAVE information, somewhere around 924.83 thousand stETH are presently mortgaged, equivalent to an volume of somewhere around $one.73 billion. This is a significant variety for an asset like stETH.

StETH mortgage loan information on AAVE – Source: AAVE (July eleven, 2023)

StETH mortgage loan information on AAVE – Source: AAVE (July eleven, 2023)

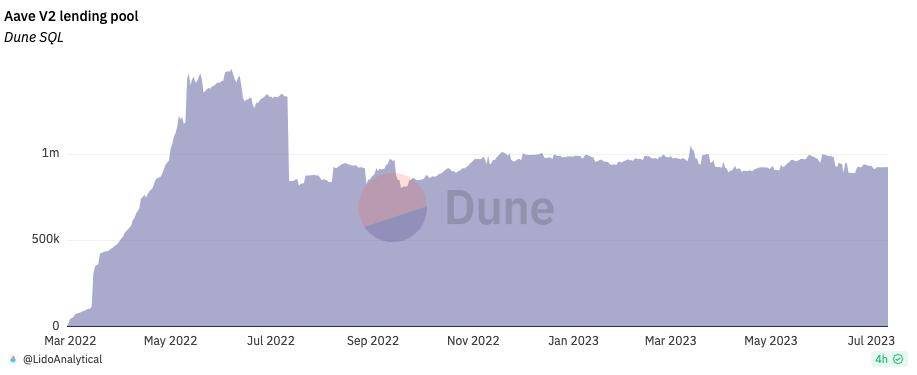

Currently, the stETH metric in the AAVE lending pool has remained reasonably steady following the UST-relevant incident.

Chart displaying the adjust in the volume of stETH in the AAVE V2 lending pool – Source: Dune, @LidoAnalytical, 07/eleven/2023

Chart displaying the adjust in the volume of stETH in the AAVE V2 lending pool – Source: Dune, @LidoAnalytical, 07/eleven/2023

three.five. CDP stablecoin

In this section I want to mention Lybra Finance as the most normal instance. You can comprehend the working mechanism of this kind of product or service by way of the picture under:

How Lybra Finance operates – Source: Lybra Finance

How Lybra Finance operates – Source: Lybra Finance

Simply place, you can deposit ETH or stETH into these protocols as collateral, then mint eUSD or other stablecoins, use this stablecoin into other Defi protocols, or hold it for revenue.

Therefore, in this situation, the most important inspiration of most customers is the revenue from owning stablecoins. You can see that Lybra gives a fairly excellent APY of ~seven.two%, so the protocol also attracts a significant variety of customers. There is presently somewhere around USD 335 million (ETH and stETH) utilised as collateral on the exchange…