Fed Chairman Jerome Powell currently launched his hottest remarks on the agency’s stance on the state of stablecoins.

In his speech at a conference at the Cato Institute on the evening of September eight, Fed Chairman Jerome Powell mentioned that stablecoins ought to be regulated mainly because the operation of this sector is not seriously regulated, but he also admitted that stablecoins would have a effective influence on the economic process if accompanied by legislation.

“We don’t want to get in the way of proper innovation. However, stablecoins will need proper regulation and regulation. They must provide consumers with clear, transparent and fully guaranteed quality assets that are highly liquid ”.

Additionally, the Fed chairman also talked about the chance of the physical appearance of a digital dollar (CBDC) in his forty-minute speech. Jerome Powell explained the Fed is reevaluating regardless of whether to situation a CBDC and weighing troubles this kind of as privacy.

“We do not intend to proceed with enacting a CBDC without explicit support from both the executive branch and Congress, ideally in the form of a specific mandate law.”

This see is fully steady with US Treasury Secretary Janet Yellen’s consideration in December 2021, though the Fed has previously officially launched significant analysis reviews on CBDCs. Recently, Fed Vice President Lael Brainard also explained that in the situation of the CDBC launch, the US will consider yet another five many years to accomplish this.

The hottest statement from President Jerome Powell may well assess that the Fed does not consider as well unfavorable a see on stablecoins except to verify that it is setting some expectations on this sector. Notably, in October 2021, the Fed chairman confirmed that the company does not intend to ban Bitcoin and cryptocurrencies.

However, shortly just after the data was launched, Bitcoin’s price tag at the time of creating has had an amazing recovery, up extra than six% in the previous 24 hrs and is trading all-around USD twenty,500.

However, this was not ample for Bitcoin and the total cryptocurrency industry to be capable to recover the losses of about two weeks in the past, also influenced by the Fed’s yearly political speech at the Jackson Hole Conference.

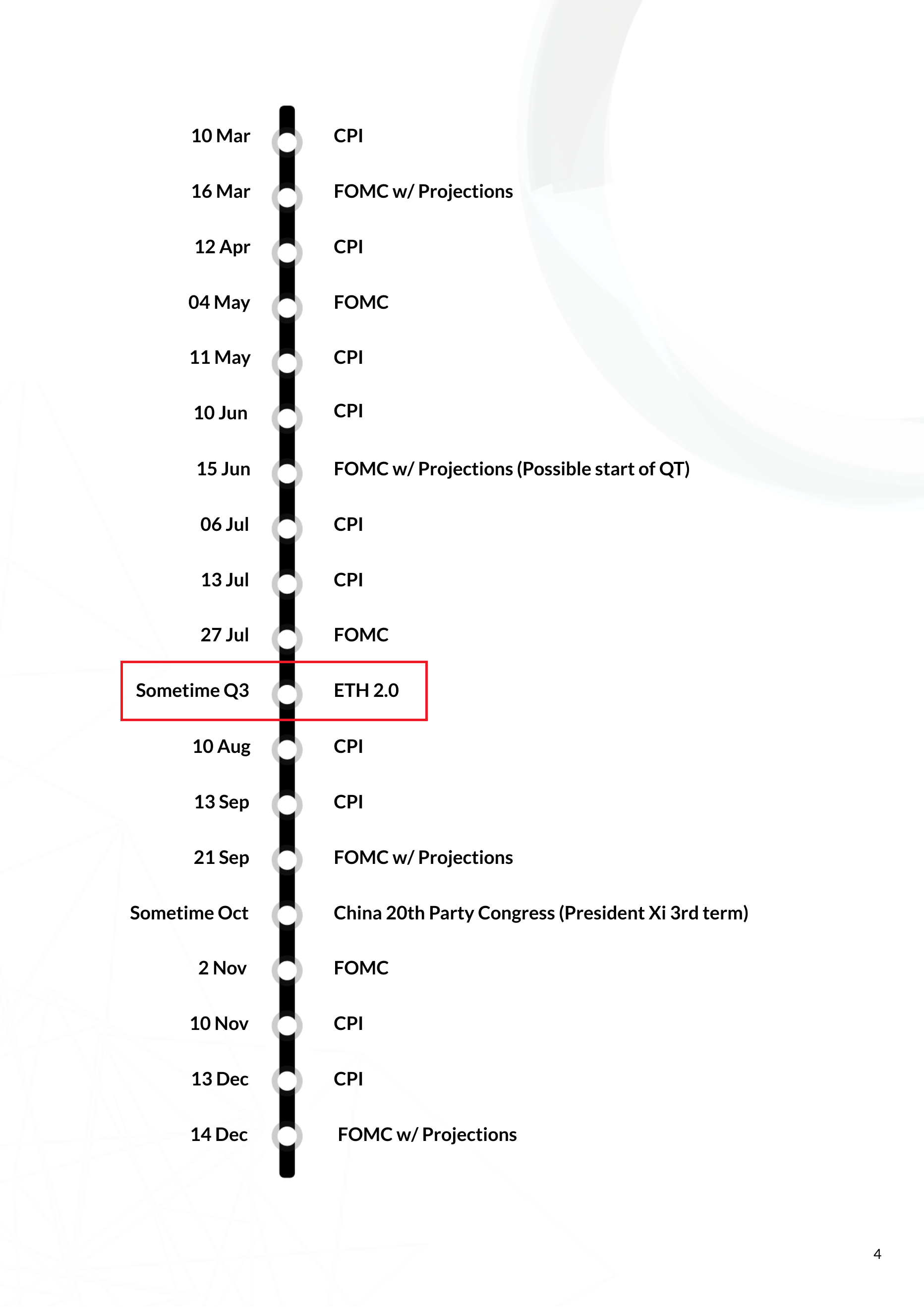

On September 13, the Fed will release information from the Consumer Price Index (CPI), a measure of the US economy’s inflation fee, from which it decides to increase curiosity prices on September 21. Therefore, traders must be cautious as this time period will make the industry incredibly volatile.

Synthetic currency 68

Maybe you are interested: