Ethereum Level two Scaling Solutions Optimism and arbitrum are tense on the trading track.

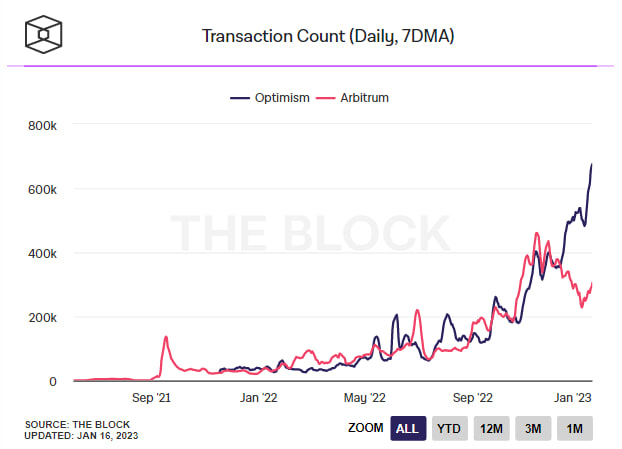

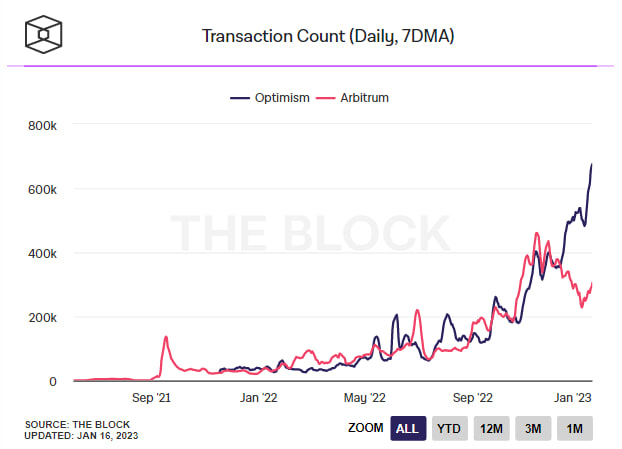

Over the previous month, exercise on the Optimism and Arbitrum networks has diverged sharply. Projected primarily based on information The block statistics, Optimism reached 675,000 transactions per day, though Arbitrum was only modest at 305,000. Since December, optimism has enhanced and far ahead of the competitors.

While the two protocols have been on a regular upward trend because early 2022, this is the very first time that optimism has surpassed the Arbitrum. So what is the result in?

Active end users on Optimism could be due to the token result of the platform, OP has reacted really positively to the rate in the previous. Specifically, the rate of the OP is up extra than 41% on the weekly frame, up almost 90% from the earlier month, and is at present trading about the $one.77 deal with.

Other tokens in the Optimism ecosystem, this kind of as Velo and Sonne, have also observed spectacular rate efficiency on the exact same benchmark frame.

Optimism (OP) recognized it is an extensible alternative layer-two for Ethereum, it issued OP tokens in June of the exact same turbulent launch. At the exact same time, optimism constantly launches quite a few packages to motivate end users to come to the platform. For illustration, the governance mechanism Collective of optimismwhich includes the “bicameral” Token House and Citizens’ House, or the fund for the improvement of the ecosystem Optimism Stimpack. Recently, optimism as well launched a $ten million funding bundle for worthwhile tasks.

Meanwhile, rival Arbitrum has not nonetheless issued its very own token and quite a few corporations are attracting end users in 2022. The quantity of day-to-day transactions on Arbitrum has decreased by extra than 50% in December 2022.

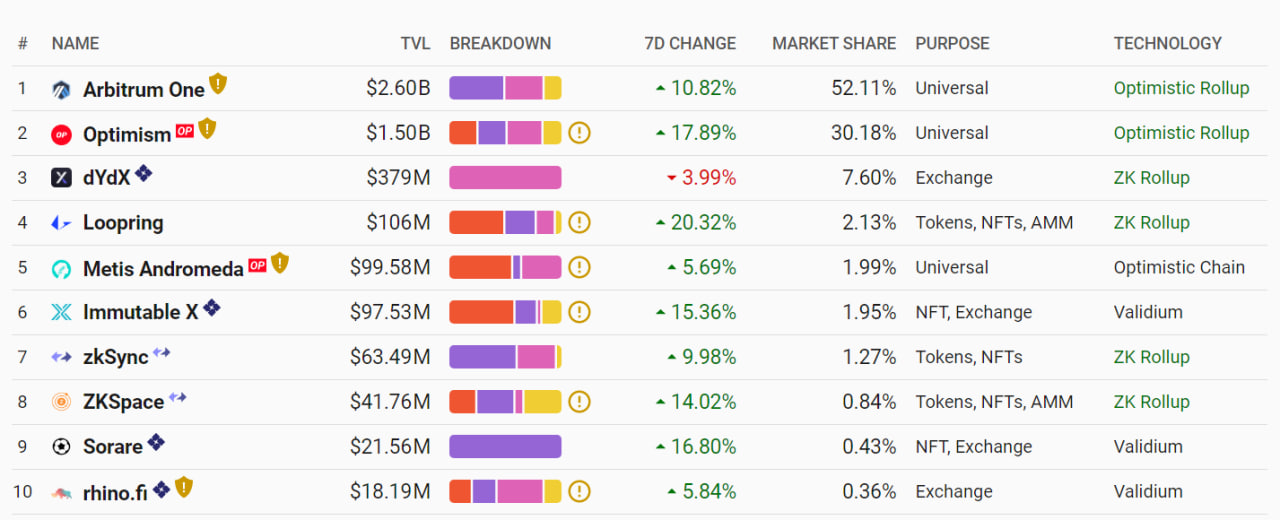

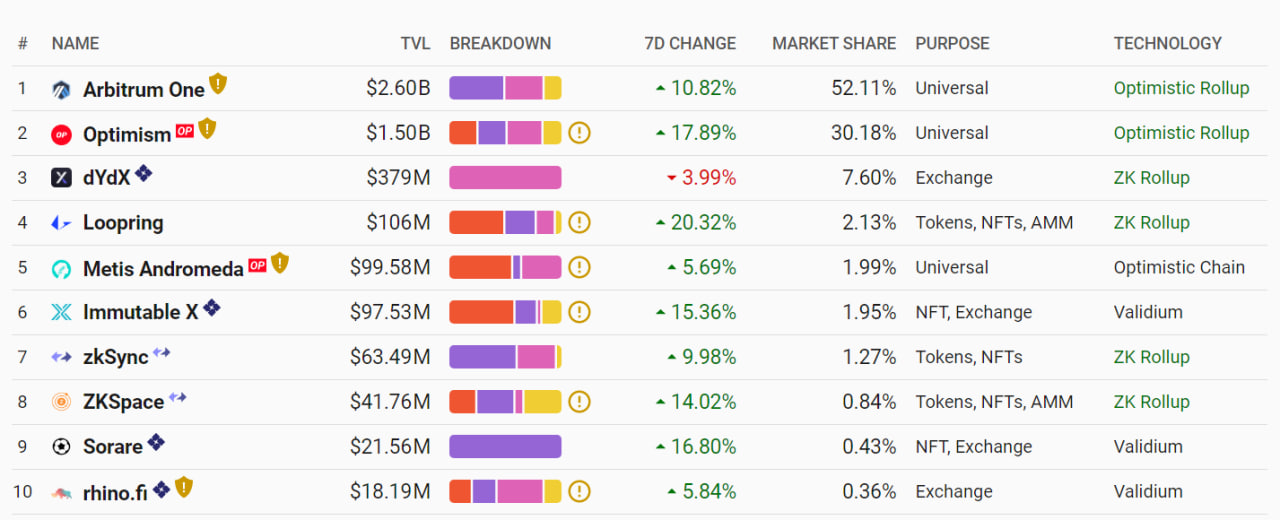

However, in terms of complete locked worth (TVL), Arbitrum ($one.66B) is even now somewhat superior than Optimism ($670M) and this is even now it is a single of tier two which has a good deal of space for improvement in the potential.

Also, there are now extra helpful options for end users. Liquid staking derivatives on Lido and Rocket Pool are also gaining recognition.

Synthetic currency68

Maybe you are interested:

Ethereum Level two Scaling Solutions Optimism and arbitrum are tense on the trading track.

Over the previous month, exercise on the Optimism and Arbitrum networks has diverged sharply. Projected primarily based on information The block statistics, Optimism reached 675,000 transactions per day, though Arbitrum was only modest at 305,000. Since December, optimism has enhanced and far ahead of the competitors.

While the two protocols have been on a regular upward trend because early 2022, this is the very first time that optimism has surpassed the Arbitrum. So what is the result in?

Active end users on Optimism could be due to the token result of the platform, OP has reacted really positively to the rate in the previous. Specifically, the rate of the OP is up extra than 41% on the weekly frame, up almost 90% from the earlier month, and is at present trading about the $one.77 deal with.

Other tokens in the Optimism ecosystem, this kind of as Velo and Sonne, have also observed spectacular rate efficiency on the exact same benchmark frame.

Optimism (OP) recognized it is an extensible alternative layer-two for Ethereum, it issued OP tokens in June of the exact same turbulent launch. At the exact same time, optimism constantly launches quite a few packages to motivate end users to come to the platform. For illustration, the governance mechanism Collective of optimismwhich includes the “bicameral” Token House and Citizens’ House, or the fund for the improvement of the ecosystem Optimism Stimpack. Recently, optimism as well launched a $ten million funding bundle for worthwhile tasks.

Meanwhile, rival Arbitrum has not nonetheless issued its very own token and quite a few corporations are attracting end users in 2022. The quantity of day-to-day transactions on Arbitrum has decreased by extra than 50% in December 2022.

However, in terms of complete locked worth (TVL), Arbitrum ($one.66B) is even now somewhat superior than Optimism ($670M) and this is even now it is a single of tier two which has a good deal of space for improvement in the potential.

Also, there are now extra helpful options for end users. Liquid staking derivatives on Lido and Rocket Pool are also gaining recognition.

Synthetic currency68

Maybe you are interested: