The complete re-important worth (TVL) in Layer two protocols on Ethereum (ETH) has plummeted in the final two months, hitting a lower in 2022.

No miracles seem

About a month in the past, Layer two (L2) was observed as the most important “light of hope” that could deliver some favourable alterations to the market place soon after a lengthy series of days of economic downturn, by TVL on Layer two protocols. , $ two billion in April, the highest degree in historical past the marketplace has ever reached.

However, in the encounter of Boba Network’s efforts to increase $ 45 million in capital, GameStop leapt into the NFT market place with Loopring, an amazing launch by means of the token issuance of Optimism and the establishment of a fund of 231 million tokens. OP for advancement Even producing the ecosystem from scratch does not get sufficient “traction” to assistance layer two sustain its regular state.

As of press time, the TVL of all Layer two platforms on Ethereum has dropped to an yearly lower of all-around $ four.four billion, respectively. According to skilled analyst Patrick Hansen, an investment advisor to Insight Capital, the final time the worth was this lower was in mid-October 2021.

Ethereum’s L2s presently struggle to meet higher expectations – bear in mind the L222 meme?

The actuality is that L2 TVL is at its lowest this 12 months, in spite of enormous liquidity incentives and token farming efforts. pic.twitter.com/YQkxIfL5Ko

– Patrick Hansen (@paddi_hansen) May 29, 2022

Why did degree two drop so dramatically?

To see a actual image of what drove Layer two TVL so lower, we require to search at the correlation involving L2 and Ethereum. Ethereum and Layer two can be in contrast to the legendary Achilles’ heel in Greek mythology.

The difficulties of gasoline charges and transaction velocity this kind of as Ether’s “heel” are now firmly covered by the L2 answer. Basically, Layer two is capable of dealing with much more transactions, decreasing prices and has a lot quicker transaction confirmation charges. According to a current report from the a16z investment fund, L2’s assistance is really sizeable when aggregated for the duration of the application procedure so far, scaling remedies have contributed all-around one.five% to the financial savings charges created on ETH.

The explanation TVL L2 established ATH in April amidst the red market place largely depends on Ethereum’s belief that the Proof-of-Stake (PoS) consolidation will be productive on routine, through the Kiln testnet in mid-March and the productive launch of the “Forcella d’ombra” at that time.

However, right up until the middle of final week, the “heart” of the Ethereum two. Beacon Chain had a significant glitch, coupled with the reality that the Ropsten testnet network of the “The Merge” roadmap was also “harassed”, creating the communities are not afraid that the merger will carry on to be delayed for a lengthy time, in spite of the Ethereum advancement workforce getting once more announced that The Merge will consider spot in August 2022.

This inadvertently pushed the value of ETH to carry on to drop deeply, straight affecting the complete L2 ecosystem. Simply understood by the illustration stated over, when Achilles’ complete physique slowly weakened, the “shield” covering the hero’s heels was also meaningless.

On the other hand, Ethereum’s DeFi platforms are also heavily degraded by the present predicament, in particular by the “massacre” known as LUNA-UST. The steady funds movement from DeFi demonstrates that customers are no longer as well keen to participate in the area, they use L2 to optimize transactions in DeFi and see this as a prospective investment device, therefore triggering the decline of TVL L2.

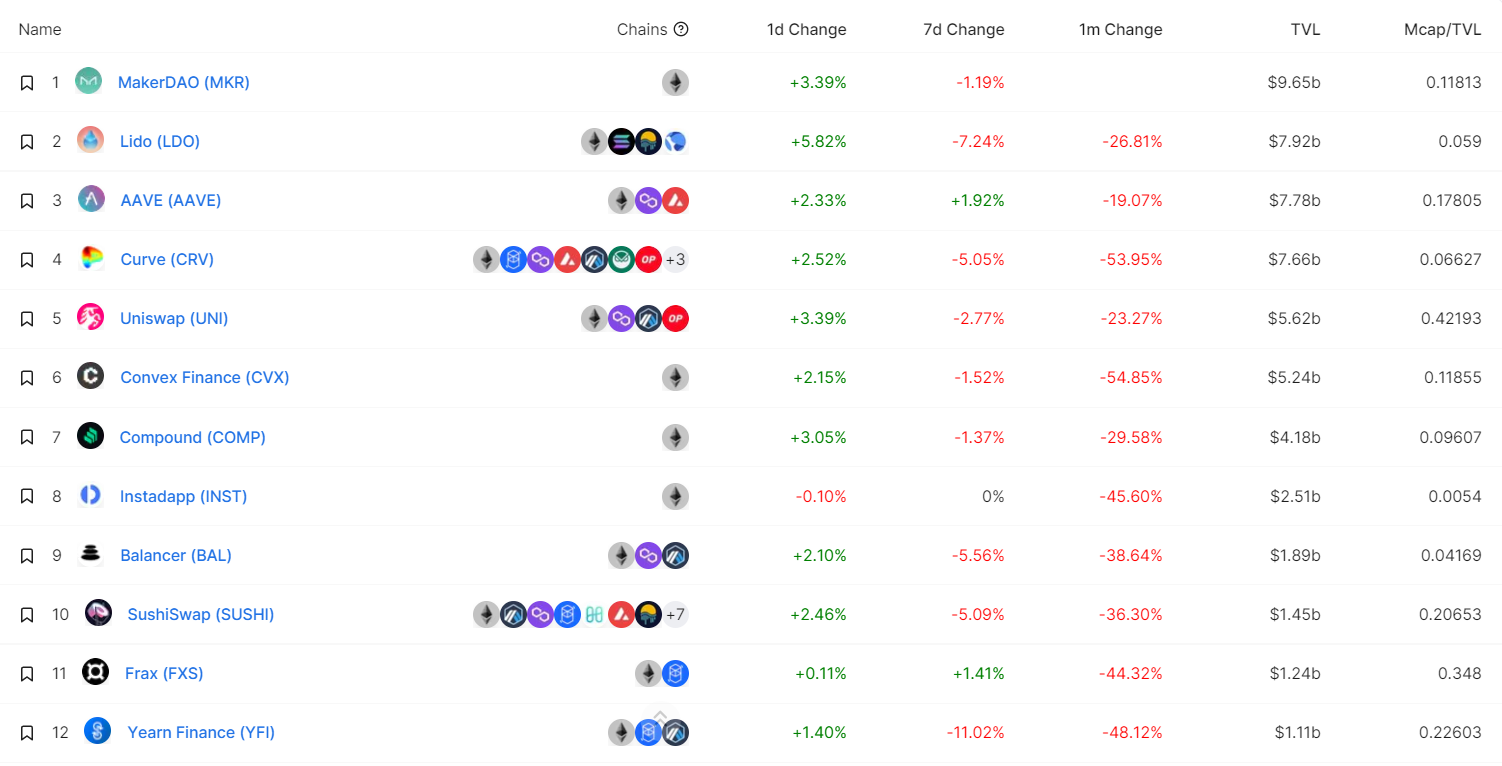

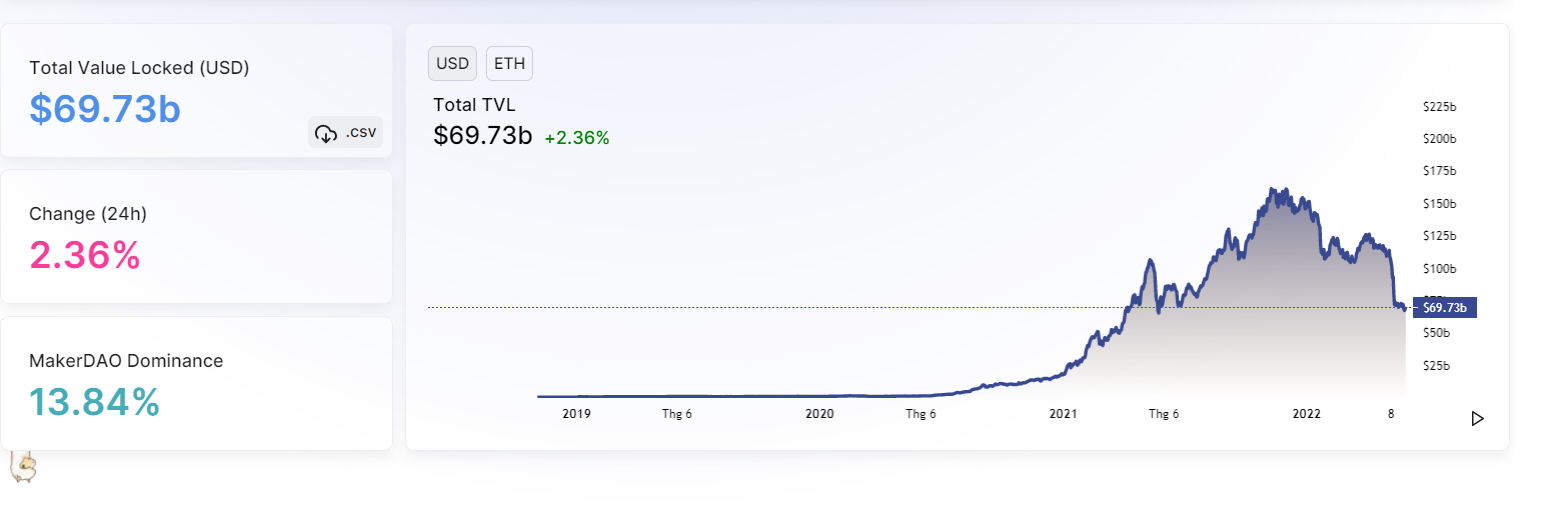

According to information from DeFiLlama, DeFi on Ethereum misplaced forty% of its TVL in just thirty days. Currently, the TVL volume in DeFi is $ 67.92 billion, down practically $ one hundred billion from the ATH set at November 2021 at $ 169 billion.

Synthetic currency 68

Maybe you are interested: