As a single of the primary protocols in decentralized derivatives trading, in excess of time, Perpetual Protocol has continued to create and create merchandise, in spite of the common problems of DeFi and the marketplace.

In today’s short article, let us find out about the new Perpetual Protocol proposal to get worth for PERP, the project’s native token! (You can read through all the information here).

In this proposal there will be three essential contents:

one. vePERP

PERP will put into action a token model very similar to Curve’s CRV. You can block PERP to get vePERP. During the trial time period, you can block up to one yr. This is to be certain that if improvements are necessary, the task will not shell out as well a lot time waiting for PERP to be unlocked.

two. Reward Programs

Usually, liquidity incentive plans normally lead to the dilemma of symbolic inflation for the task. To repair this, PERP created two improvements:

- Update the Liquidity Mining plan to make it a plan Cash extraction as a support.

- Liquidity Acquisition: This plan will entice money flows, external ensures in Perp to improve liquidity, in return people who give liquidity will get rewards.

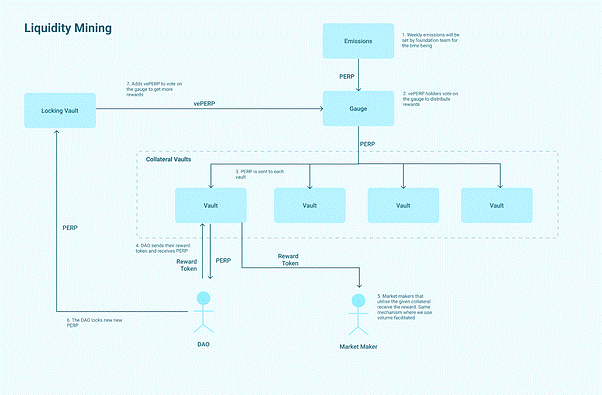

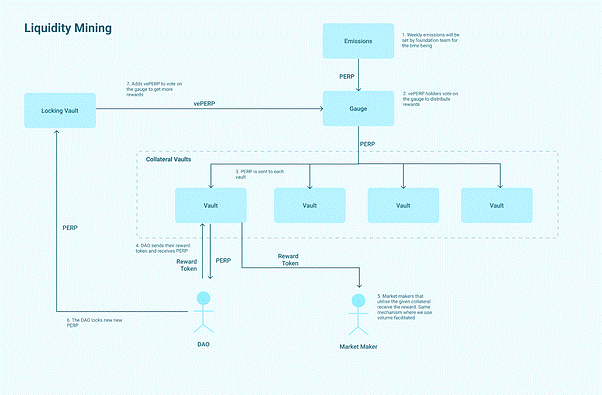

two.one. Cash extraction as a support

Currently, Liquidity Mining is a plan that just rewards liquidity suppliers on Perp. In buy to decrease the damaging effect on the lengthy-phrase task (deflation, dumping of PERP => outgoing settlement suppliers => illiquid tasks …), Perp has determined to use a Liquidity Mining as a Service model .

Perp will build an operational mechanism all-around the vePERP token model, enabling DAOs to incentivize and build demand for their tokens.

The mechanism of action is as follows:

- VePERP holders can vote on PERP distribution to Vaults. Therefore, tasks will want to have as several vePERPs as probable to fulfill their functions.

- The DAOs will then exchange their tokens or stablecoins with PERP.

- These tokens will be utilized by the perpetual protocol to be redistributed to reward Vaults suppliers. Of program, the DAOs will set particular prerequisites for the award-winning Vault. For illustration, DAO X only rewards UST end users who give liquidity on the Perpetual Protocol.

- After exchanging PERPs, DAOs can carry on to block, get vePERPs and vote for the Vault they want.

The over mechanism will fix the PERP inflation dilemma, producing a form of PERP war in excess of protocol. At the exact same time, DAOs will also be attracted to this model, as they can use their tokens in exchange for PERP => producing additional token incentives.

Best of all, the Perpetual Protocol will not only restrict the permission for DAOs to use their stablecoins or tokens, it will also increase to asset courses this kind of as stETH … This will assist the Perpetual Protocol entice a substantial volume of liquidity from much less handy asset forms this kind of as stETH.

two.two. Acquisition of liquidity

To recognize this model, initial, you need to have an picture with three events concerned, which include: Perpetual Protocol, Lender (loan provider), Market Maker.

- VePERP holders can vote for the Vault they want.

- Lenders will place their assets in the Vault, which will be locked for a particular time period of time. After offering the items, the lenders will be rewarded with PERP. For additional rewards, lenders can lock PERP on hodl vePERP.

- Market Maker will borrow and assets in the Vault to build a marketplace on Perp V2. At the finish of the loan phrase, they will return the house to the lenders.

Therefore, the liquidity model of the Perpetual Protocol now consists of the borrowing and lending of assets.

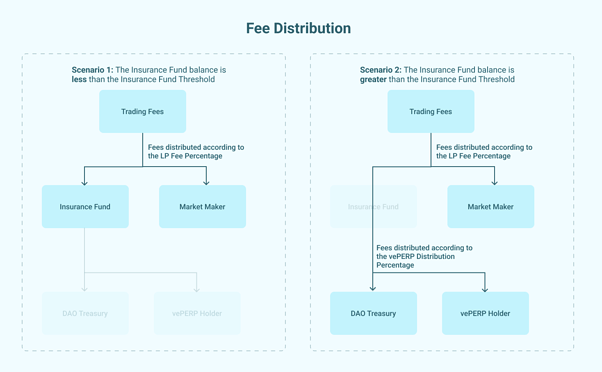

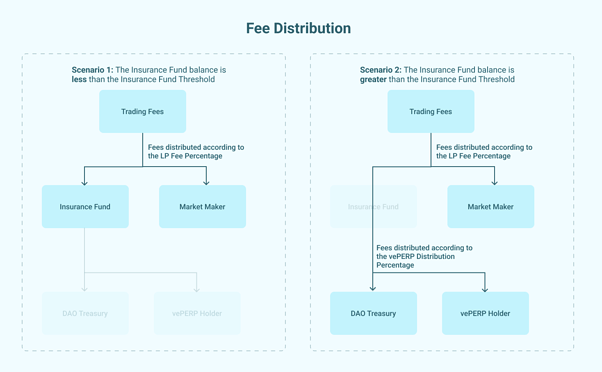

three. Distribution of commissions on the protocol

The Perpetual Protocol proposes to distribute the Tariff obtained in 4 key offices, which include:

- Premiums for liquidity suppliers.

- The protocol insurance coverage fund (following this fund has reached the highest threshold), Fee will carry on to be incorporated in the Treasury.

- vePERP proprietor

Therefore, the distribution of the Perpetual Protocol Commissions will be divided into two scenarios:

Case one

If the insurance coverage fund has not reached the threshold, the commission is split only between the LPs (liquidity suppliers) and place into the fund.

Case two

When the fund reaches the threshold, the commission is split among LP, Treasury and vePERP Holders.

four. End

With the updates in Tokenomic V2, Perpetual Protocol is searching to boost liquidity (by attracting liquidity suppliers, DAOs participating in Perp wars), consequently strengthening the products => attracting additional new traders => generates additional Fee => vePERP holders advantage additional => repeat the cycle.

In my viewpoint, this is fairly a ideal driver for Perpetual Protocol in the recent context. You can carry on to check and wait for this proposal to be officially utilized, consequently evaluating regardless of whether PERP is a prospective investment.

Poseidon

Maybe you are interested:

As a single of the primary protocols in decentralized derivatives trading, in excess of time, Perpetual Protocol has continued to create and create merchandise, in spite of the common problems of DeFi and the marketplace.

In today’s short article, let us find out about the new Perpetual Protocol proposal to get worth for PERP, the project’s native token! (You can read through all the information here).

In this proposal there will be three essential contents:

one. vePERP

PERP will put into action a token model very similar to Curve’s CRV. You can block PERP to get vePERP. During the trial time period, you can block up to one yr. This is to be certain that if improvements are necessary, the task will not shell out as well a lot time waiting for PERP to be unlocked.

two. Reward Programs

Usually, liquidity incentive plans normally lead to the dilemma of symbolic inflation for the task. To repair this, PERP created two improvements:

- Update the Liquidity Mining plan to make it a plan Cash extraction as a support.

- Liquidity Acquisition: This plan will entice money flows, external ensures in Perp to improve liquidity, in return people who give liquidity will get rewards.

two.one. Cash extraction as a support

Currently, Liquidity Mining is a plan that just rewards liquidity suppliers on Perp. In buy to decrease the damaging effect on the lengthy-phrase task (deflation, dumping of PERP => outgoing settlement suppliers => illiquid tasks …), Perp has determined to use a Liquidity Mining as a Service model .

Perp will build an operational mechanism all-around the vePERP token model, enabling DAOs to incentivize and build demand for their tokens.

The mechanism of action is as follows:

- VePERP holders can vote on PERP distribution to Vaults. Therefore, tasks will want to have as several vePERPs as probable to fulfill their functions.

- The DAOs will then exchange their tokens or stablecoins with PERP.

- These tokens will be utilized by the perpetual protocol to be redistributed to reward Vaults suppliers. Of program, the DAOs will set particular prerequisites for the award-winning Vault. For illustration, DAO X only rewards UST end users who give liquidity on the Perpetual Protocol.

- After exchanging PERPs, DAOs can carry on to block, get vePERPs and vote for the Vault they want.

The over mechanism will fix the PERP inflation dilemma, producing a form of PERP war in excess of protocol. At the exact same time, DAOs will also be attracted to this model, as they can use their tokens in exchange for PERP => producing additional token incentives.

Best of all, the Perpetual Protocol will not only restrict the permission for DAOs to use their stablecoins or tokens, it will also increase to asset courses this kind of as stETH … This will assist the Perpetual Protocol entice a substantial volume of liquidity from much less handy asset forms this kind of as stETH.

two.two. Acquisition of liquidity

To recognize this model, initial, you need to have an picture with three events concerned, which include: Perpetual Protocol, Lender (loan provider), Market Maker.

- VePERP holders can vote for the Vault they want.

- Lenders will place their assets in the Vault, which will be locked for a particular time period of time. After offering the items, the lenders will be rewarded with PERP. For additional rewards, lenders can lock PERP on hodl vePERP.

- Market Maker will borrow and assets in the Vault to build a marketplace on Perp V2. At the finish of the loan phrase, they will return the house to the lenders.

Therefore, the liquidity model of the Perpetual Protocol now consists of the borrowing and lending of assets.

three. Distribution of commissions on the protocol

The Perpetual Protocol proposes to distribute the Tariff obtained in 4 key offices, which include:

- Premiums for liquidity suppliers.

- The protocol insurance coverage fund (following this fund has reached the highest threshold), Fee will carry on to be incorporated in the Treasury.

- vePERP proprietor

Therefore, the distribution of the Perpetual Protocol Commissions will be divided into two scenarios:

Case one

If the insurance coverage fund has not reached the threshold, the commission is split only between the LPs (liquidity suppliers) and place into the fund.

Case two

When the fund reaches the threshold, the commission is split among LP, Treasury and vePERP Holders.

four. End

With the updates in Tokenomic V2, Perpetual Protocol is searching to boost liquidity (by attracting liquidity suppliers, DAOs participating in Perp wars), consequently strengthening the products => attracting additional new traders => generates additional Fee => vePERP holders advantage additional => repeat the cycle.

In my viewpoint, this is fairly a ideal driver for Perpetual Protocol in the recent context. You can carry on to check and wait for this proposal to be officially utilized, consequently evaluating regardless of whether PERP is a prospective investment.

Poseidon

Maybe you are interested: