Rumors asking Tether to publish a side company audit for USDT resurfaced just after the stablecoin was lately eliminated.

Wave of de-peg spread of stablecoins from UST

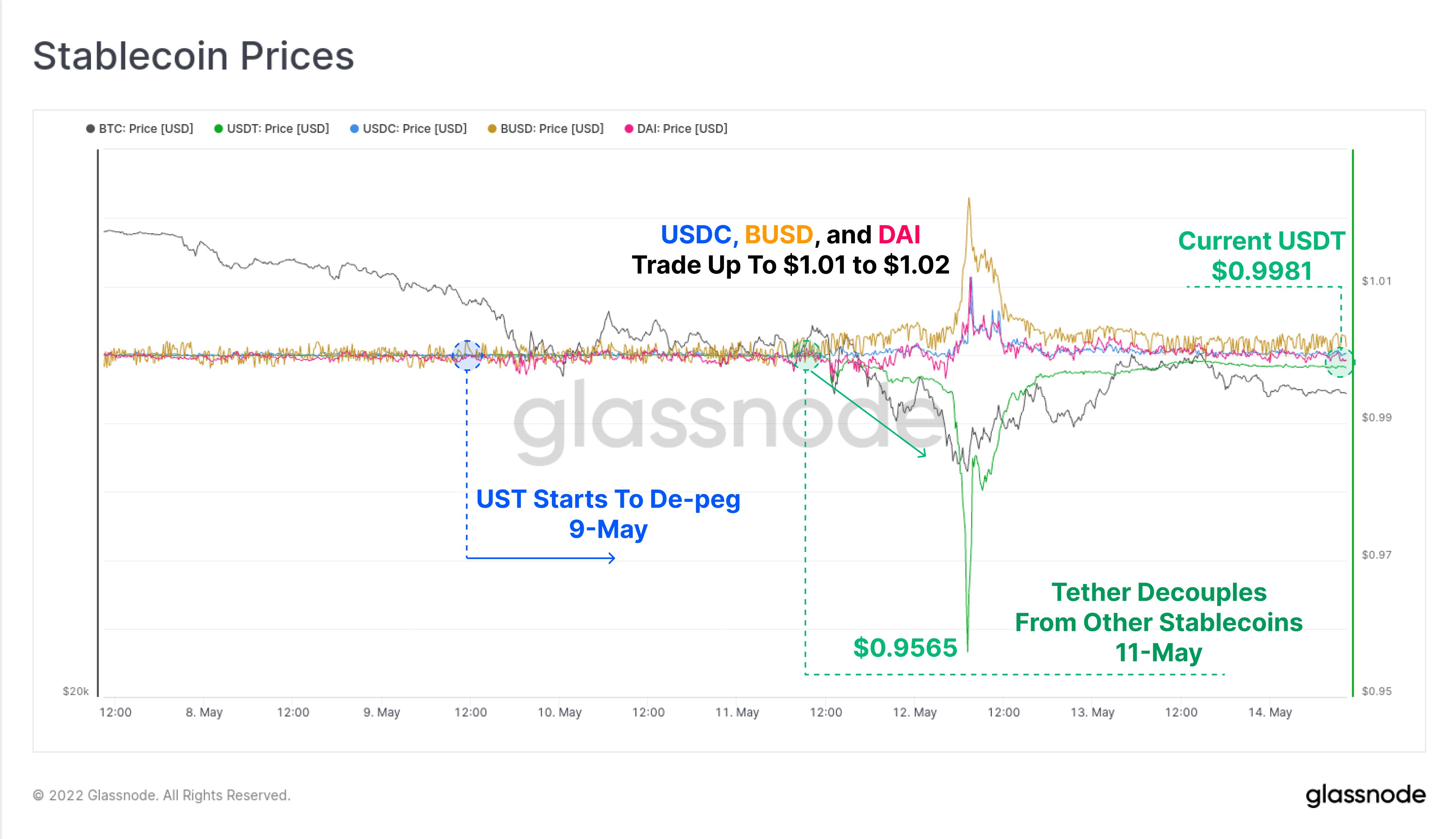

As reported by Coinlive, the UST stablecoin de-peg occasion (shedding the worth of one USD) in the final week brought about a ripple impact across the total cryptocurrency industry in common and the stablecoin array in certain.

Soon just after, UST-like (crypto-backed) algorithmic stablecoin tasks this kind of as USDX from Kava, USDN from Waves or DEI from Deus Finance also misplaced the peg, dropping deeply from the $ one threshold.

Not stopping there, the “traditional” (USD-denominated) stablecoin with the greatest industry capitalization, Tether (USDT), also offered on May twelve, falling to $ .95 at instances. Although the USDT rapidly recovered in the USD .98-.99 region, several folks feared the possibility even just after holding stablecoins.

According to Coinlive, the motive why USDT is de-peg, does not rival USD Coin (USDC) or Binance (BUSD) is for the reason that this stablecoin has extended been questioned on the difficulty of “security assets”.

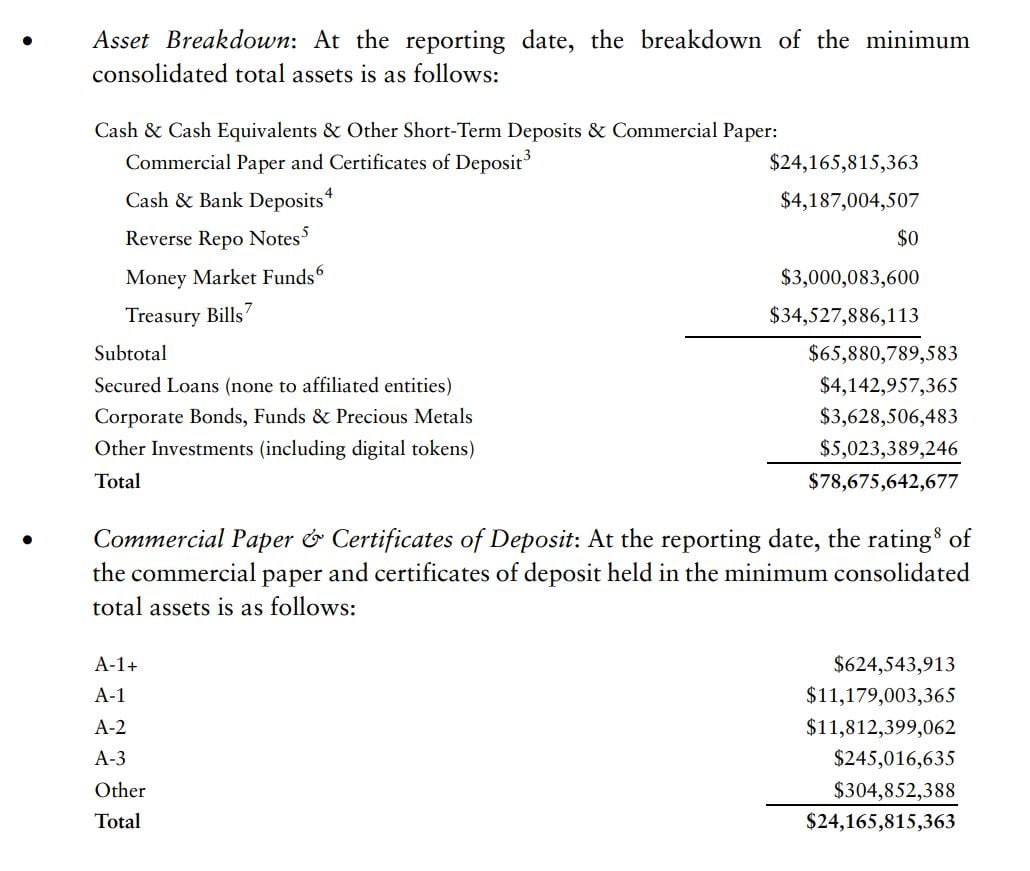

Quote most recent report released by Tether in December 2021, the enterprise holds only USD four billion in money to “back” USDT 78 billion issued in the industry, although the rest is US Treasury expenses (USD 34.five billion), corporate bonds $ 24.one billion) and the the rest are other substantial-possibility investments, such as cryptocurrencies. Newspaper Bloomberg In October 2021, they launched an investigative report, claiming they had been unable to confirm the origin of Tether’s revenue and warning that it was a “slow-blast bomb” for the cryptocurrency sector.

Compared to the USDC from April 2022, Circle issued $ 50.six billion, backed by $ eleven.six billion in money (22.9%) and $ 39 billion in US Treasuries with maturities of three months or significantly less (77, one USD). Meanwhile, BUSD is 1: 1 guarantee in USD for 17.4 billion BUSD issued by them beginning from the finish of March.

Due to the belief that USDC and BUSD are safer than USDT, cryptocurrency traders massively fled from USDT to USDC and BUSD on May twelve, resulting in a significant depreciation of USDT as the exchange charge towards USDC and BUSD rose. .

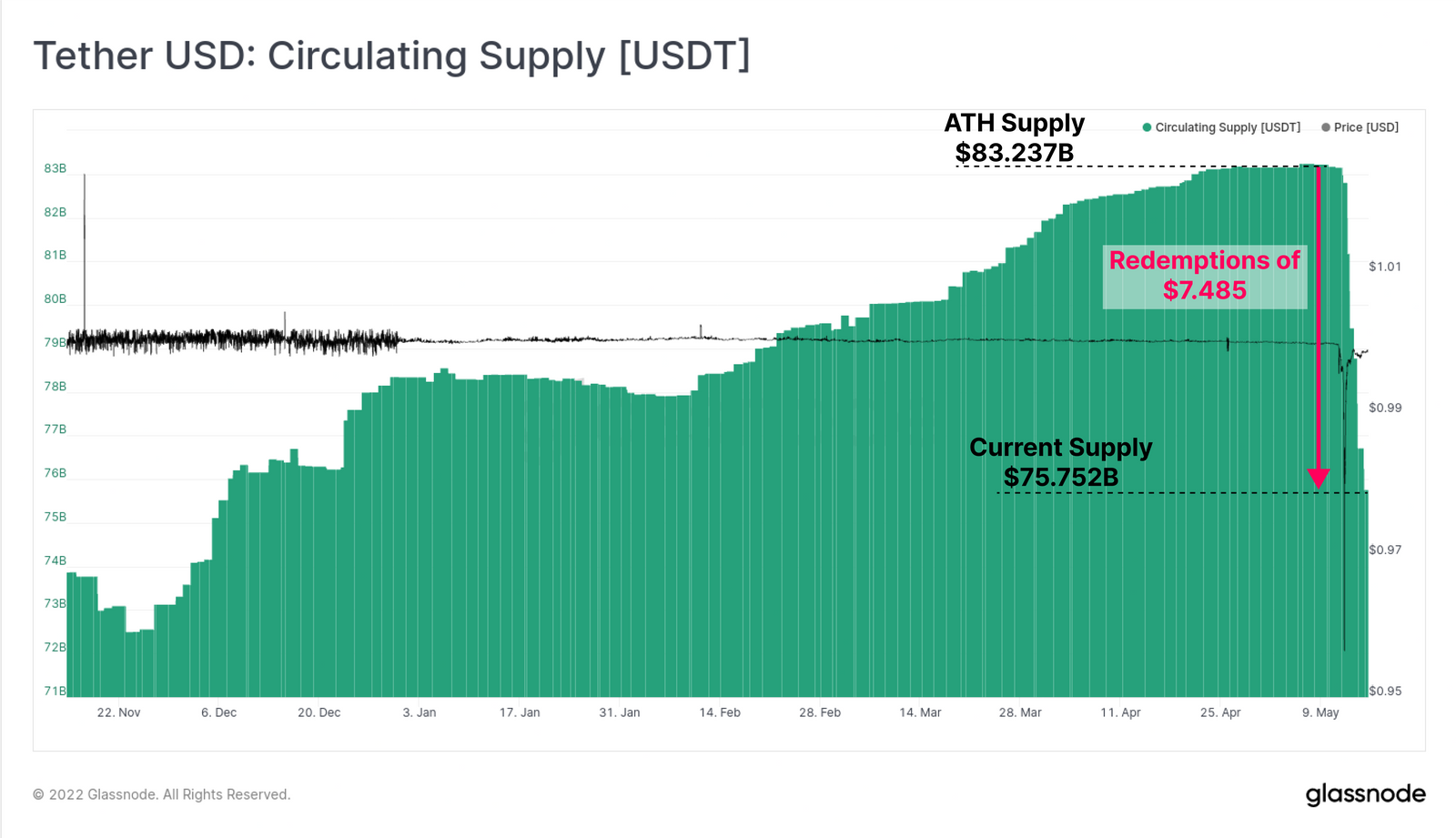

As unveiled by Tether, only on May twelve, it had 2 billion USDT converted into USD by consumers, the enterprise is committed to even now owning enough liquidity to meet the demands of traders who no longer want to hold this stablecoin and the possibility of task insolvency is non-existent.

Since then, Tether’s capitalization has fallen from in excess of $ 83.two billion to $ 75.seven billion without having the enterprise announcing a bid adjustment, that means this is the sum that has been misplaced. , converted to USD by USDT traders in the final week.

This data was also confirmed by Tether.

Such as #Bind USDt is ready to hold its peg as other stablecoins drop

Read our new website publish right here ️https://t.co/NGjTilv7SE

– Tether (@Tether_to) May 16, 2022

The neighborhood asks Tether to be “transparent”

While USDT has due to the fact returned to a selling price shut to USD one and restored stability, the cryptocurrency neighborhood needs even far more reassurance from the greatest stablecoin in the cryptocurrency industry, as proven by a detailed audit report performed by a third get together. respectable portion.

Mr. Ki Young Ju, CEO of data analytics enterprise CryptoQuant from Korea, immediately raised the over query to Mr. Paolo Ardoino, Chief Technology Officer and spokesperson for Tether.

With all due respect, sir, when $ USDT audit report?

We are afraid for the reason that of the $ US collapse and the industry needs spots #Bitcoin ETF.

Cryptocurrency regulators, institutions and traders are waiting for your response as to whether or not $ 75 billion of USDT is thoroughly secured or not.

– Ki Young Ju (@ki_younger_ju) May 17, 2022

“Dear sir Paolo Ardoino,

With all due respect, when will the USDT audit report come out?

We have all been frightened by the latest crash of the FSO and the industry demands a spot Bitcoin ETF.

Are regulators, fiscal institutions and cryptocurrency traders alike waiting for your response as to whether or not USDT 75 billion is thoroughly securitized or not?

The SEC continues to deny the publish #Bitcoin ETFs due to the Tether difficulty.

I’m not releasing FUD or something like that, sirhttps://t.co/r1kRb6RZQF pic.twitter.com/nTTgU9V5XH

– Ki Young Ju (@ki_younger_ju) May 17, 2022

“The SEC continues to reject the Bitcoin spot ETF due to Tether.

I never intend to publish fud or something, sir. “

In response, Mr. Paolo Ardoino wrote:

We redeemed 7B in 48h, without having a blink of an eye. How several institutions can do the exact same?

We can move forward if the industry needs, we have all the liquidity to control big redemptions and pay out almost everything one to one.

Yes, Tether is thoroughly supported.—Paolo Ardoino (@paoloardoino) May 17, 2022

“We converted $ seven billion in 48 hrs with no complications. How several organizations can do this? We can even now trade far more if the industry demands it, there is even now liquidity to deal with even big transactions and assure a one: one ratio.

Yes, Tether is thoroughly securitized. “

But it looks that the response from Tether’s CTO is not sufficient for Ki Young Ju. He continued:

Without a doubt Tether has the most robust backup program in contrast to other stablecoins.

And I feel thoroughly assured issuance is not a massive deal for the reason that the money reserve ratio for conventional banking institutions is usually only ten%.

The reality is, regulators want the numbers to advance this sector.

– Ki Young Ju (@ki_younger_ju) May 17, 2022

“I have no doubt that Tether has a more powerful and far more abundant provide than other stablecoins.

And I also feel that the query of whether or not or not complete margin is also massive for the reason that the industrial bank’s money reserve ratio is only ten%.

But it is significant that fiscal authorities want a validated amount to enable the sector to move forward. “

So please response my authentic query.

When did the audit report come out?

– Ki Young Ju (@ki_younger_ju) May 17, 2022

“So response my authentic query.

When will the Tether audit report come out?“

At the time of creating this write-up, Mr. Paolo Ardoino has not however answered this query.

However, in other Twitter feedback, Tether’s CTO mentioned:

When I referred to the secret sauce, it was for the reason that I was asked to listing all of our counterparts.

Speaking of which, we’re functioning on an audit (it was announced some time in the past) and we’re hoping regulators will push far more auditors to be far more cryptocurrencies.—Paolo Ardoino (@paoloardoino) May 17, 2022

“By the way, we are still writing an audit report (which was announced a long time ago) and hopefully the regulator will push more auditors to become more crypto-compatible.”

We can carry on to redeem if needed.

Tether is intended to have hugely liquid reserves.—Paolo Ardoino (@paoloardoino) May 17, 2022

“Nothing will occur to USDT.

We can convert if needed. Tether is intended to be a liquid reserve asset. “

Last week, Paolo Ardoino unveiled that Tether had halved its holdings in corporate bonds, but did not disclose a precise amount.

Tether cuts industrial paper availability – https://t.co/sSsqq7sDsg

—Paolo Ardoino (@paoloardoino) May 13, 2022

Synthetic currency 68

Maybe you are interested: