Total TVL in DeFi protocols just hit a record variety – $ 148 billion. Has a new Altcoin season arrived?

What is TVL?

Total Locked Value (TVL) in DeFi protocols represents the quantity of assets held in that protocol’s clever contract.

The additional sources in the protocol, the additional believe in the consumer has in the undertaking.

While not a fantastic metric, TVL is even now the most crucial indicator of DeFi protocol development, displaying in which consumer and undertaking income flows lie.

TVL DeFi is approaching new highs

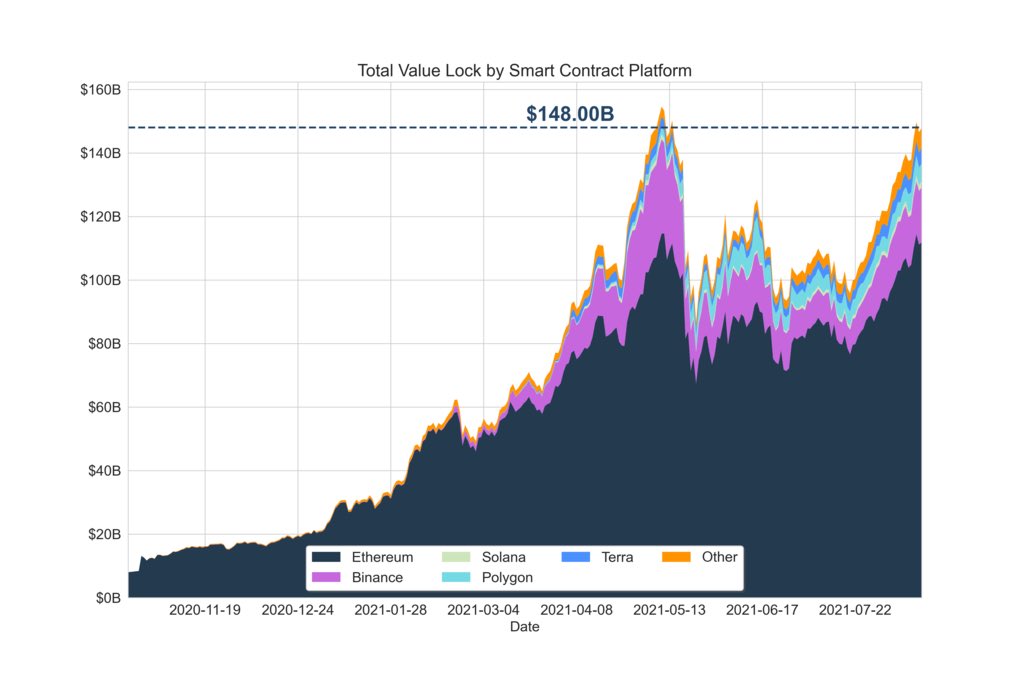

According to the newest information from Messari, the complete TVL in DeFi protocols has now reached $ 148 billion. This variety is continually developing and new ATHs will be established quickly.

Of the DeFi ecosystems thought of, Ethereum, BSC, Polygon, Terra and Solana are people with the highest share of TVL.

So, let us break down every single of these ecosystems in detail!

TVL overview for every single ecosystem

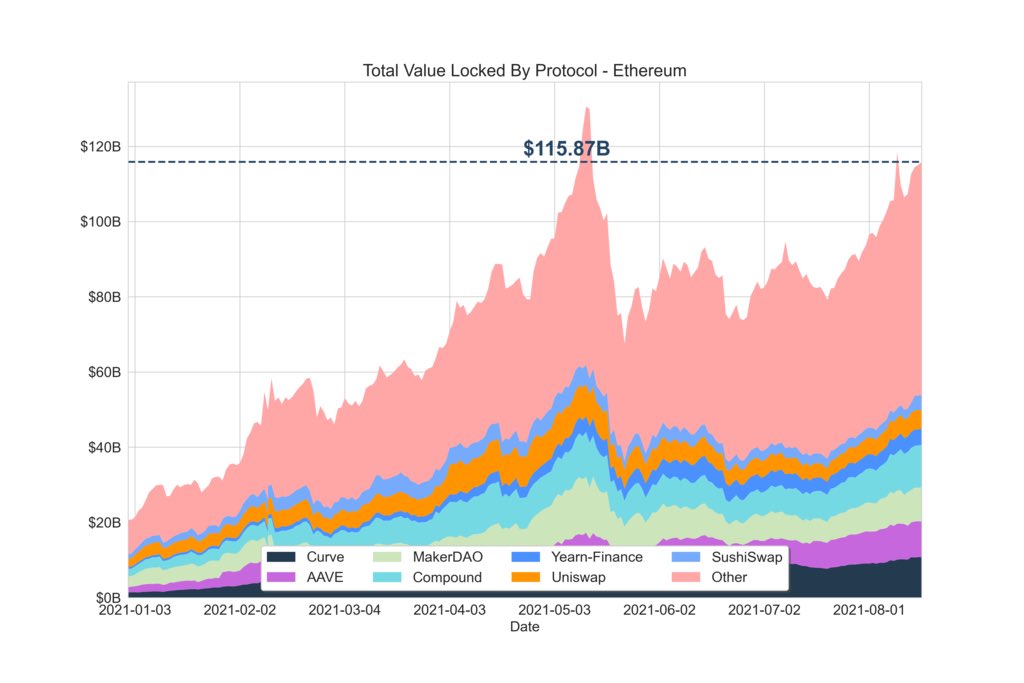

one. Ethereum procedure: 116 billion bucks

Being the oldest DeFi ecosystem, the clever contract creation platform, of program Ethereum even now accounts for the biggest variety of locked assets. With 116 billion bucks, equivalent to additional than 78% In TVL’s industry share, the Ethereum ecosystem holds a exclusive place in the DeFi planet.

In the Ethereum ecosystem, Curve (CRV), Yearn Finance (YFI), AAVE, MakerDAO (MKR) or Uniswap (UNI), SushiSwap (SUSHI) are even now the protocols with the most “huge” resource movement. These are mainly names acquainted to the DeFi consumer local community.

In unique, if you search closer, the TVLs of Curve and AAVE have just reached new ATHs, displaying that the influx of sources into these two protocols has reached an unprecedented peak.

Furthermore, the battle to grow to be the best DEX concerning Uniwap and SushiSwap is not in excess of. Despite the “late birth”, even if TVL in some cases drops by 50%, SushiSwap is even now well worth the wait. While Optimistic and Uniswap had been acquiring a fiery “drama”, the hacker assisted SushiSwap conserve $ 350 million. The IDO MISO open revenue platform is also a aspect that draws local community interest to SUSHI.

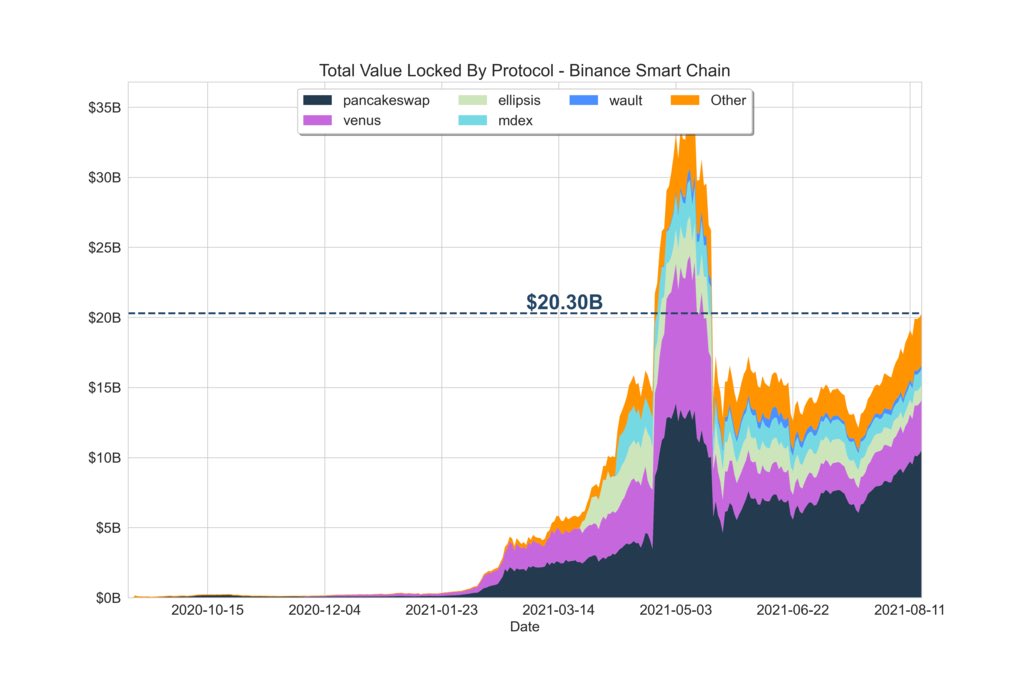

two. Binance Smart Chain (BSC): USD twenty billion

Although it even now holds the 2nd biggest TVL industry share right after Ethereum, the BSC procedure has proven indicators of critical decline.

After a series of BSC hacks, coupled with the rise of the Polygon (MATIC) procedure, the movement of funds into BSC started to decline.

From the picture over, it can be viewed that PancakeSwap (CAKE) or Venus (XVS) even now holds the most quantity of sources in the BSC procedure. However, it can obviously be viewed that the pending DeFi tasks on BSC are even now pretty modest in contrast to their “brother” Ethereum.

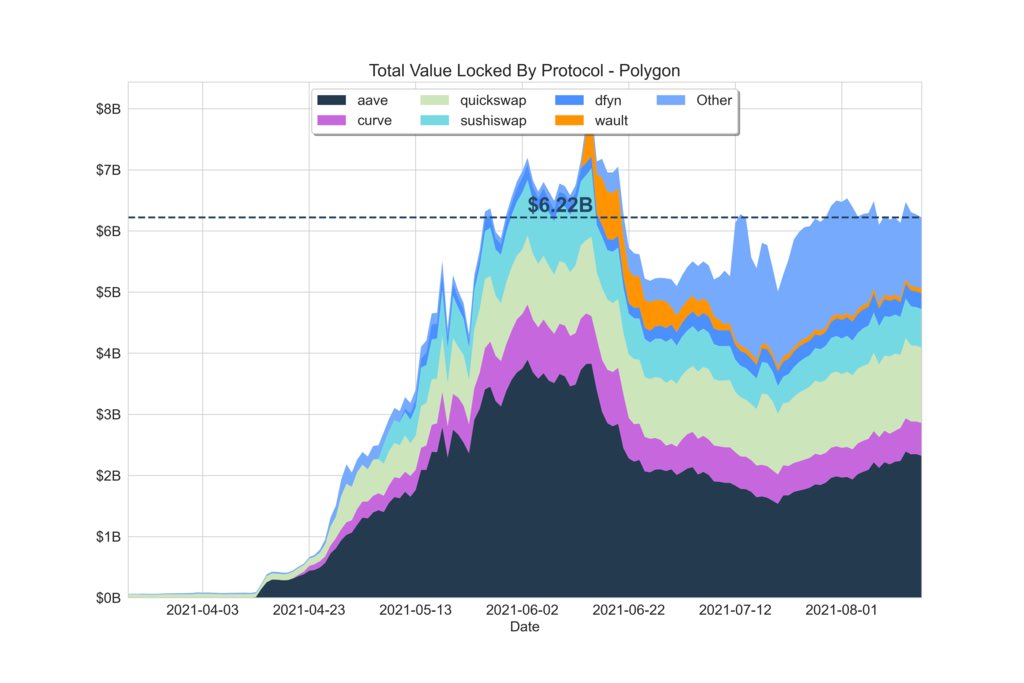

three. Polygonal procedure: USD six billion

Being the most effective representative of Layer two remedies, Polygon is understandable. As explained over, TVL in Polygon greater by one.102%, even though BSC decreased by 50% in May, resulting in enormous development for this ecosystem.

Part of the Polygon boom also comes from Coinbase and Binance integrating Polygon wallets, building it less difficult for consumers to transact and interact with MATIC.

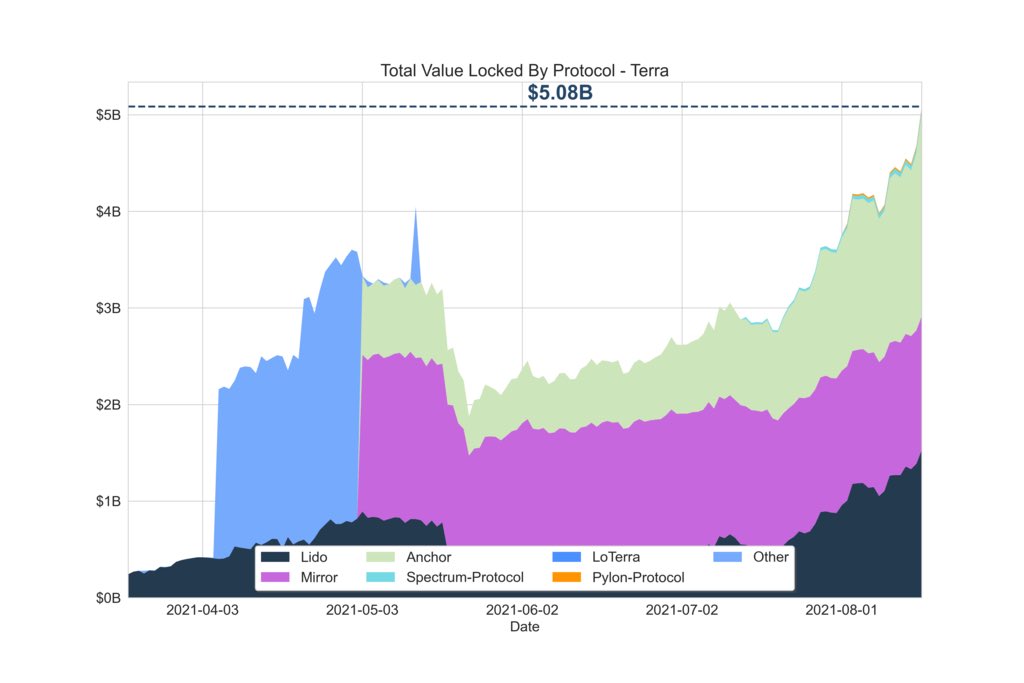

four. Earth System: US $ five billion

The complete worth locked in Terra’s DeFi protocols peaked at $ five billion. The price tag of LUNA “breakthrough” 165% final week also brought a major shock to the DeFi consumer local community.

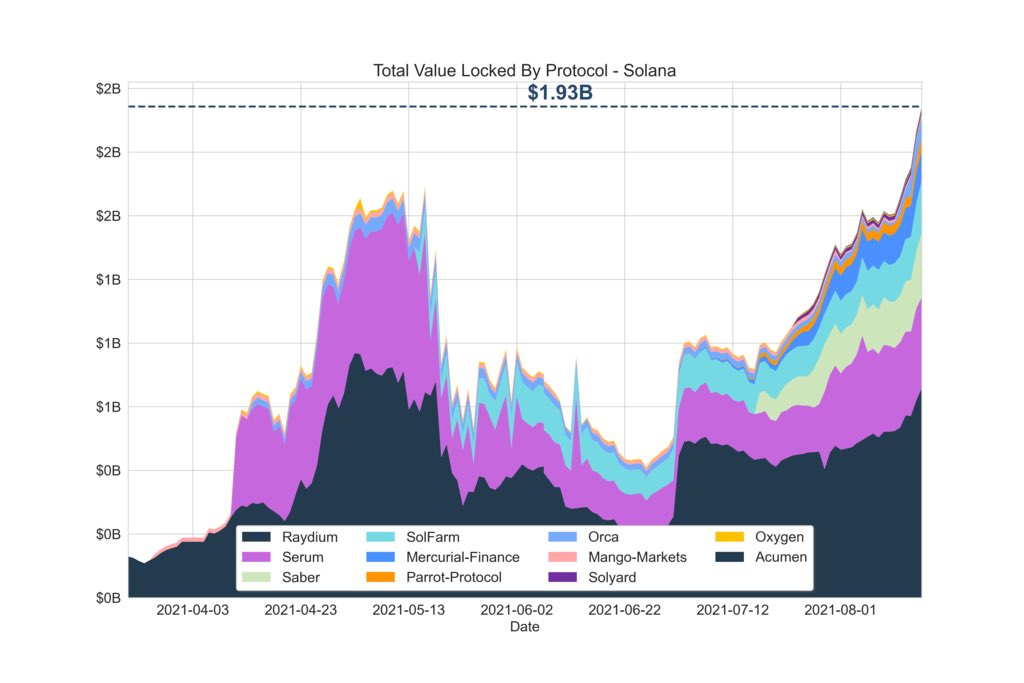

five. Solana procedure: $ two billion

Thanks to the price tag (SOL) establishing a new ATH – the explosion of the Solana ecosystem led to the TVL of the protocols on Solana. SOL is a great deal of hype in the crypto local community when quite a few people today from the Solana Summer undertaking arrived.

However, in the post Is Solana (SOL) sporting a shirt as well major ?, the writer commented that the Solana procedure is not actually worthy of the interest it has, since the income movement and the undertaking are only “stub” respect to other DeFi programs. Solana’s TVL only requires one.three% on complete TVL ($ two billion out of $ 148 billion), line up Thursday This listing also demonstrates Solana’s real spot.

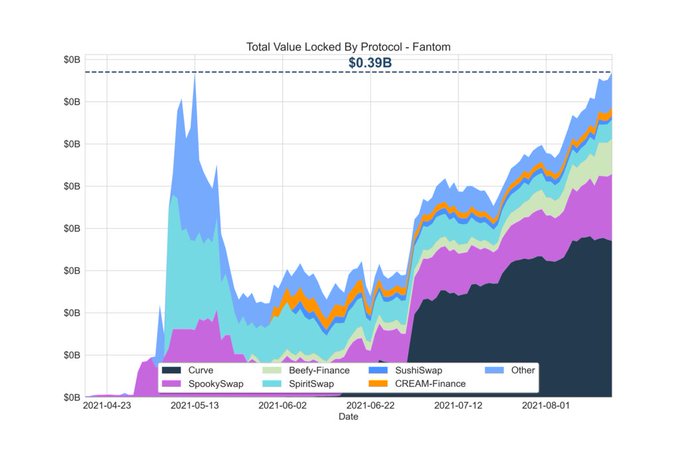

six. Fantom procedure: $ 400 million

The Fantom ecosystem holds USD 400 million TVL. The information under demonstrates that practically half of Fantom’s TVL comes from Curve, which is Ethereum’s inherent protocol extending to Fantom.

From this, it can be viewed that the Fantom procedure does not however have a main official DeFi protocol, capable of “comparing” with the protocols of other programs.

Of program, from a additional good viewpoint, Fantom is a fertile land with good probable for DeFi tasks and teams. If you establish a “nail” undertaking on Fantom, a great deal of funds will come in.

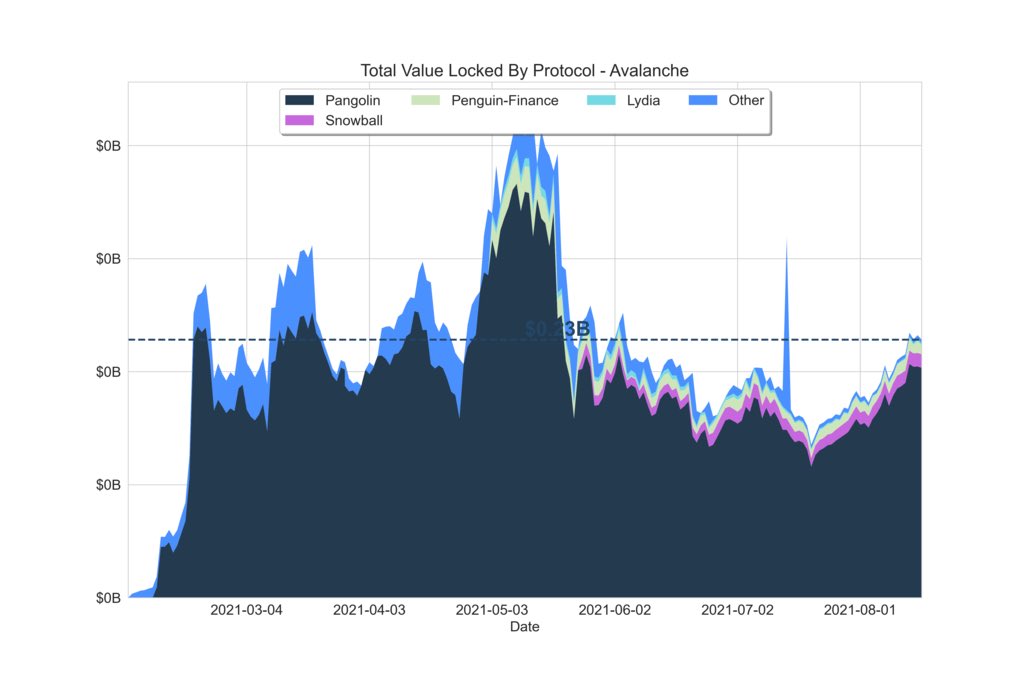

seven. Avalanche procedure: $ 230 million

Like Fantom, the Avalanche procedure even now has a great deal of probable for tasks that want to discover a new platform, with out acquiring to compete with the “big players”.

After announcing the Roadmap 2021, AVAX is officially the ninth identify that Tether spots its believe in in issuing USDT. The presence of the biggest stablecoin in the planet by trading volume on Avalanche has produced it even less difficult for funds to movement into this ecosystem.

Additionally, Avalanche launches a system to lure $ 180 million in DeFi with AAVE and Curve, the top rated two protocols on Ethereum that will aid Avalanche’s TVL explode even additional in the close to long term.

Jane

Maybe you are interested: