Each form of evaluation has pros and drawbacks. In this write-up we will speak about the initial form, Fundamental Analysis.

What is basic evaluation? How to assess crypto tasks employing basic evaluation

What is basic evaluation? How to assess crypto tasks employing basic evaluation

When embarking on the investment journey, no matter what the marketplace, evaluation is crucial. Analysis aids traders make judgments and give self-assurance in their investments.

In common fiscal markets, there are two most important kinds of evaluation: basic evaluation and technical evaluation. However, for the cryptocurrency marketplace there is a third kind of evaluation, On-Chain evaluation.

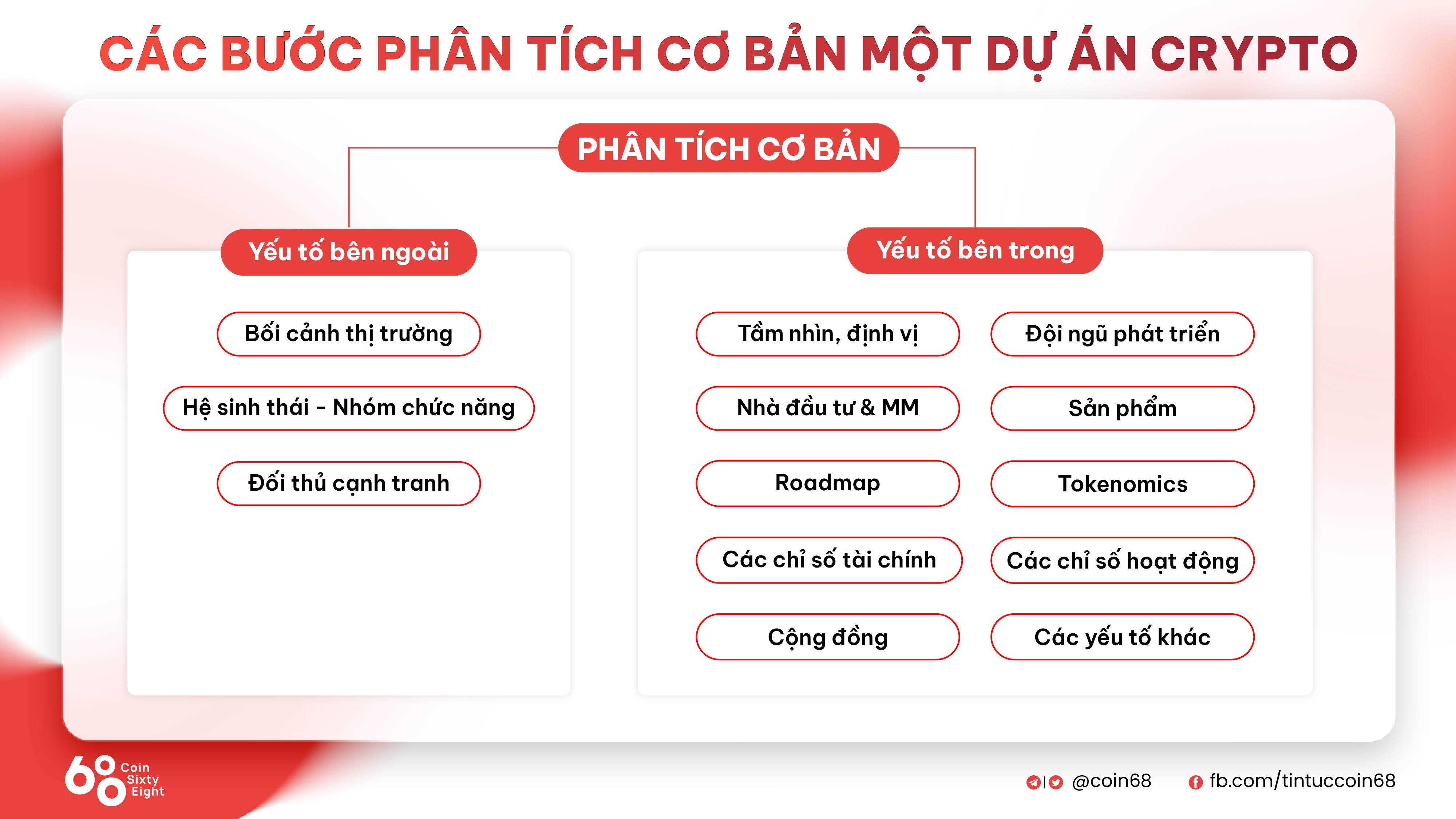

- Fundamental evaluation: It is the exercise of analyzing the simple factors of the undertaking and the external setting this kind of as (items, teams, tokenomics, rivals, organization setting…) so assisting traders to ascertain the inner worth of the undertaking.

- Technical evaluation: Technical analysts will look at that all other variables are reflected in the cost line, so this form will mostly depend on cost charts and other technical resources to ascertain the upcoming trend.

- Chain evaluation: This is a special attribute of the cryptocurrency marketplace that are unable to be duplicated with other fiscal markets. Blockchain aids make anything transparent, which includes the circulation of tokens. A new form of evaluation is hence born: On-chain Analysis. Analysts will depend on on-chain indicators to predict the upcoming cost conduct.

Each form of evaluation has pros and drawbacks. In this write-up we will speak about the initial form, Fundamental Analysis.

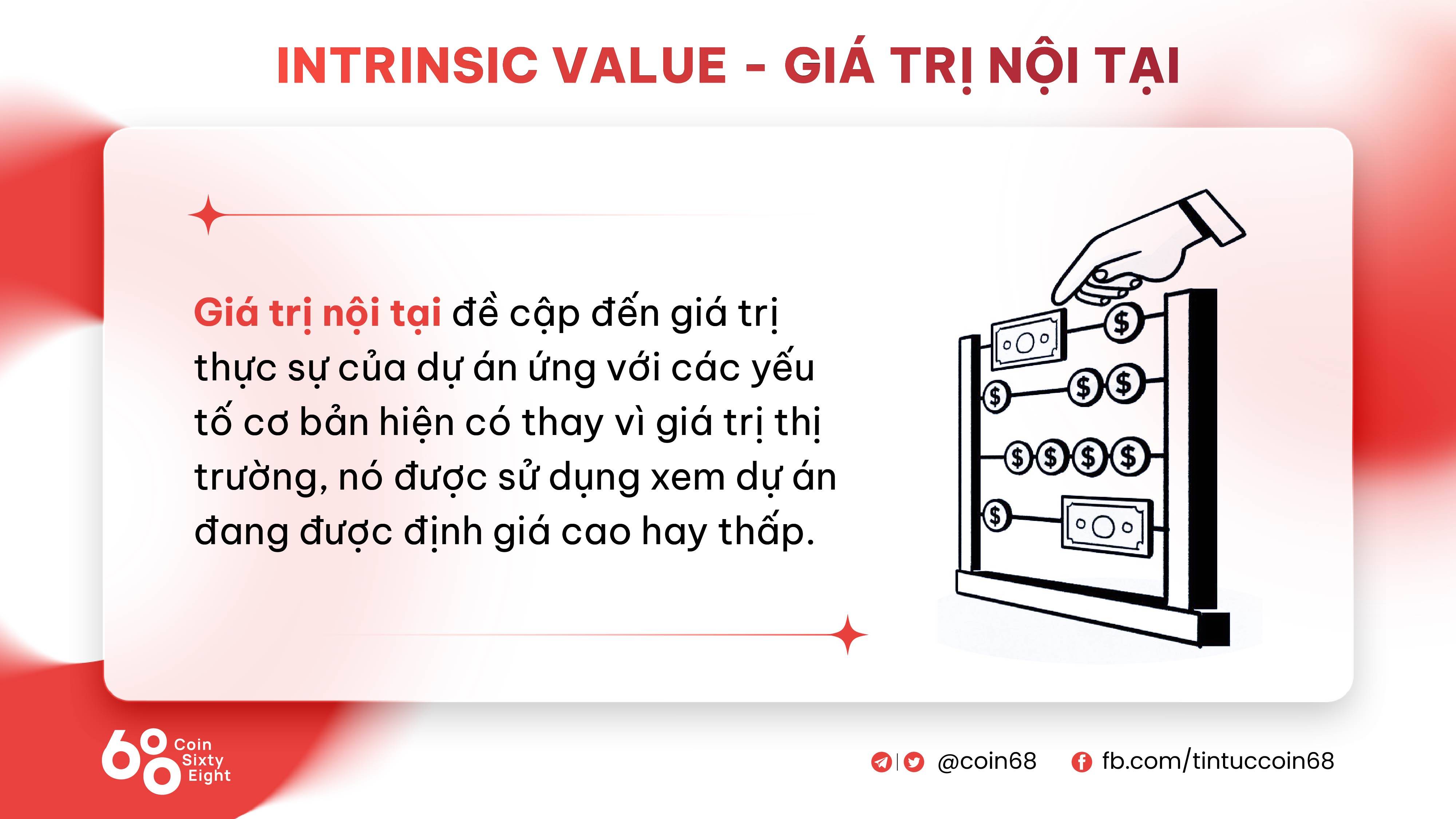

Fundamental evaluation in standard and in the discipline of cryptocurrencies in individual is the exercise of analyzing the simple factors of a undertaking with the aim of ascertain intrinsic worth and the improvement likely of the undertaking.

The intrinsic worth of a cryptocurrency undertaking

The intrinsic worth of a cryptocurrency undertaking

Intrinsic worth refers to the real worth of the undertaking primarily based on current fundamentals rather than marketplace worth, it is made use of to see if the undertaking is overvalued or undervalued.

Fundamental variables (or basic variables) incorporate but are not restricted to: individuals, items, technological innovation, traders, working model, fiscal indicators, improvement stage, tokenomics, organization philosophy, local community, marketplace context, rivals…

We’ll consider a closer appear at every single element in the following sections.

Advantage

Fundamental evaluation aids you ascertain the real worth of the undertaking and its improvement likely in the recent marketplace setting. From there, it provides you reliable self-assurance to “diamond hand” or skip the undertaking. If you never realize the undertaking, you never know what your investment is for, even just a small FUD will promptly get you concerned in a fire sale.

Fundamental evaluation delivers traders a prolonged-phrase standpoint. Because the simple factors of the undertaking are not as straightforward to modify overnight as the cost line.

Defect

Fundamental evaluation involves the analyst to have a broad and reliable understanding base, which includes macro, micro and technological understanding if they want to offer an exact valuation consequence.

Therefore, in contrast to cost indices and on-chain indices with the formula one+one=two, the benefits of basic evaluation are strongly influenced by the person analyst.

Furthermore, in the cryptocurrency marketplace basic details can also be restricted and not normally exact. Because the details published by the undertaking has hardly been verified by any competent organization.

In this area, we will find out in detail every single simple component to analyze of a cryptographic undertaking. These variables are the salient factors that will need to be evaluated, but you can analyze several other variables as properly.

Regarding the path of the evaluation, you can decide on to go from within to outdoors, or from outdoors to within. But it is improved to go from macro to micro, so you have a see from the standard to the detail.

Macro scenario (financial, political, social) > Industry (blockchain and cryptocurrencies) > Ecosystem > Functional groups > Projects.

Factors that should really be evaluated in basic evaluation

Factors that should really be evaluated in basic evaluation

Internal variables

Vision/Positioning

For several individuals this is a rather theoretical criterion, but in massive tasks identifying the vision and positioning of the brand is crucial for prolonged-phrase improvement. It is the guideline for all operations above a prolonged time period of many years.

– Vision it is a multi-yr potential picture of what the undertaking aspires to develop into. It is a statement of objectives and potential path.

You can locate details about the project’s mission and vision in the Whitepaper or on the official undertaking portal.

For illustration, Ethereum’s vision is to develop a decentralized, versatile, and potent blockchain platform that offers the infrastructure for setting up decentralized applications. The target is to make a decentralized Internet method wherever individuals can interact, make and exchange worth without having the intervention of third events. (Source: White paper on Ethereum)

– Positioning this is how the undertaking desires shoppers to perceive them. Positioning is the exercise of setting up your place in the minds of target shoppers, assisting them differentiate your undertaking from rivals.

For illustration: Solana positioning is a decentralized blockchain platform with higher overall performance and higher velocity. Thanks to this positioning, Solana accepts the trade-off amongst decentralization and protection in exchange for velocity in the unattainable trinity, so gaining a aggressive benefit above Ethereum in the Layer one battle.

A great tracker can only be developed by a crew that understands the technological innovation and understands the marketplace. A undertaking with a great positioning method will kind a reliable basis for the upcoming ways.

Development crew

The improvement crew is an exceptionally critical element that wants to be meticulously studied. The results or failure of a undertaking depends on the crew that supports it, mainly because they are the ones who develop and deliver the solution to existence. A robust crew is a crew composed of complete members covering all critical positions (management, technological innovation, communication, finance…), wherever every single person has expertise in the discipline, in the location he manages and also in the cryptocurrencies.

You can locate details about the undertaking improvement crew by social networking channels this kind of as LinkedIn and Twitter.

Some tasks adhere to the lead of teams that anonymize authentic-existence details (publishing only social network accounts) or that anonymize it absolutely. In any situation this is also a attribute of the cryptocurrency marketplace, several anonymous tasks have had robust improvement this kind of as PancakeSwap or Bitcoin.

This lack of details is a detrimental stage, but it isn’t going to suggest we should really disregard it: let us mix it with other details to make the ultimate choice.

Investor and MM

In current many years, the saying “swimming with the sharks” or “following the big investment funds” has develop into preferred in the cryptocurrency planet. Swimming on a significant price range is a great technique, but it also has pros and drawbacks that you will need to realize in advance of every single journey to the pool.

The initial, a undertaking financed by an investment fund has passed by a filter degree. The “better” the investment fund, the improved the good quality of the filter layer. Therefore one particular may possibly truly feel “a little” safer if a undertaking receives investments from several massive money.

On the contrary, you ought to also know that agreeing to invest in a undertaking with a fund usually means that from a specific stage of see you are getting liquidity for the fund. The cost obtained from investment money will absolutely be several instances more affordable than the cost you can invest in. This is mainly because the money not only help the undertaking financially but also in communication, relational connection, branding and strategic consultancy.

Pay interest to your place relative to other undertaking participants to create revenue expectations and determine ideal timing.

Monday, not all money are “good”. There are several kinds of investment money, there are investment money that are committed to traveling prolonged distances and supporting tasks, but there are also investment money that just wait for the token to be unlocked and then release it.

Still understanding that revenue is the greatest target regardless of whether it is an person investor or a fund, but for prolonged-distance money they agree to bury the capital to reap significant earnings in the potential, even though quick-distance money just wait to pay out tokens to make fomos to download. Therefore, you will need to know which money are prolonged-phrase and which are quick-phrase. Even understanding this, it is nevertheless challenging, considering the fact that for every single undertaking they will ascertain investments in a distinctive time frame, you will need to more analysis the solution and tokenomics to assess more.

Tuesday, it is not correct that extra traders are improved. The expression “5 people, 10 ideas” is almost certainly the ideal way to describe this subject. The extra events concerned, the extra challenging it gets to be steady in operations. However, it ought to be extra that right here “many” usually means a whole lot in terms of voting rights and not in the kind of a couple of money contributing a modest investment worth mostly for cooperation in the media.

Wednesday, you should not place all your believe in in massive money. Alameda Research, FTX Ventures, Three Arrows Capital are absolutely no strangers to us. Don’t place as well a great deal faith in any entity in the cryptocurrency marketplace, mainly because the most steady empires can nevertheless collapse overnight.

AND The ultimate, investment money are not normally correct. Funds nevertheless have to allocate their investment portfolios across several distinctive tasks and classes. Not all tasks with the presence of massive money have great development.

Product

The solution is the upcoming critical element that wants to be studied. With this criterion we ought to reply the queries:

- The undertaking is making an attempt…