Raft is a lending and borrowing protocol that makes it possible for customers to mortgage loan Liquid Staking Token (LST) to mint and borrow the R stablecoin. It is an emerging task in the LSDfi ecosystem backed by investment money Popular traders like Jump Crypto , Wintermute, Lemniscap,.. So what is particular about this Raft task? Let’s come across out with Coinlive as a result of the report under!

What is Raft? Jump Crypto invests in emerging protocol LSDfi

What is Raft?

Raft is a lending and borrowing protocol that makes it possible for customers to collateralize Liquid Staking (LST) tokens to mint and borrow the R stablecoin. Raft aims to create a DeFi ecosystem on Ethereum to help customers boost the efficiency of their use of capital in a secure and secure setting.

What is Raft?

To mint and borrow the protocol’s R stablecoin, customers will pledge the supported Liquid Staking (LST) tokens stETH, wstETH, and rETH. From right here, customers can use the R stablecoin to borrow liquidity to give liquidity on other protocols this kind of as Uniswap, Balancer,… to earn much more income.

What sets the R stablecoin apart from other stablecoins with lending protocols this kind of as SAI (Single Collateral DAI) and LUSD is its ground breaking technique to stability, enhanced capital efficiency, and a versatile charge framework. Central to the stability of the R stablecoin is the one of a kind mixture of the Hard Peg and Soft Peg mechanisms. These two mechanisms mix to assure that the worth of R is normally pegged to the worth of the USD, supplying a secure cost in the array of one – one.two USD.

Products for rafts

Raft’s flagship product or service is the R stablecoin backed by LST collateral and pegged one:one to the USD. Central to the stability of the R stablecoin is the one of a kind mixture of Hard Peg and Soft Peg mechanisms to assure that the worth of R is normally pegged to the worth of the USD.

Hard pegs it is an arbitrage-based mostly mechanism to retain the cost of the R stablecoin in line with its collateral and normally inside a cost array of USD one to USD one.one. This happens as a result of two mechanisms: Reimbursement and Over-Collateralization.

-

Redemption: This is a mechanism that makes it possible for holders of the R stablecoin to exchange it for collateral of equivalent worth. Every time a consumer redeems their R stablecoins, they get burned by the intelligent contract. From right here, the circulating provide of R will lower and contribute to the boost in the worth of R. This guarantees that even if the cost of R falls under the one USD threshold, customers nevertheless have the means to exchange R for products secure mortgages.

-

Excessive assure: This is a mechanism that makes it possible for customers to mortgage loan assets really worth one.two USD to mint one R stablecoin really worth one USD. From right here, customers can promote R on the open industry for much more than $one.twenty and make a revenue as a result of arbitrage. By expanding provide, the protocol also balances cases wherever the cost of R may possibly rise over the $one.two threshold, hence supporting the stabilization of the worth of R.

Soft pegs it is a mechanism that relies on the style of the stablecoin to incentivize customers to act on the expectation that the R stablecoin will continue to be pegged to the USD in the long term. This happens by producing a Schelling level to which the procedure tends to return right after short-term deviations.

For instance: When R trades over $one, current borrowers have no incentive to redeem their positions. Conversely, other customers can advantage by borrowing and marketing R on the open industry. The exact same problem applies when R trades under one USD, borrowers are incentivized to repay their debt although other customers are incentivized to acquire R on the open industry and redeem them with backed collateral sorts.

Raft’s mechanism of action

Users deposit supported LST assets as collateral to mint and borrow the protocol’s R stablecoin. Users can borrow a minimal of R3000 with a collateral ratio for every single R borrowed of at least 120%. This guarantees that customers can afford the borrowed debt and maintains the stability of the protocol. When customers borrow R, they have to pay out curiosity and charges on the loan.

-

Loan curiosity price: This is the sum of the base price and the borrowing spread with the cap set at five%.

-

Loan charge: This is a charge calculated by multiplying the loan quantity by the loan curiosity price. For instance, if the charge is .05% and the consumer borrows R ten,000, they will have to pay out a charge of R five. Therefore, the complete debt will quantity to R ten,005.

Returning the borrowed stablecoin R to Raft is a straightforward procedure, and the borrower repays the burned R straight away. There are 3 strategies to repay the borrowed R, together with:

-

Repayment (loan repayment): Borrowers can repay the R tokens borrowed in Raft and get the LST collateral back. Users can make partial or complete refunds, but ought to assure that the excellent stability does not fall under the minimal necessity. Successful repayment not only improves the collateral ratio of the borrower’s place, but also increases the quantity of collateral readily available to draw on.

-

Redemption: The redemption mechanism makes it possible for customers who personal R on the open industry to redeem them and get collateral from the borrower. The conversion procedure refers to employing the converted R to pay out off a portion of the debt of every single current place. The repaid debt quantity will be distributed proportionally concerning positions based mostly on the borrower’s mortgage loan quantity.

-

Clearance: Liquidation serves as a safeguard to assure that every single R is normally backed by collateral really worth at least $one. A place will be liquidated when its collateral falls under the minimal collateral ratio. The settlement procedure starts when the third-get together MEV liquidator commences interacting with the intelligent contract and the liquidator repays the borrower’s debt. They will get the borrower’s assure as a reward.

Characteristics of the raft

Position

Raft makes it possible for customers to mint and borrow the R stablecoin by opening a place with every single wallet tackle representing a place. Users ought to as a result collateralize the LST assets supported by the protocol with a minimal collateralization ratio of 120%. The lending procedure comes with specific prerequisites, together with a minimal loan quantity of R3000.

Additionally, the consumer has to bear the loan charge paid in Rs, calculated based mostly on the quantity and curiosity price borrowed. This charge is influenced by how typically a consumer redeems R inside the protocol.

To redeem

This is a function that makes it possible for customers to convert R to collateral with a one:one conversion ratio to USD. There are two most important parts concerned in the redemption procedure: Redemptors and Ransom Providers (RPs).

-

Redeemers: These are the people today who will be wanting to convert the R stablecoin into collateralized LST assets. Raft incorporates a spread mechanism with costs ranging from .25% to a hundred% to reduce dangers for the Redeemers. Additionally, Redeemers are topic to an exchange charge paid in Rs calculated based mostly on the worth and conversion price.

-

Redemption Providers (RP): These are the ones who will give the assured LST assets to facilitate redemption. They will get a portion of the commission calculated in accordance to the following formula: Conversion Commission * Percentage of commission per RP. Wherein, the commission price for RPs varies from % to a hundred%.

Mint Flash

This is a function that makes it possible for customers to mint the R stablecoin up to ten% of the complete provide with no generating any first payments. However, they have to refund R in the exact same transaction with a charge of .five%. Initially, this price is capped at .five%, but will be adjusted up to five% based mostly on real utilization of the R stablecoin token.

Lever

This is a leverage function that makes it possible for customers to boost capital ratio per trade and earn increased income from smaller sized investments as a result of personalized margin costs. However, customers should really be cautious simply because the leverage function will boost the threat of reduction, primarily in the course of intervals of sturdy industry fluctuations. To sustain stability, Raft sets the optimum leverage at six%.

Liquidator

The position of the liquidator is important in making certain that every single R stablecoin maintains its worth with collateral LST, equivalent to one USD. Users can participate as a liquidator to settle the borrower’s debt and get collateral equivalent to the liquidated quantity. Raft incentivizes customers to develop into liquidators to earn further income as a result of liquidated collateral rewards.

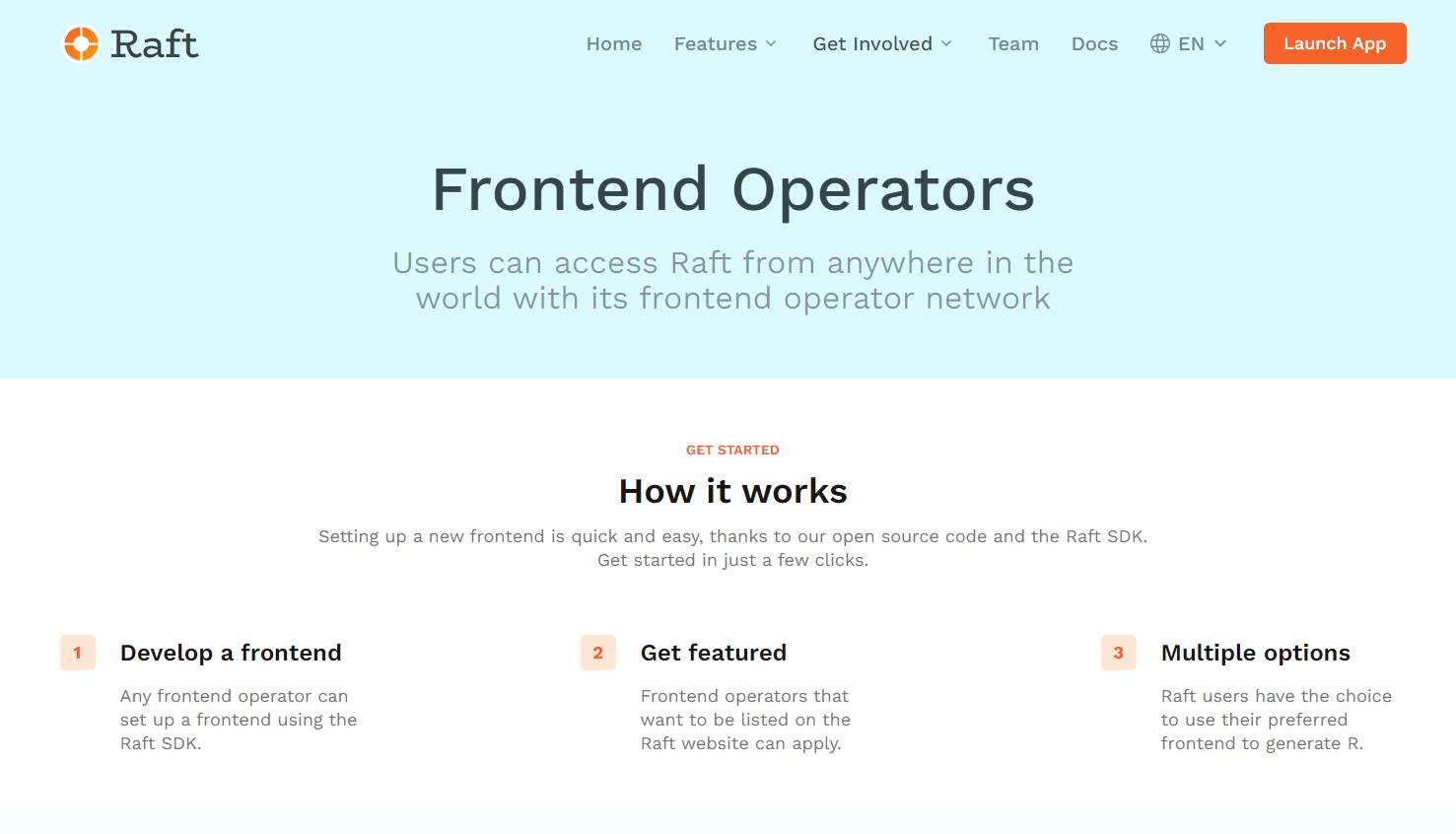

Frontend operators

Raft offers help to developers as a result of its Frontend Operators performance, supplying a toolkit that facilitates the integration of their DApps into Raft. Additionally, frontend operators get technical and advertising and marketing help to support them maximize rewards by contributing to Raft’s advancement.

Frontend operator performance interface

Oracle

Raft’s Oracle procedure is developed to be adaptable and manageable in a multisig (multi-signature) configuration. This framework makes it possible for multisig participants to make essential updates to assure the protocol stays robust and dependable.

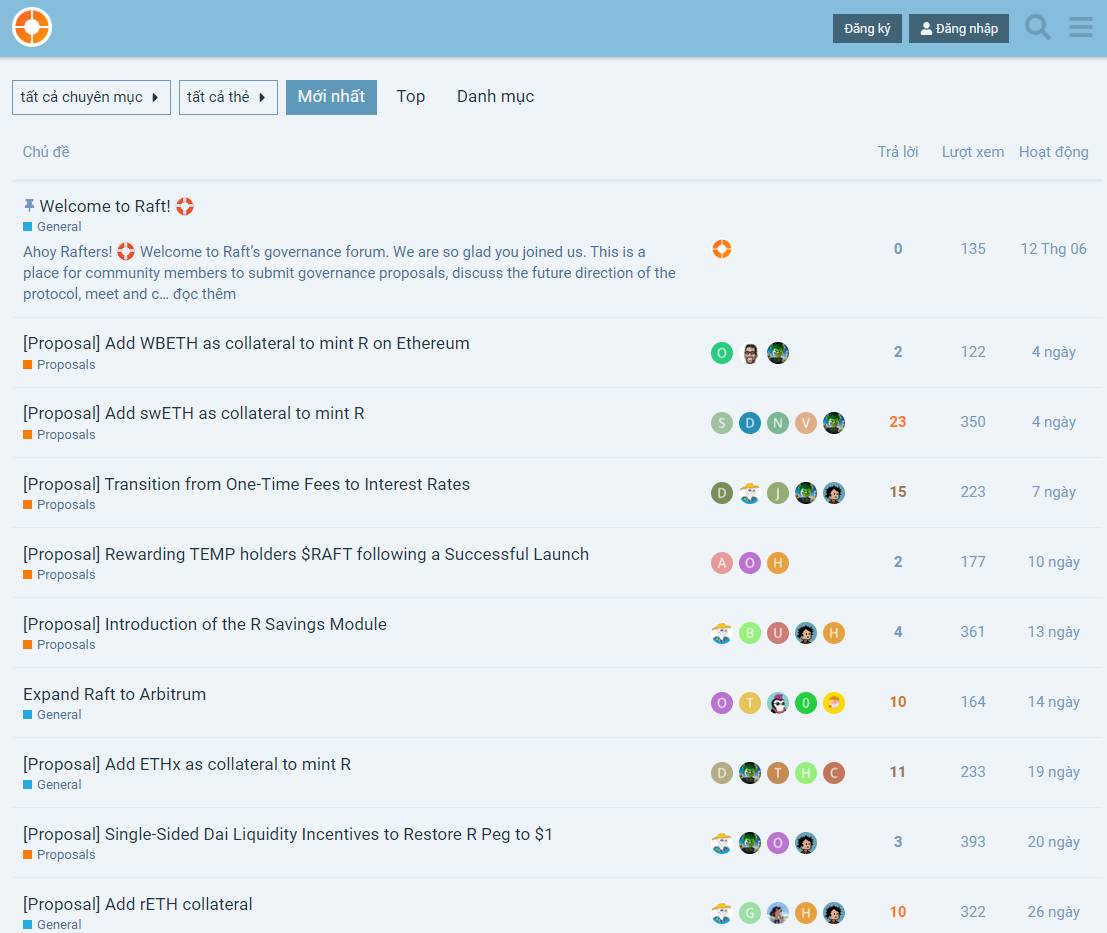

Governance Forum

To sustain decentralization, Raft delivers customers the chance to participate in the governance forum and makes it possible for them to actively contribute to the governance of the protocol. Users can express their opinions on vital locations this kind of as the appointment of the Liquidity Committee, determination of the liquidity pool for the R stablecoin, treasury fund allocation and protocol charges, and so forth.

Governance Forum capabilities interface

Basic info about tokens

At the minute, Raft has no info on long term token issuance. Coinlive will update as quickly as there is the most current info on the task.

Roadmap for advancement

Tags: CryptoEmerginginvestsJumpLSDfiProtocolRaftSkip Cryptocurrency