On Sunday, September 24, the rates of two DeFi tokens, CRV and CREAM, greater concurrently. While CRV greater by far more than ten%, CREAM noticed an sudden boost of far more than 80%. Below is the info mixed with the chain to make clear the over incident.

CRV and CREAM rates are at the exact same pump, what is the cause?

CRV and CREAM rates are at the exact same pump, what is the cause?

one. CRV greater far more than ten% due to whale buildup

On September 13, the selling price of CRV fell under USD .four and reached USD .38, reduce than the selling price at which founder Michael Egorov opened an OTC sale to hold his lending place, which raised fears to traders that the money obtained by CRV would run out.

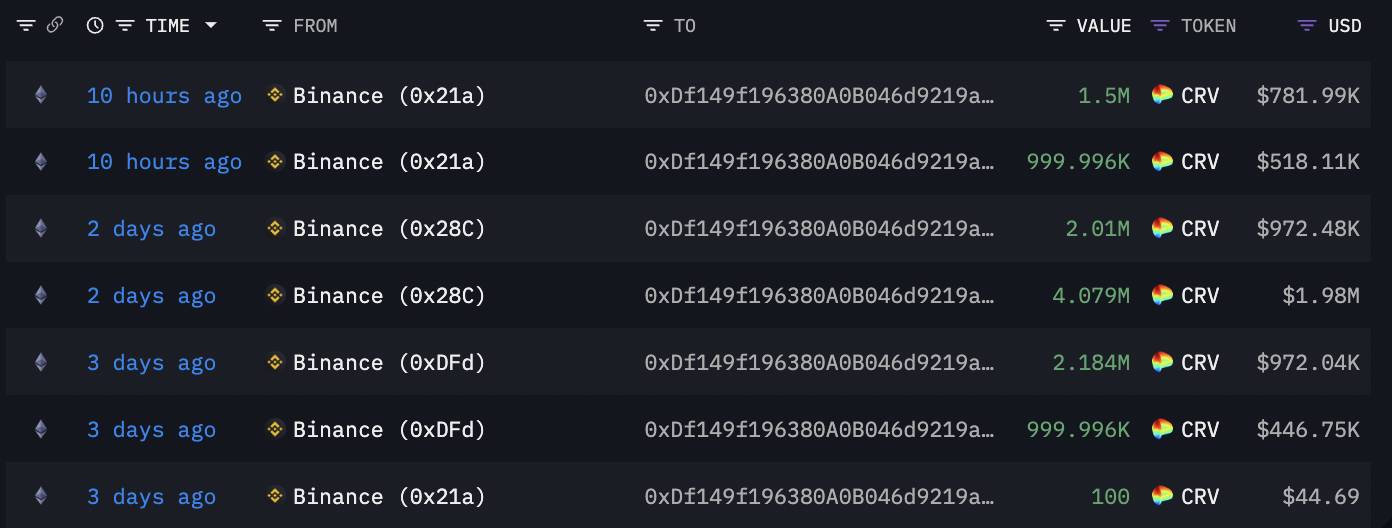

However, following that, the selling price of CRV progressively recovered till September 24, when the local community observed the development of this token. The cause is to have a whale wallet 0xQf1 withdrew a big quantity of CRV from Binance. If you appear at Arkham Intelligence’s on-chain information, this wallet tends to make far more withdrawals 19 million CRV (roughly $9.78 million) from September 21st to September 24th at the most up-to-date.

Withdraw BTC from Binance. Source: Arkham Intelligence

Withdraw BTC from Binance. Source: Arkham Intelligence

After every single CRV withdrawal, the 0xDf1 whale wallet brings all these staked tokens into Convex for storage. Staking CRV brings a lot of rewards to this whale.

Operation to transfer CRV’s stake to Convex. Source: Arkham Intelligence

Operation to transfer CRV’s stake to Convex. Source: Arkham Intelligence

Amount of CRV staked on Convex and rewards. Source: DeBank

Amount of CRV staked on Convex and rewards. Source: DeBank

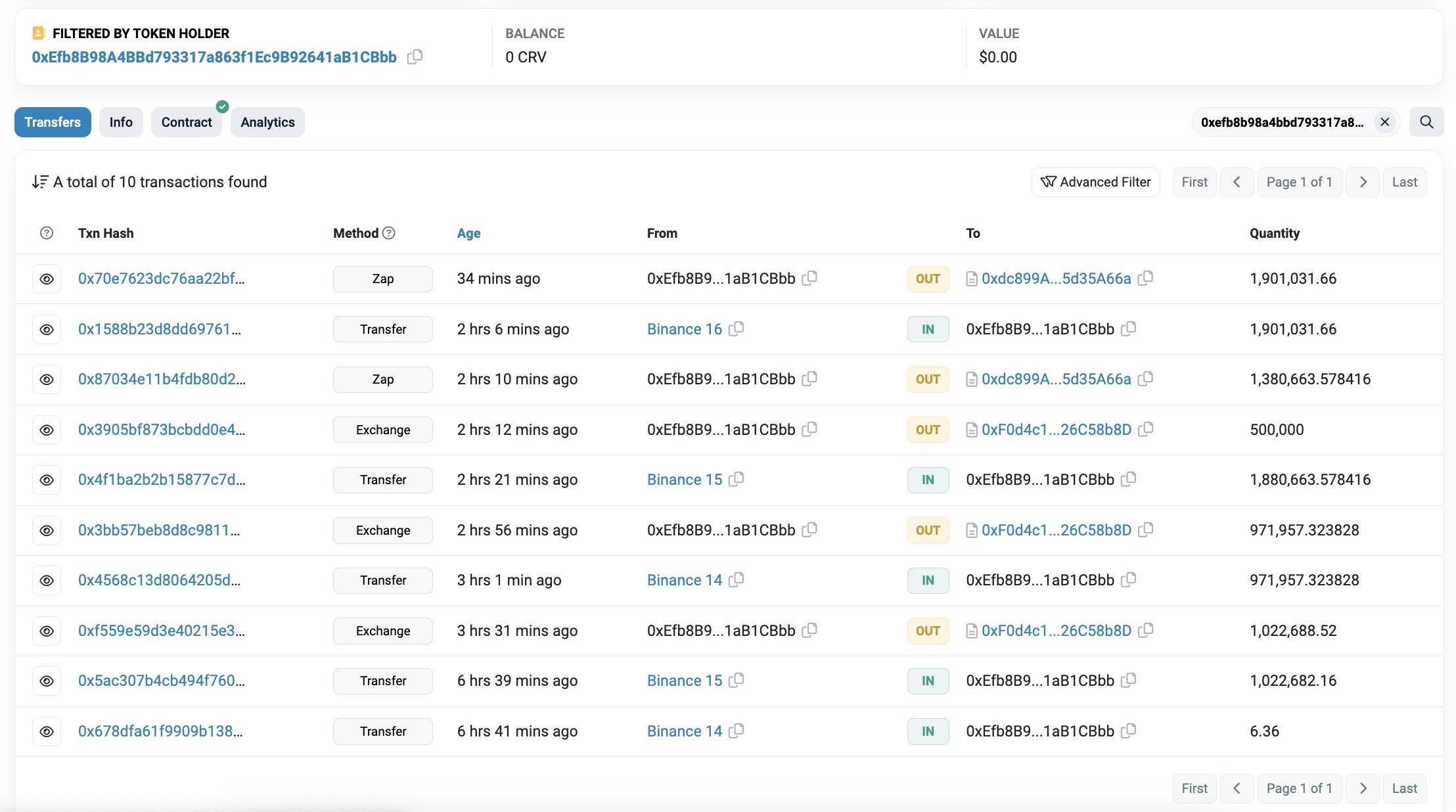

In addition to the 0xDf1 wallet, wallet 0xEfb also manufactured a withdrawal five.78 million CRVis equivalent to $three.02 million from Binance.

0xEfb wallet withdraws CRV. Source: Etherscan

0xEfb wallet withdraws CRV. Source: Etherscan

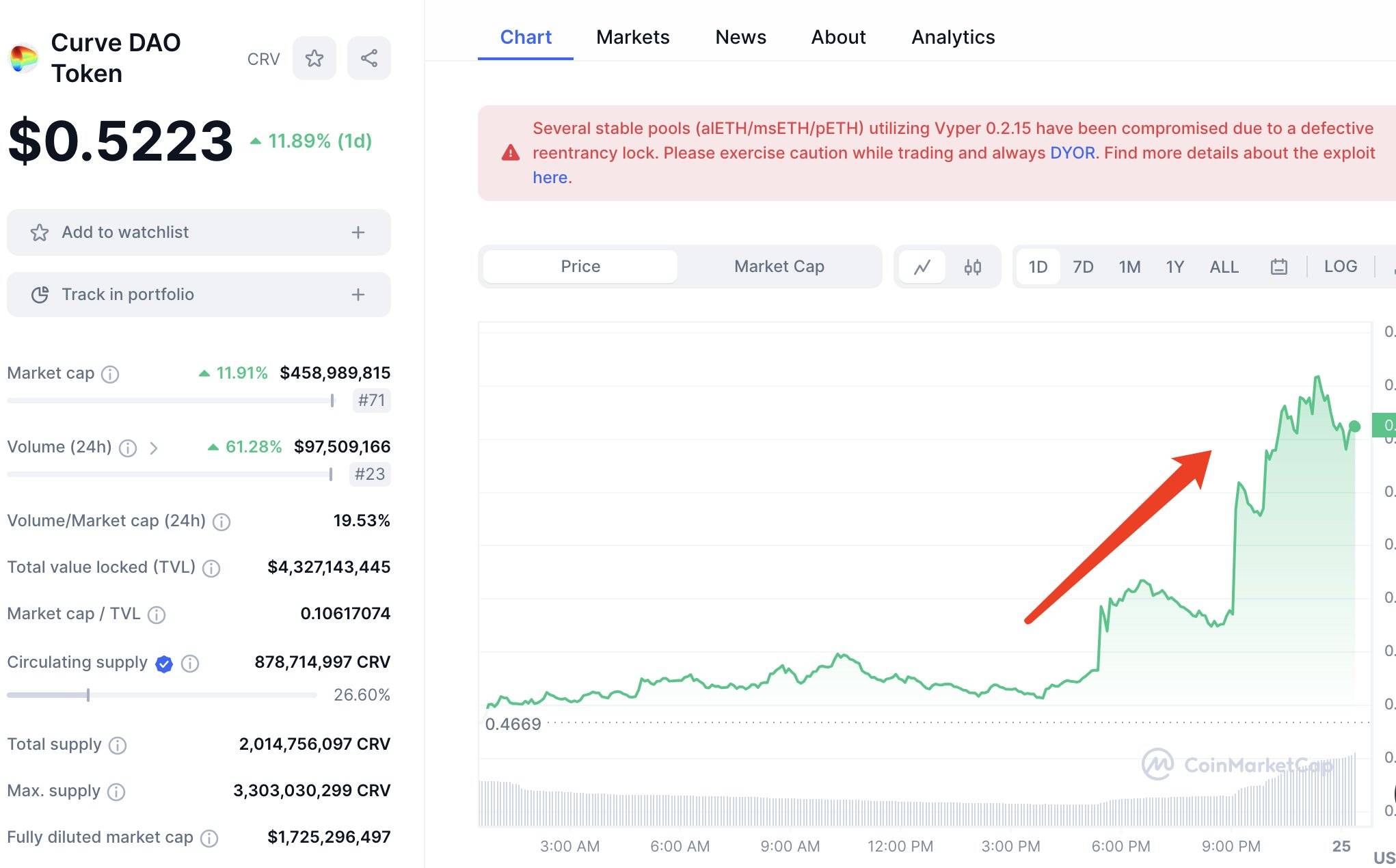

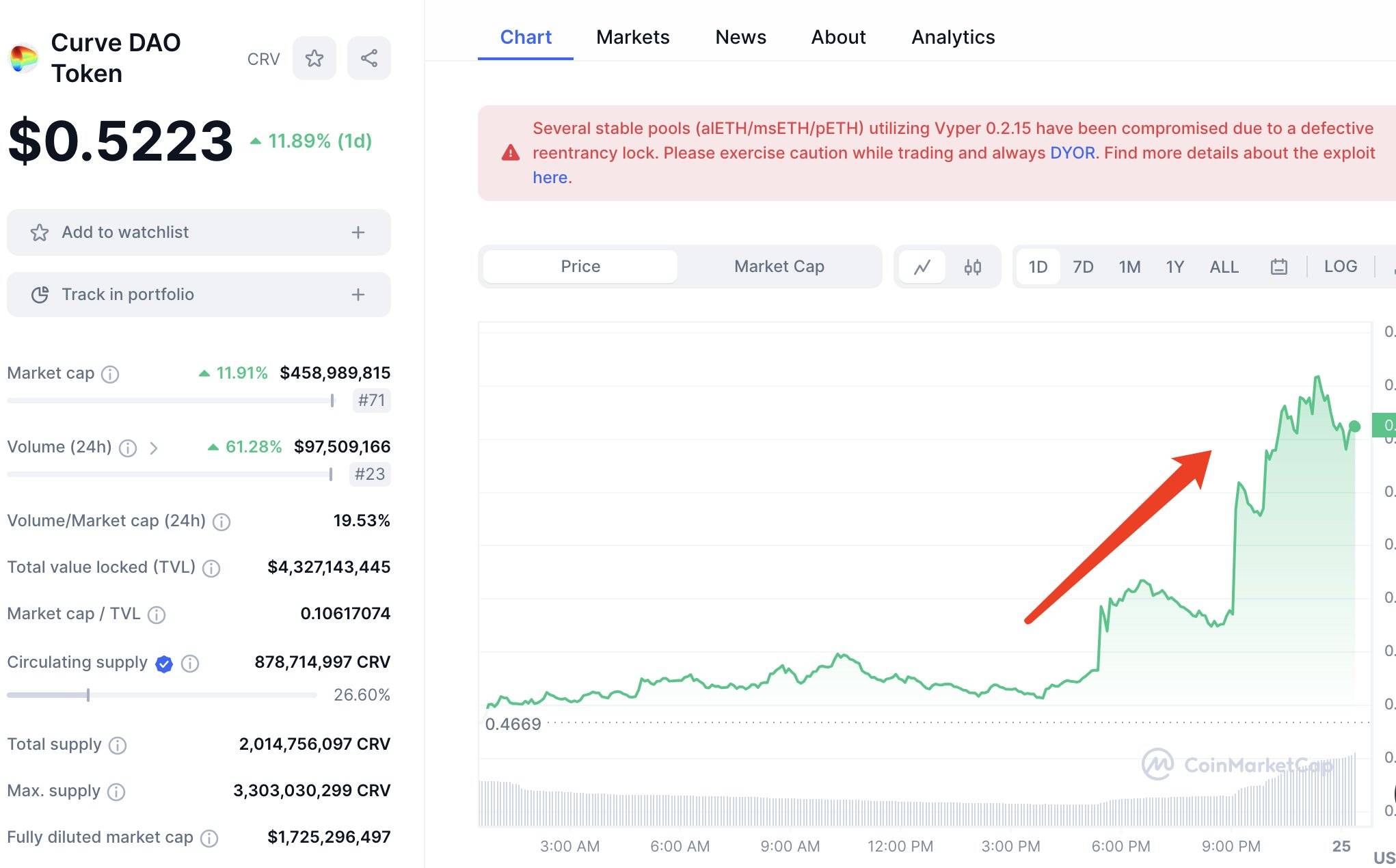

The selling price of CRV following the withdrawal of a big quantity of tokens from the exchange has greater by far more than 27% considering the fact that September 21.

CRV selling price in the final 24 hrs. Source: CoinMarketCap (September 25, 2023)

CRV selling price in the final 24 hrs. Source: CoinMarketCap (September 25, 2023)

two. CREAM selling price increases when tokens are not stationary

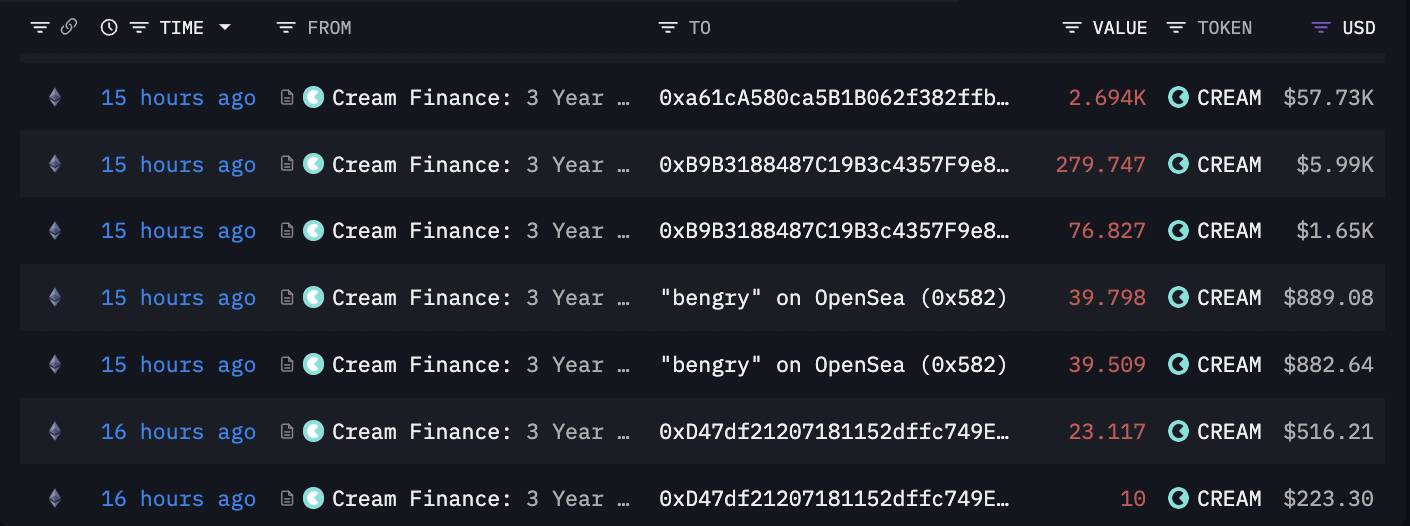

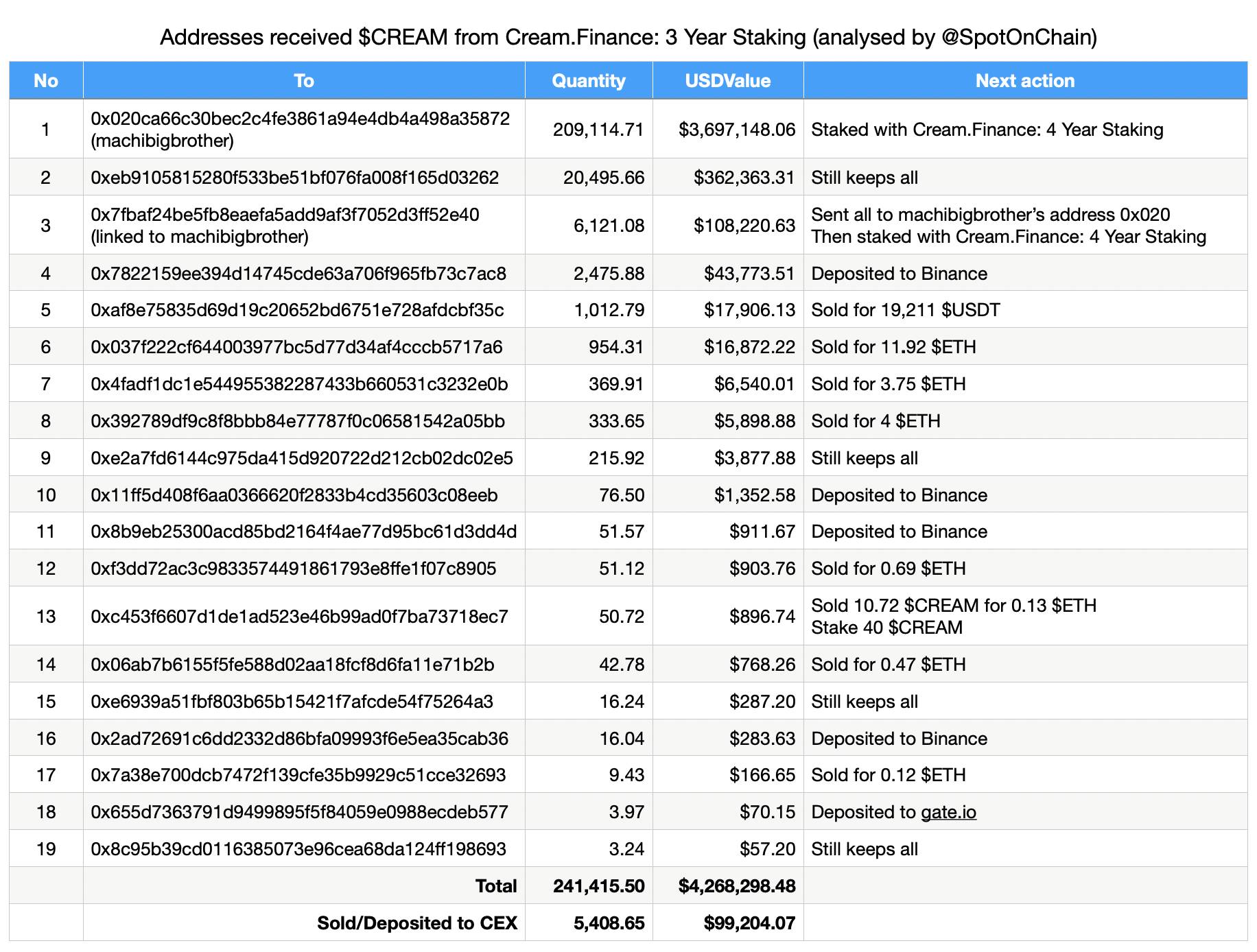

As of September 23, the 3-yr staking contract for Cream Finance’s CREAM token expired and was paid. 241,415 CREAM ($four.27 million) for traders. This contract sends CREAM numbers to 19 distinct addresses.

Cream Finance assignment contract. Source: Arkham Intelligence

Cream Finance assignment contract. Source: Arkham Intelligence

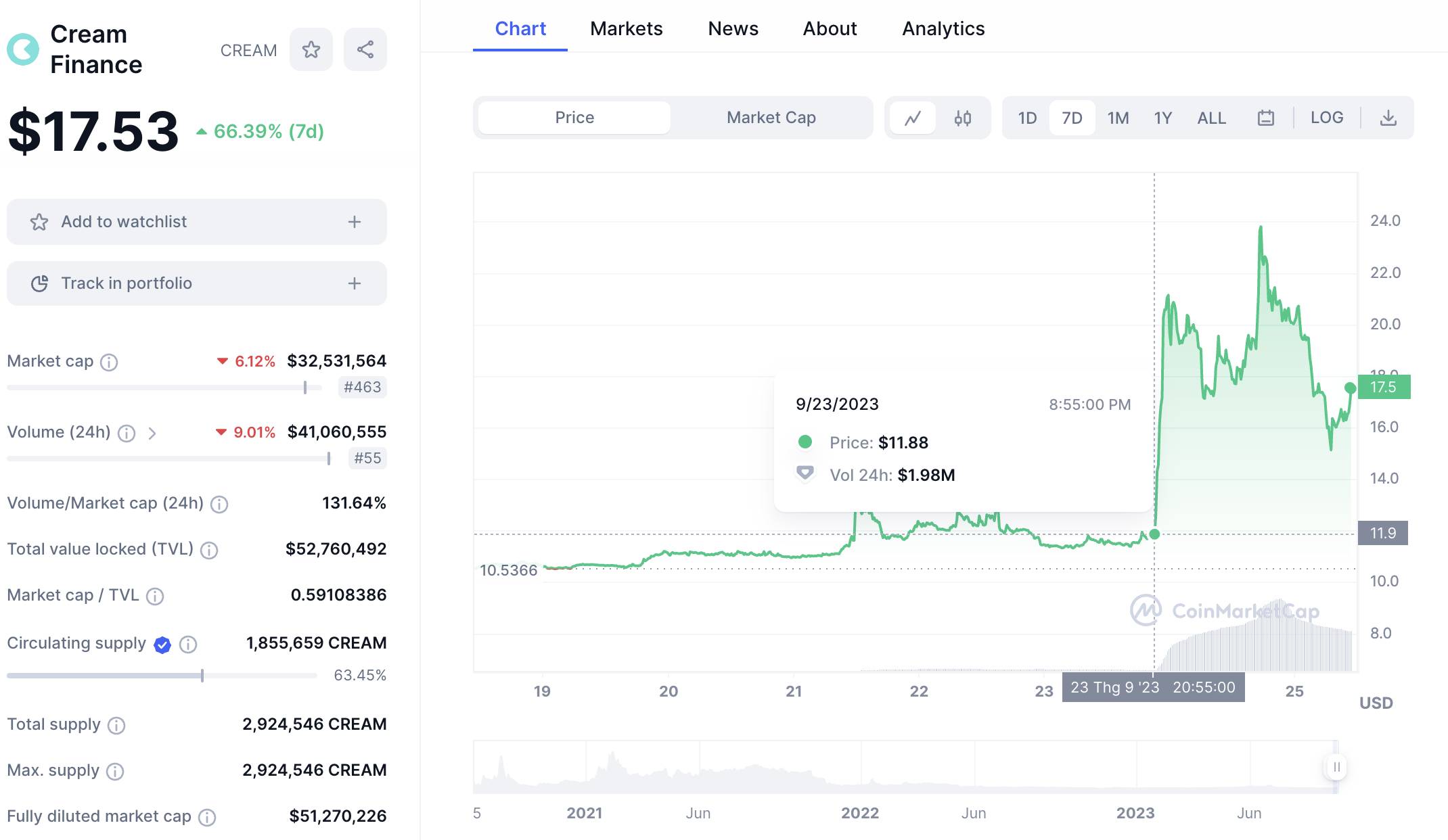

What is well worth mentioning right here is that just before the contract paid out the tokens, the selling price of CREAM had risen pretty sharply by above 70%, from $twelve to above $twenty.

CREAM selling price just before and following buy. Source: CoinMarketCap (September 25, 2023)

CREAM selling price just before and following buy. Source: CoinMarketCap (September 25, 2023)

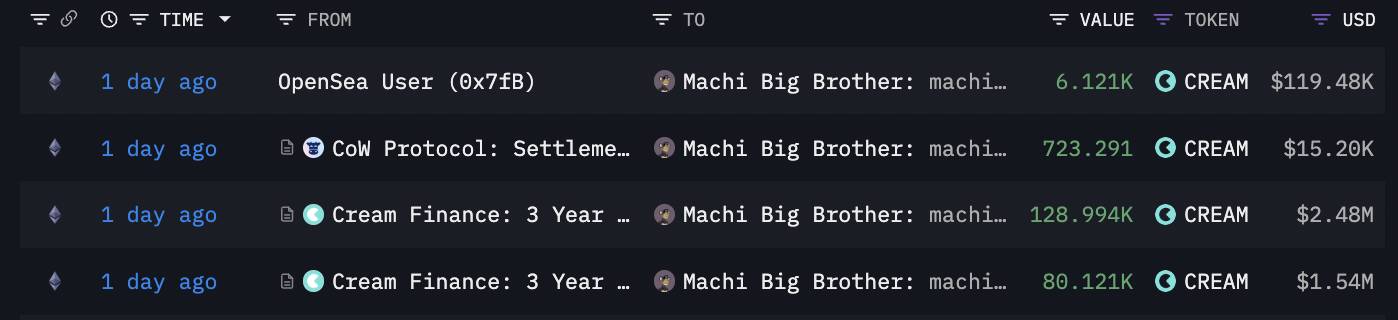

Among the wallets that obtained CREAM, machibigbrother’s wallet obtained the greatest share 215,236 CREAM ($three.eight million). The payment of the CREAM amount requires spot by way of two wallets: 0x020 and 0x7fb. Wallet 0x7fb then transfers all CREAM to major wallet 0x020.

Transaction to acquire CREAM. Source: Arkham Intelligence

Transaction to acquire CREAM. Source: Arkham Intelligence

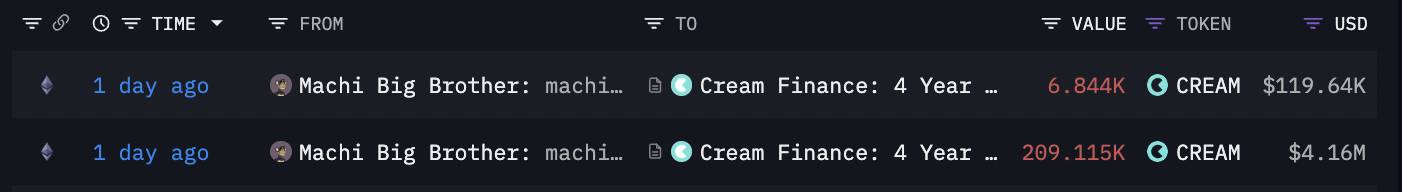

All CREAM numbers are reinvested in Cream Finance by machibigbrother with a four-yr contract. Currently, this wallet consists of a complete of 326,072 CREAM ($seven.43 million).

CREAM continues to hold a stake in Cream Finance. Source: Arkham Intelligence

CREAM continues to hold a stake in Cream Finance. Source: Arkham Intelligence

Unlike machibigbrother, some wallets stored CREAM intact or deposited a complete of five,408 CREAM (99,200 USD) on Binance, Gate.io or DEX.

List of wallets getting CREAM. Source: Spot on the chain

List of wallets getting CREAM. Source: Spot on the chain

Cameron

Join the discussion on the hottest challenges in the DeFi market place in the chat group Coinlive Chats Let’s join the administrators of Coinlive!!!