The cryptocurrency marketplace continues to practical experience a third quarter of 2023 devoid of a great deal alter in the charges of key coins, but it is total of occasions and fluctuations in between segments.

Post-bankruptcy scandal, FTX planning for coin dumping, a series of FUD all-around Binance and the launch of numerous Arkham or Worldcoin dramas are in target these three months.

Furthermore, the cryptocurrency winter entered its harshest phase, when numerous substantial and modest organizations chose to exit the sector, the NFT section was bleak, and marketplace liquidity dried up.

Third Quarter 2023 Highlights Summary

Third Quarter 2023 Highlights Summary

GM Vietnam affirms its leadership in the Vietnamese marketplace

GM Vietnam’s blockchain week occasion requires spot more than two days, from seven to eight July 2023, in the context that the cryptocurrency marketplace is in the midst of a gloomy “crypto winter”, right after a 12 months 2022 which is a shame. fluctuations and the price tag of Bitcoin is only reasonable set the peak of the year at $31,500.

Yet GM Vietnam was extra welcoming five,000 participantsOf 200 tasks and extra forty occasions modest and substantial marginal realities. Perhaps co-organizers include things like Kyros Ventures, Ancient8 and Coin98 I also did not count on the warmth of this kind of a huge occasion. Thus demonstrating that the prospective of the Vietnamese cryptocurrency marketplace is indisputable, not only in the introductory lines on paper, but also confirmed by an global occasion.

Photo supply: GM Vietnam

Photo supply: GM Vietnam

During the occasion, sizzling subjects in the sector had been “dissected” this kind of as:

XRP is not a “security”

On the evening of July 13, the judge ruled that product sales of XRP to third-get together organizations via direct or OTC discounts are nonetheless viewed as securities, but product sales via purchase books of intermediary exchanges are not.

In essence, it partially refuted the SEC’s assertion that XRP is a protection, demonstrated by the nature of an investment contract beneath the Howey Test. Thus, the court indirectly acknowledged that XRP does not thoroughly constitute a protection.

Although the verdict has not however been officially announced, it can be noticed that the stability of the victory is in favor of Ripple. The price tag of XRP surged, pushing XRP trading volume to raise sharply on Binance.

At the exact same time, it developed a precedent for other coins declared by the SEC as securities with a probability of winning the situation, thanks to which the charges of SOL, MATIC and ADA enhanced substantially.

The multichain stopped doing work

On July seven, Multichain withdrew a substantial volume of dollars, major the local community to speculate that the protocol had been hacked. On the 11th we continued to observe “abnormal” funds movement, so we suspected it was an inner pull pull.

But almost everything grew to become clear when it was announced on July 13 that the venture director had been arrested by Chinese police. Furthermore, the CEO is the only man or woman who holds the critical to accessing the project’s sources.

Finally, the up coming day, Multichain officially announced its closure, placing an finish to the after popular venture. Other ecosystems are also extra or significantly less concerned in this accident, the most severe is in all probability Fantom.

Arkham Intelligence and the rise of on-chain monitoring

On-chain is no longer a odd phrase in the business, but it was not till Arkham Intelligence launched ARKM tokens and grew to become the 32nd Binance Launchpad venture that the on-chain “investigation” trend was taken to new heights.

Despite the consumer electronic mail leak scandal, the local community is nonetheless incredibly enthusiastic about the venture when extra than $two.four billion in BNB is locked up to participate in the public sale of ARKM.

Since they have tokens and use them to shell out rewards, consumers of the platform have grow to be more and more energetic. The wallets of Do Kwon, Sam Bankman-Fried and Elon Musk had been closely hunted, the platform also “discovered” clusters of wallets containing substantial quantities of BTC and ETH from Robinhood and Grayscale.

Worldcoin launches the WLD token, frequently finding into difficulties with the authorities

Worldcoin also “went public” in July, but encountered extra FUD than Arkham. First, the venture has a record FDV, which has led to debates about the genuine worth of the token.

Then there is the prospective possibility of the type of retinal scan identification pursued by the venture. CertiK also reported a vulnerability that could result in Worldcoin to get manage of the Orb.

Not only are business leaders like Vitaklik anxious, but numerous nations all-around the planet are also investigating Worldcoin this kind of as: England, France, Germany, Kenya, Argentina,…

With this kind of a series of FUD, the consequence is that the WLD token fell by 44% right after one month of launch.

Curve (CRV) is connected with the DeFi sector

At the finish of July Curve Finance’s liquidity pools had been constantly attacked due to protection vulnerabilities, the lousy information immediately reflected the collapse of the CRV price tag. At some stage, the sirens will sound loudly when a CRV mortgage loan loan is about to settle.

The explanation is since Curve founder Michael Egorov had previously applied his allotted CRV – which represented 47% of the circulating provide – to mortgage loan substantial loans on DeFi lending platforms this kind of as Aave, Fraxlend, Abracadabra,…

Coinlive Blog: DeFi? What else stays…https://t.co/8EdJZzsnGr

— Coinlive – Daily Cryptocurrency News (@coin68) August 2, 2023

Once Michael Egorov’s place is liquidated, CRV’s price tag will proceed to fall deeply, placing Aave and Fraxlend at possibility. The CRV dump led to a series of warnings from other liquidity pools in the sector, so diminished the hazards of USDC and USDT,…

In the 1st days of August the scenario was so severe that the founder of Curve had to promote CRVs via the OTC portal to other whales to increase money and supply extra collateral to lower the possibility of loans.

That action developed yet another issue, the “OTC Curve War” amongst the OTC consumers pointed out over, since individuals tokens had been not locked by a good contract but only by an agreement.

Luckily points did not go for the worse. The Curve scenario steadily stabilized, they recovered 70% of the stolen dollars, and CRV charges steadily enhanced once again.

“Summer in the chain” with Base

Layer-two Base incubated by Coinbase brought an interesting summer season 2023 from the mainnet.

The 1st title that emerged was memecoin BALD: it was broadly shill and fomo, then brought up right after only 24 hrs, then there had been rumors of involvement with Sam FTX.

In the early days, Base’s popularity was negatively impacted by the scenario of some theft, hacking, and exploit tasks that brought about consumers to drop dollars, this kind of as LeetSwap or RocketSwap.

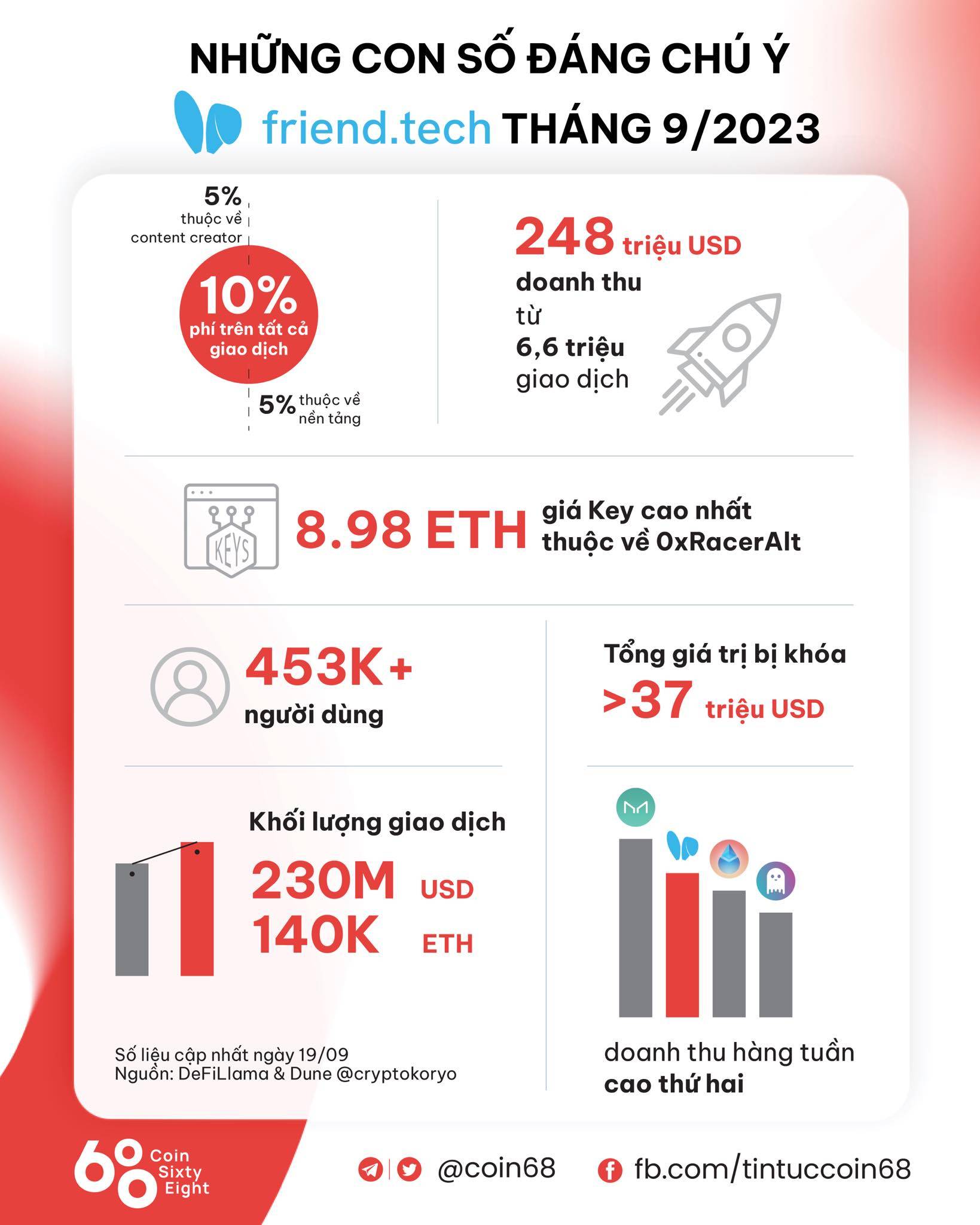

“Earthquake” amici.tech

But points have enhanced because good friend.tech appeared and developed an “earthquake” on Base. This Web3 social network is supported by the Twitter crypto local community, which invites every single other to “farm” to interact to earn reward factors and accumulate airdrops.

Thanks to this, Base has grow to be 1 of the hottest Layer-two hits now, along with Optimism and Arbitrum sustaining a modest amount of consumers throughout the gloomy downtrend time period.

PayPal problems the PYUSD stablecoin

In the context wherever US legal rules are nonetheless as well rigid in the direction of cryptocurrencies, international payments giant PayPal has produced a surprising move by launching its very own stablecoin identified as PayPal USD (PYUSD).

PYUSD was jointly issued by PayPal and Paxos, the stablecoin corporation behind Binance’s BUSD which was ordered to halt operations by the US government. The approach had been toyed with for a prolonged time, but appeared to have been place on hold right after Paxos ran into difficulties with the US government in February this 12 months.

PYUSD is backed by U.S. bucks, brief-phrase U.S. Treasury securities, and other funds equivalents. This model is equivalent to well known conventional stablecoins this kind of as Tether (USDT) and USD Coin (USDC), which are also ERC-twenty on Ethereum.

Despite remaining questioned more than its utility, engineering, and fuel costs, PYUSD is nonetheless sought right after by cryptocurrency giants, partly demonstrating that conventional institutions are on the lookout to enter the sector.

Sam Bankman-Fried was arrested

According to a new ruling issued on August twelve, the US court has reversed its determination to make it possible for former FTX CEO Sam Bankman-Fried (SBF) to be launched on bail though he awaits trial in October. This signifies that this controversial figure will be detained in New York City (USA) prison.

The explanation is that the former CEO of FTX constantly violated bail rules, for instance by employing safe messaging apps to make contact with vital witnesses in the situation, as nicely as disclosing the former CEO’s private details. Alameda Research is Caroline Ellison for American Press

SBF frequently tries to mitigate its crimes, at times blaming the “crypto winter” and at times blaming the consulting attorney.

MakerDAO struggles with a new path

The business-major DeFi platform, MakerDAO, is nonetheless grappling with its new enhancement programs.

MakerDAO officially enhanced DAI’s curiosity charge to eight% on August seven right after remaining voted on. With this figure of eight%, DAI is now 1 of the stablecoins with the highest curiosity prices.

Many substantial operators speedily took benefit of this curiosity charge possibility, when on-chain information showed a spike in funds movement in the Spark Protocol lending platform.

But difficulties quickly appeared as well. The DAI loan price for lenders is only three.19%, though the curiosity charge acquired is eight%. It is not challenging for the local community to query the sustainability of this model: “Where does the money come from to pay such high interest”?

Therefore, right after just two days of curiosity charge increases, MakerDAO adjusted the curiosity charge to five.eight% and acquired a amount of other updates. At the exact same time, the staff also announced the airdrop of the SPK token.

This story after once again displays that MakerDAO is nonetheless struggling with its new path, not seriously clarifying the up coming advancement roadmap. Even although it is by now a major DeFi platform, the staff nonetheless wants strategic techniques to get their venture past the cryptocurrency marketplace.

Huobi is embroiled in FUD and controversy right after modifying its title

On August six, a series of FUDs surrounded Huobi: senior personnel had been investigated by China, the possibility of default, USDT was offered off. Even although these are just rumors on social networks, it has brought about substantial concern amongst consumers, who have gone via numerous unpleasant experiences due to former non-compliance.

As a consequence, consumers withdrew 44 million stablecoins from Huobi in just two weekends, pushing the exchange into a state of liquidity shortage. Since then, be concerned and FUD proceed to have the possibility to spread…